- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Goldman Sachs top Q3 expectations

News & AnalysisGoldman Sachs reported their third quarter financial results before the opening bell on Friday. The company topped Wall Street analyst expectations, beating both total revenue and earnings per share estimates.

Total revenue was reported at $13.61 billion vs. $11.68 billion expected. Earnings per share at $14.94 a share vs. $10.18 per share forecast.

David Solomon, Chairman and CEO commented on solid Q3 results: ”The third quarter saw strong operating performance and an acceleration of our investment in the growth of Goldman Sachs. We announced two strategic acquisitions in our Asset Management and Consumer businesses which will enhance our scale and ability to drive higher, more durable returns. Looking forward, the opportunity set continues to be attractive across all of our businesses and our focus remains on serving our clients and executing our strategy.”

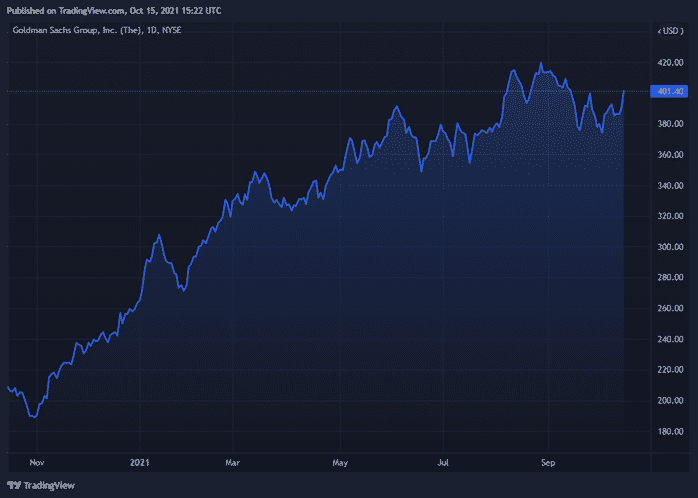

Goldman Sachs Chart (year-to-date)

The share price of Goldman Sachs was trading higher after the latest results, up by around 2% during the session on Friday. The stock price has climbed by over 90% in past year at $401.40 a share.

You can trade Goldman Sachs (GS) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Goldman Sachs, Refinitiv, TradingView

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Netflix beats Q3 expectations

Netflix reported its third-quarter financial results after the closing bell on Tuesday, delivering solid numbers and beating Wall Street analyst predictions. The online streaming service reported earnings per share at $3.19 per share vs. $2.56 a share expected. The total revenue was $7.48 billion (up 16.3% from the same time last year) in the th...

October 20, 2021Read More >Previous Article

Earning season continues – US banking giants report Q3 results

The third quarter earnings season is heating up nicely over in the US, with some of the world’s largest banks reporting their latest financial resul...

October 15, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading