- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Hawkish Powell slams Stocks, Gold and Oil, USD takes off

- Home

- News & Analysis

- Economic Updates

- Hawkish Powell slams Stocks, Gold and Oil, USD takes off

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisJerome Powell, testifying in front of Congress early in the US session, dashed the bulls hopes of a Fed pivot anytime soon after hinting that larger than expected hikes are a possibility and rates could stay higher and longer than the market was pricing in.

This saw an instant reaction in risk assets as the markets priced in a terminal Fed rate of 5.65% (an extra 105bps from where we are now). Stocks were slammed with the Dow finishing down 575 points, closing well below its 100 day MA

Other risk assets performed just as poorly with Gold having its worst day since early February with Perth Mint headlines (Selling diluted gold to China), a strong USD and surging bond yields seeing the precious metal looking to test the 2023 lows.

Crude oil also got hammered as a hawkish Powell stoked growth concerns seeing WTI crashing almost 4%, back to the $77 handle, its biggest fall in over 2 months.

In FX, the USD was king , with surging US yields and as a flight to safety saw the greenback outperform, the AUDUSD had the double whammy of a dovish RBA followed by a hawkish Powell, seeing it be the worst performing currency of the day.

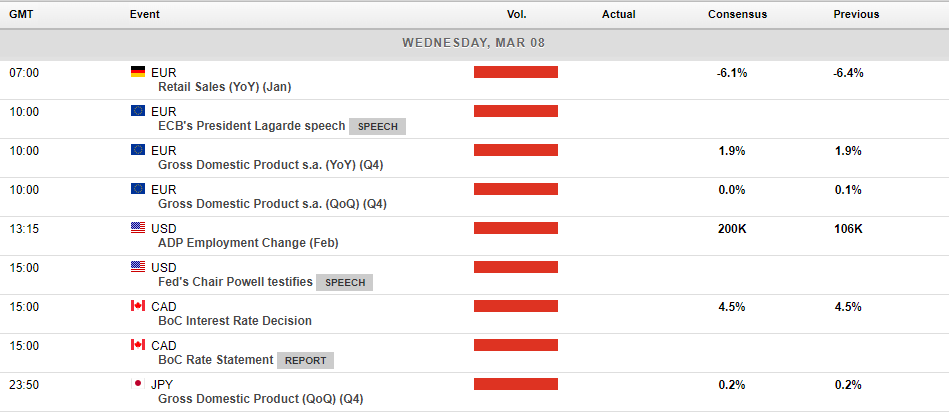

Coming up in todays economic announcements, more Central bank action as Jerome Powell continues his testimony for day 2, also the Bank of Canada rate decision where the BOC is expected to hold rates for the first time since starting their tightening cycle.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bank of Canada keeps interest rates at 4.50%

This week, the Bank of Canada (BoC) released its decision to hold interest rates at the current level of 4.50%. In the rate statement, the BoC indicated that inflation has eased to 5.9%, and the expectation for weaker economic growth and a moderation of wage growth could see inflation continue on its downward trajectory. The BoC highlighted that it...

March 10, 2023Read More >Previous Article

XAUUSD, GBPJPY, and GBPUSD Analysis

XAUUSD Analysis The gold price outlook remains positive in the short and medium term. Gold price has rested above support 1847 and support 1830...

March 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading