- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Inflation fears leads to a Bearish equity market

- Home

- News & Analysis

- Economic Updates

- Inflation fears leads to a Bearish equity market

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisEquity investors have gone through another rocky week. A week highlighted by the first post-pandemic interest rate hike by the US Federal Reserve, the on-going Russia and Ukraine conflict and the surging fuel prices that could potentially derail the global economic recovery.

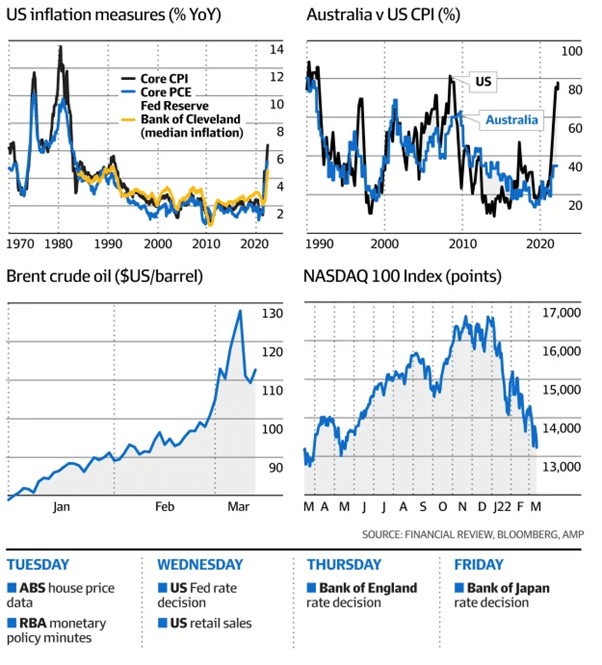

Australian equity futures increased 0.3% on Monday, despite the aforementioned risks. Energy and commodities businesses are looking to continue enjoying the price inflation, which has reached a 40 year high of 7.9% in the US.

The consensus forecast for the US Federal Reserve is to deliver a 25 basis point cash rate rise on Wednesday, which will bring it up to 0.50%. This is an initial effort to contain inflation. Some experts believe that the Russia and Ukraine conflict could push the rates up by 50 basis points. The US Federal Reserve ultimately decided to increase the interest rate by 25 basis points.

In Australia, interest rate traders have priced in multiple rate rises in 2022 from July to mean the cash rate could exceed 1 per cent by December. The next RBA interest rate meeting will be held on the 5th of April with the general consensus being split between no change and a decrease of 10 basis points.

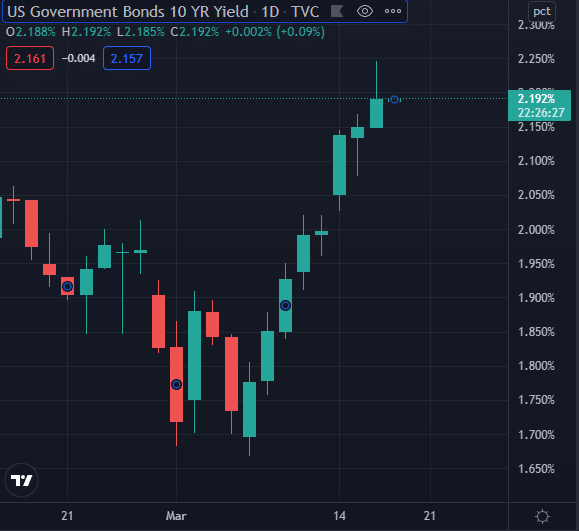

As bond traders pushed inflation and interest rate expectations higher, yields on benchmark US 10-year treasuries climbed sharply over last week to close at 2.190% on Wednesday.

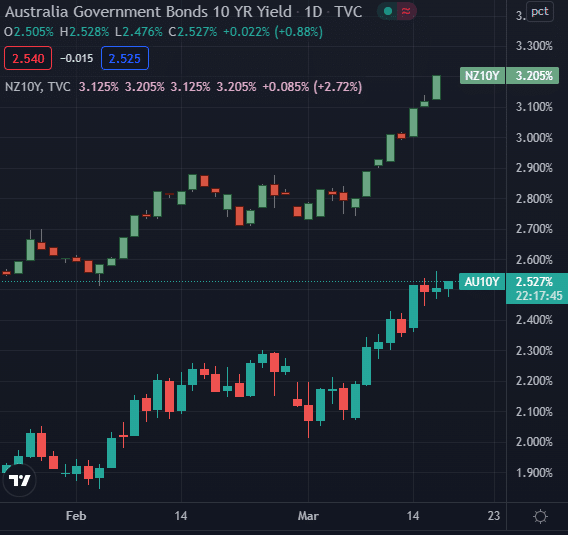

Yields on Australian 10-year bonds closed at 2.505%, the highest since December 2018. In New Zealand, 10-year yields topped 3.120% for the first time since 2018, according to Bloomberg.

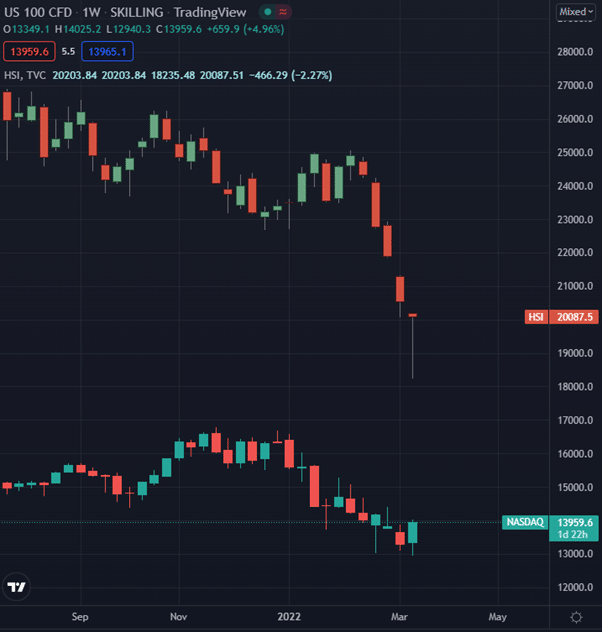

Last Friday’s close signaled a bear market for a couple of major indices. The Nasdaq index dropped by 2.1%, this is a part of a 20% decline since November. The Hang Seng Index had also dropped by 4.3%, its lowest level since 2016.

All in all, the current volatility is affecting the global equities markets. Inflation fears might be one of the contributing factors to current bearish markets. Traders will need to keep a close eye on governmental actions to combat inflation.

If you would like to take this opportunity to invest in the Index Markets and don’t already have a trading account, you can register for a CFD account at GO Markets.

Source: GO Markets, Tradingview, Bloomberg, FXstreet, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

How has Natural Gas been affected by Sanctions?

Natural gas like many other energy sectors, is not bulletproof when it comes down to volatility. It’s not hard to imagine that any destabilization of large producers or consumers within the industry would have a direct impact in its spot price, as investors are spooked of the possibility of supply chains suffering from strains in Geopolitical...

March 18, 2022Read More >Previous Article

US indices have a bumper session on the back of positive direction given from the Federal Reserve

US indices had a bumper day of trading as the Federal Reserve increased interest rates by 25 basis points. The Reserve is also expected to raise rates...

March 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading