- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Gold and equities rally as Cryptos crash and Dollar dips

- Home

- News & Analysis

- Economic Updates

- Gold and equities rally as Cryptos crash and Dollar dips

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAfter dipping early in the month as inflation fears resurfaced, markets bounced back to broadly rally, with US and Australian equity markets touching on all-time highs.

Global Equities

Major world indices rallied strongly in May. Gains were seen across the US, EU/UK, and Asia/pacific as central banks struck a mostly dovish tone and economic recovery continued from pandemic lows.

Source: Bloomberg

Equities wobbled in early May as higher than expected inflation figures spooked the market. Central Bank chiefs in the US and EU calmed the market, calling these elevated readings ‘transitory’ and reassuring investors easy money policies are not going anywhere for the time being.

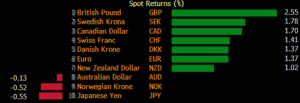

FX Markets

May saw a mostly weaker US dollar as the majority of G10 currencies outperformed the greenback. GBP and CAD performed particularly well as the central banks of those two nations indicated a timeline to end emergency accommodative policies. NZD also played catch up later in the month, as the RBNZ joined their UK and Canadian counterparts in setting a timeline to exit QE policies.

Source: Bloomberg

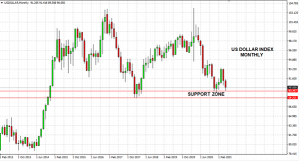

US Dollar

The US dollar index continued its decline in May, despite a bump early in the month due to inflation fears caused by an elevated CPI reading.

The index dropped over 1% as the Federal Reserve dismissed inflation figures as ‘transitory’ and re-affirmed their easy money policies were here to stay until targets were met in the labour market. The Dollar index is trading at its important support level around the lows of 2021, where it’s found some support.

Source: GO MT4

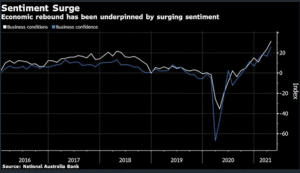

AUDUSD

The Aussie dollar again tested its resistance zone above 0.78c US on strong economic figures and elevated iron ore prices. It again was rebuffed as heavy selling pushed it back down to the middle of its 2021 range. The RBA faces mounting pressure around announcing tapering of its bond purchase program. Rising sentiments in business conditions and confidence will have them fast approaching a decision whether to join Canada and New Zealand in signaling an end to emergency measures.

Source: NAB

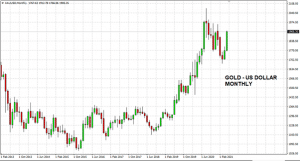

Gold

Gold prices rallied strongly in May and XUAUSD has now recovered more than $220 per ounce since the bottom at the start of April, and is fast approaching its 2021 high set in January.

May saw a perfect environment for gold as its two traditional drivers came into play. A hedge against inflation and a flight to safety, it was also helped along by a weak US dollar. Analysts are citing $1950 per ounce as the level to watch as traders digest lower-than-expected US economic data along with higher inflation numbers.

Source: GO MT4

Cryptocurrencies

The Crypto complex had an extremely volatile month with seemingly endless negative headlines weighing heavily on the Bitcoin price, and by extension most other altcoins as well.

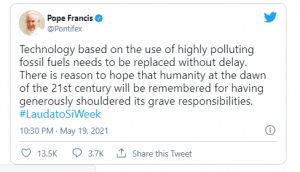

BTCUSD dropped over 50% during May as everyone from Elon Musk to the Pope seemed to have something negative to say about the cryptocurrency.

Source: Twitter

Source: Twitter

BTCUSD did find support though at around the $30k USD level and bounced strongly to hold levels around $35k. With the weak hands now seemingly shaken out, the week ahead will be an important indicator on the viability of Cryptos being taken seriously as a financial asset in the near term.

Source: GO MT4

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Equities see-saw as Fed spooks then calms the market, US Dollar surges

June was a rollercoaster ride for world markets with inflation concerns and the major Central banks' response to these driving big moves in FX, Equities, and commodities. Global Equities Major world indices mostly rallied in June with US indices the S&P 500 and NASDAQ finishing the month strongly to set new all-time highs. European and UK m...

June 30, 2021Read More >Previous Article

The “Aussie’s” outlook amid Diplomatic tensions with China

The Aussie dollar is on the rise again after the tumble taken after China decided to halt economic dialogues. Apart from becoming a commodity currency...

May 11, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading