- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- JPMorgan Q1 results announced

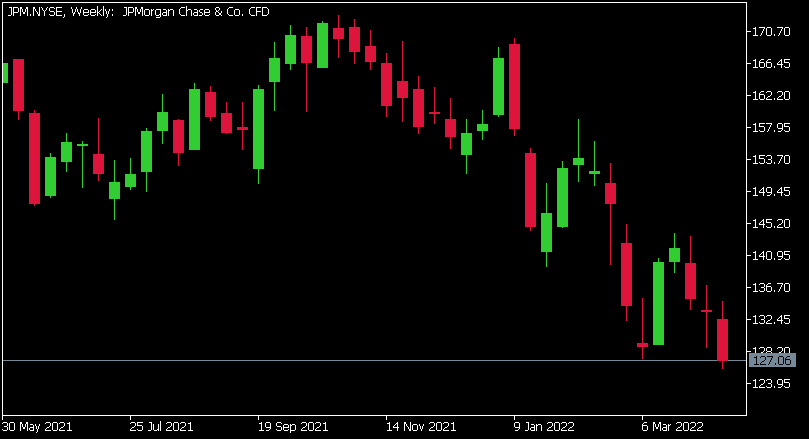

- 1 Month -7.99%

- 3 Month -24.40%

- Year-to-date -19.58%

- 1 Year -15.79%

News & AnalysisJPMorgan Chase & Co. reported its latest financial results for Q1 before the opening bell on Wall Street on Wednesday.

World’s largest bank reported revenue of $30.717 billion in the quarter, narrowly beating analyst estimate of $30.59 billion.

Earnings per share fell short of Wall Street expectations at $2.63 per share vs. $2.72 per share expected.

CEO of JPMorgan, Jamie Dimon commented on the latest results: ”JPMorgan Chase generated a healthy $30 billion of revenue, $8.3 billion of earnings and an ROTCE of 16% in the first quarter after adding $902 million in credit reserves largely due to higher probabilities of downside risks. Lending strength continued with average firmwide loans up 5% while credit losses are still at historically low levels. We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

”Our focus this quarter remained on helping our clients navigate difficult markets and unpredictable events, which included working with governments to implement economic sanctions of unprecedented complexity. While our company will continue to deal with this global turmoil, our hearts go out to the extreme suffering of the Ukrainian people and to all of those affected by the war,” Dimon added.

JPMorgan Chase & Co. chart

Shares of JPMorgan were down by around 3% during the trading day on Wednesday at $127.06 a share.

Here is how the stock has performed in the past year:

JPMorgan Chase & Co. is the 18th largest company in the world with a market cap of $374.17 billion.

You can trade JPMorgan Chase & Co. (JMP) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: JPMorgan Chase & Co., TradingView, CompaniesMarketCap, MetaTrader 5

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Where to next for Magellan Financial?

Magellan Financial Group (MFG) has seen a tumultuous 12 months in which the share price has seen a large fall from grace. The large Australian managed funds company has had a myriad of bad announcements and bad news. Resignation from key members of its leadership team and an exodus of cash outflows from investors have caused a large drop in price...

April 14, 2022Read More >Previous Article

Better than expected – BlackRock tops Wall Street estimates for Q1

BlackRock Inc. reported its first quarter financial results before the opening bell in the US on Wednesday. World’s largest asset manager reporte...

April 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading