- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- How to identify key resistance levels

News & AnalysisA resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to surpass. Resistance levels are often used in conjunction with support levels, or the point at which traders are unwilling to let an asset’s price drop much lower.

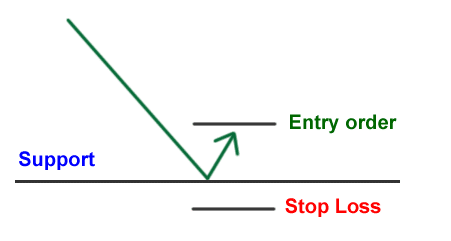

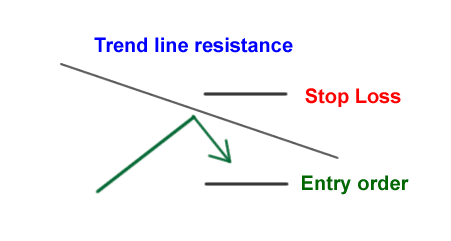

To understand this fully, it’s important to understand how support and resistance works in general. A support line is when a price hits a low point (on the selling side) and resistance is when the price hits a high (on the buying side). If the prices rebound back to this price or continue to hit this price without surpassing it, it then starts to become a key resistance or support level.

As a rule of thumb when using technical analysis, these tools become very important for some traders. This is due to those points offering various outcomes. Whether they are a Bounce or a Break, essentially meaning, does the price hit the support/resistance and comes back (Bounce) or does it go through the support/resistance lines (Breaks).

It is important to also use other indicators to accompany your technical analysis, as these movements could also easily become reversals or break outs, meaning, instead of them following your prognosis the price does the opposite.

When a price has been rejected various times, it builds an even stronger key resistance. Trading volume and sentiment can help to propel a price past this point and some of the biggest movements come after a price breaks a key resistance.

Using a current trend (Fig 1) and a hypothetical trend (Fig 2), let’s take the daily timeframe for BTCUSD as an example (below). The daily candle has broken through a key resistance of $41,000 as shown on figure 1. If a trader identifies this, they can do one of two things; trade it aggressively and place a trade as it breaks through or trade it conservatively and wait for the former resistance line to become the new support line before placing a trade (so wait for the price to bounce off as outlined on the drawn projection and circled on figure 2).

Figure 1.

Figure 2.

This technical analysis can be used for any asset you wish to trade: it’s transferrable and key in identifying entry or exit points of trades. By learning to spot the patterns and combining this with knowledge of trading volume and sentiment, you can start to understand the markets better.

Sources: Babypips, Investopedia, @sell9000 Twitter.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Pfizer Q4 results announced

Pfizer Inc. (PFE) reported its Q4 financial results before the market open on Wall Street on Tuesday. The world’s third largest pharmaceutical company reported total revenue of $23.838 billion in the previous quarter (105% increase from the same period in 2020), falling short of analyst forecast of $24.157 billion. Earnings per share report...

February 9, 2022Read More >Previous Article

Identifying opportunities and managing risk with Autochartist

Autochartist's advanced chart pattern recognition can help you with identifying real-time trading opportunities and making more informed trading d...

February 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading