- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- JPMorgan and Goldman Sachs Q2 numbers are in

News & AnalysisJPMorgan and Goldman Sachs reported their Q2 earnings before the opening bell on Tuesday – both beating analyst forecasts.

JP Morgan & Co

JP Morgan reported total revenue of $31.4 billion in Q2, above analyst forecast of $29.90 billion. Earnings per share were reported at $3.78 vs. $3.21 estimate.

”JPMorgan Chase delivered solid performance across our businesses as we generated over $30 billion in revenue while continuing to make significant investments in technology, people and market expansion. This quarter we once again benefited from a significant reserve release as the environment continues to improve, but as we have said before, we do not consider these core or recurring profits. Our earnings, not including the reserve release, were $9.6 billion. Consumer and wholesale balance sheets remain exceptionally strong as the economic outlook continues to improve. In particular, net charge-offs, down 53%, were better than expected, reflecting the increasingly healthy condition of our customers and clients.” – Jamie Dimon, Chairman, and CEO commented on the strong Q2 results following the announcement.

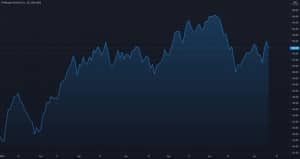

JPMorgan Chase & Co Chart (year-to-date)

The share price of JPMorgan Chase & Co was trading down by around 1.42% towards the end of the US session trading at $155.79 per share following the latest results. The stock is up by around 22% year-to-date.

Goldman Sachs

Goldman Sachs also reported strong numbers with revenue of $15.39 billion in Q2, higher than analyst estimate of $12.17 billion. Earnings per share at $15.02, above the forecast of $10.24 per share.

Following the latest earnings report from Goldman Sachs, David Solomon, Chairman and CEO commented on results – ”Our second quarter performance and record revenues for the first half of the year demonstrate the strength of our client franchise and our continued progress on our strategic priorities. While the economic recovery is underway, our clients and communities still face challenges in overcoming the pandemic. But, as always, I am proud of the dedication and resilience of our people, who have worked tirelessly to help our clients navigate the ever-changing market environment.”

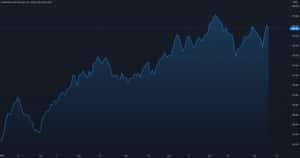

Goldman Sachs Chart (year-to-date)

Share of Goldman Sachs also trading slightly lower despite beating estimates, down by around 0.76% towards the end of the session at $377.31 per share. The share price up by around 43% year-to-date.

Bank of America (BAC), Citigroup (C) and Wells Fargo & Co (WFC) report their Q2 numbers before US market opens on Wednesday.

You can trade JPMorgan Chase & Co (JPM), Goldman Sachs (GS) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Goldman Sachs, JP Morgan & Co, Refinitiv, TradingView

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Up next – Bank of America, Citigroup and Wells Fargo report Q2 results

On Tuesday, JPMorgan and Goldman Sachs released their Q2 results before the US market open – both beating analyst expectations. Today, Bank of America, Citigroup and Wells Fargo & Co released their numbers for the previous quarter before the opening bell. Bank of America Bank of America reported a total revenue of $21.6 billion in Q2, s...

July 15, 2021Read More >Previous Article

Equities see-saw as Fed spooks then calms the market, US Dollar surges

June was a rollercoaster ride for world markets with inflation concerns and the major Central banks' response to these driving big moves in FX, Equiti...

June 30, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading