- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- JPMorgan falls short in Q2

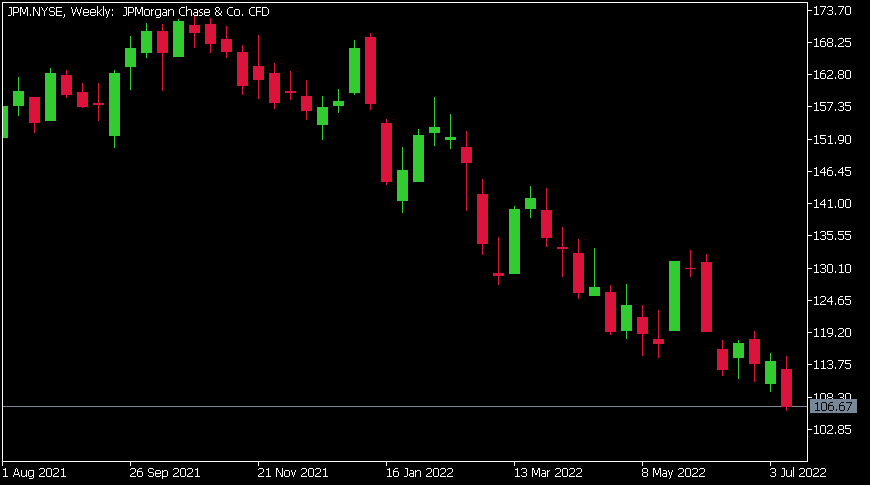

- 1 Month -5.16%

- 3 Month -14.70%

- Year-to-date -32.06%

- 1 Year -30.80%

- Morgan Stanley $127

- Citigroup $135

- Jefferies $126

- Wells Fargo $120

News & AnalysisJPMorgan Chase & Co. (JPM) reported its latest financial results for Q2 before the opening bell on Wall Street on Thursday.

World’s largest bank reported revenue of $30.715 billion, falling short of analyst estimate of $31.806 billion.

Earnings per share reported at $2.76 per share vs. $2.89 per share expected.

CEO of JPMorgan, Jamie Dimon commented on the latest results: ”JPMorgan Chase performed well in the second quarter as we earned $8.6 billion in net income on revenue of $30.7 billion and an ROTCE of 17%, with growth across the lines of business, while maintaining credit discipline and a fortress balance sheet.”

”In our global economy, we are dealing with two conflicting factors, operating on different timetables. The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy. But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road. We are prepared for whatever happens and will continue to serve clients even in the toughest of times.”

”As a result of the recent stress tests and the already scheduled GSIB increase, we will build capital and continue to effectively and actively manage our RWA. In order to quickly meet the higher requirements, we have temporarily suspended share buybacks which will allow us maximum flexibility to best serve our customers, clients and community through a broad range of economic environments,” Dimon concluded.

JPMorgan Chase & Co. (JPM) chart

Share price of JPMorgan took a hit after the latest financial results were announced. The stock was down by around 4% following the announcement at $106.67 per share.

Here is how the stock has performed in the past year:

JPMorgan price targets

JPMorgan Chase & Co. is the 20th largest company in the world with a market cap of $314.44 billion.

You can trade JPMorgan Chase & Co. (JMP) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: JPMorgan Chase & Co., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Morgan Stanley results announced

Morgan Stanley (MS) reported its latest financial results for the second quarter before the market open in the US on Thursday. The US financial services company reported revenue of $13.132 billion in Q2 which did not meet analyst forecast of $13.386 billion. Earnings per share also missed expectations at $1.44 per share vs. $1.56 per share es...

July 15, 2022Read More >Previous Article

Australian employment figures see a big beat as unemployment hits an historical low

Australian employment figures saw 88,000 new jobs created in June, a huge beat of the expected 30k analysts had forecast. The unemployment rate also d...

July 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading