- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Johnson & Johnson results beat estimates

- 1 Month -0.31%

- 3 Month -5.79%

- Year-to-date +0.82%

- 1 Year +2.39%

- Wells Fargo $195

- Morgan Stanley $174

- Citigroup $205

- Raymond James $196

- Credit Suisse $205

- Goldman Sachs $181

News & AnalysisJohnson & Johnson (JNJ) reported its latest financial results for the second quarter before the opening bell in the US on Tuesday.

The US pharmaceutical and consumer goods company reported revenue that topped the Wall Street expectations at $24.02 billion (up 3% year-over-year) vs. $23.771 billion expected.

Earnings per share reported at $2.59 per share (up 4.4% year-over-year) vs. $2.54 per share estimate.

”Our solid second quarter results across Johnson & Johnson reflect the strength and resilience of our Company’s market leadership in the midst of macroeconomic challenges,” said Joaquin Duato, CEO of the company.

”I am continually energized by the focus and passion of my Johnson & Johnson colleagues and their dedication toward delivering transformative healthcare solutions to patients and consumers around the world,” Duato concluded.

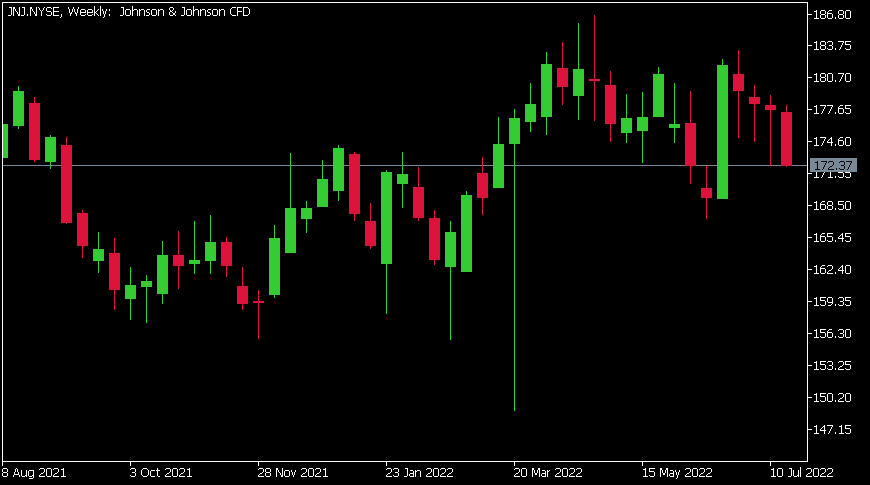

Johnson & Johnson (JNJ) chart

The stock was down by around 1% during the trading day on Tuesday at $172.37 per share.

Here is how the stock has performed in the past year:

Johnson & Johnson price targets

Johnson & Johnson is the 10th largest company in the world with a market cap of $453.99 billion.

You can trade Johnson & Johnson (JNJ) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Johnson & Johnson, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Netflix results announced – the stock is up

Netflix Inc. (NFLX) reported its Q2 results after the closing bell in the US on Tuesday. The online streaming service company reported fairly positive results for the quarter, sending the stock price higher in the after-hours trading. The company reported revenue of $7.97 billion in Q2, narrowly missing analyst estimate of $8.026 billion. Ear...

July 20, 2022Read More >Previous Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from bet...

July 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading