- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- GOLD and how it moves in times of crisis

- Home

- News & Analysis

- Articles

- Economic Updates

- GOLD and how it moves in times of crisis

- Safe haven investments offer protection from market downswings.

- Precious metals, currencies, and stocks from particular sectors have been identified as safe havens in the past.

- Safe havens in one period of market volatility may react differently in another, so there is no consistent safe haven other than portfolio diversity.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

For years, gold has been considered a store of value. As a physical commodity, it cannot be printed like money, and its value is not impacted by interest rate decisions made by a government. Because gold has historically maintained its value over time, it serves as a form of insurance against adverse economic events. When an adverse event occurs that lingers for a while, investors tend to pile their funds into gold, which drives up its price due to increased demand.

There have been many instances in our history, where war has ignited investment into gold. One particular moment in the 21st century which signaled a strong movement into gold as a safe haven was the unfortunate event which occurred on 9/11. Another was the Global Financial Crisis in 2008. In both instances gold’s price sored and it returned higher profits than any other financial asset. It’s important to understand at this stage, even though gold has these unique characteristics, it is not a long-term solution for a portfolio hedge or as a safe heaven. Negative news tends to come after more negative news, which changes investor behaviors and tends to worry investors who in turn would sell their positions in gold, thus sending the price down to original levels or even lower.

Some Key Points

Latest Price Action

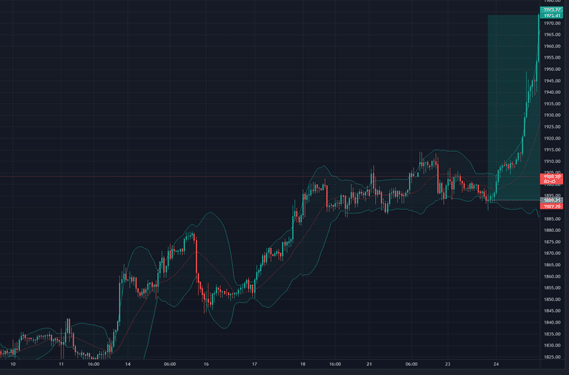

Prior to Russia’s intentions of an invasion into Ukraine and fears of war, which is creating upheaval in the political landscape in Europe and around the world, gold was steadily rising in a sideways movement. However this past week you would have noticed a sharp price action jump 3% from $1892.00 to $1973.00 USD (see below), a price that we haven’t seen since 1st of January 2021 and there is a strong feeling that it could push past this figure as Russia ramps up its invasion into eastern Ukraine. If this happens, we could start to see higher highs as a result, as investors are spooked by the potential turmoil and destabilization.

Gold or XAUUSD, can be accessible in different forms. You can purchase gold bullion in a number of ways: through an online dealer, or even a local dealer or collector. A pawn shop may also sell gold. You are advised to note gold’s spot price – the price per ounce right now in the market – as you’re buying, so that you can make a fair deal. You could also find access to gold in the following ways:

Gold Futures, ETFs that own gold, Mining Stocks, ETFs that own mining stocks, or you if you wish to trade it, you could use CFDs, where you can trade the value of the shiny metal when it goes up or down. Visit our website here to get started with a CFD trading account and start taking advantage of opportunities.

Sources: www.bankrate.com, Investopedia, Tradingview.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Markets finish with mixed results overnight after a choppy trading session

US and European equity markets remained volatile as fighting between Russian and Ukraine forces continued and negotiation talks failed to result in any progress. Both parties however have committed to another round of discussions. The VIX, Wall Street’s volatility measure surged 12% to 30 indicating the increased fear investors are feeling fro...

March 1, 2022Read More >Previous Article

Moderna gets a boost

Moderna Inc. (MRNA) reported it latest financial numbers before the opening bell in the US on Thursday. The pharmaceutical company reported results...

February 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading