- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Key events in the week ahead – Activity data dominates

- Home

- News & Analysis

- Articles

- Economic Updates

- Key events in the week ahead – Activity data dominates

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAfter last week’s Inflation themed calendar, we head into the new week where the main theme will be activity data with a raft of manufacturing and services PMI figures from the UK, Eurozone and the US. some of which will help determine what happens at the forthcoming round of central bank rate decisions in the coming weeks.

USA

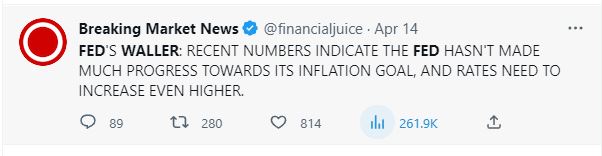

With the market still somewhat split on whether the FOMC will hike rates in the US on the 3rd of May (Though odds of a hike have risen considerably in the last week) Investors will be scrutinising any Fed commentary before their pre-meeting blackout period, particularly that of Fed Governor Waller due to speak on Thursday. Waller has been very hawkish, with comments on inflation he made on Friday being a big driver of the aforementioned shift to the upside for a Fed hike at the next meeting.

More Hawkishness from Waller will likely see some volatility in FX and equity markets, giving the USD some short-term support.

UK

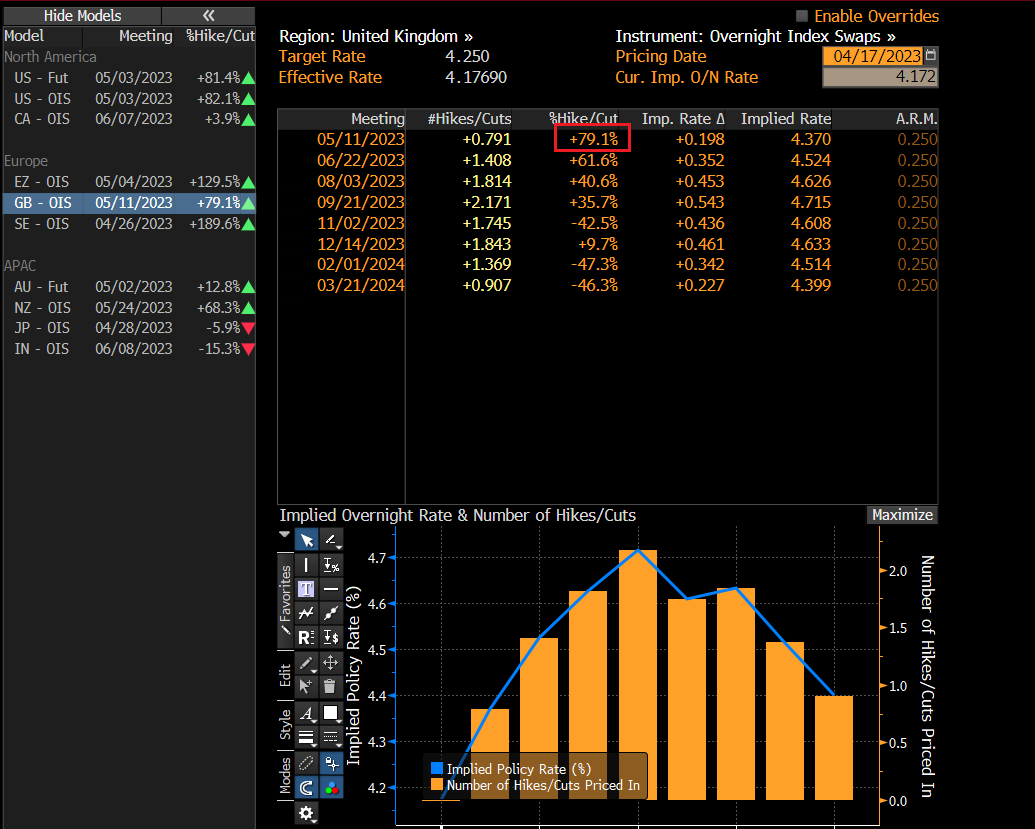

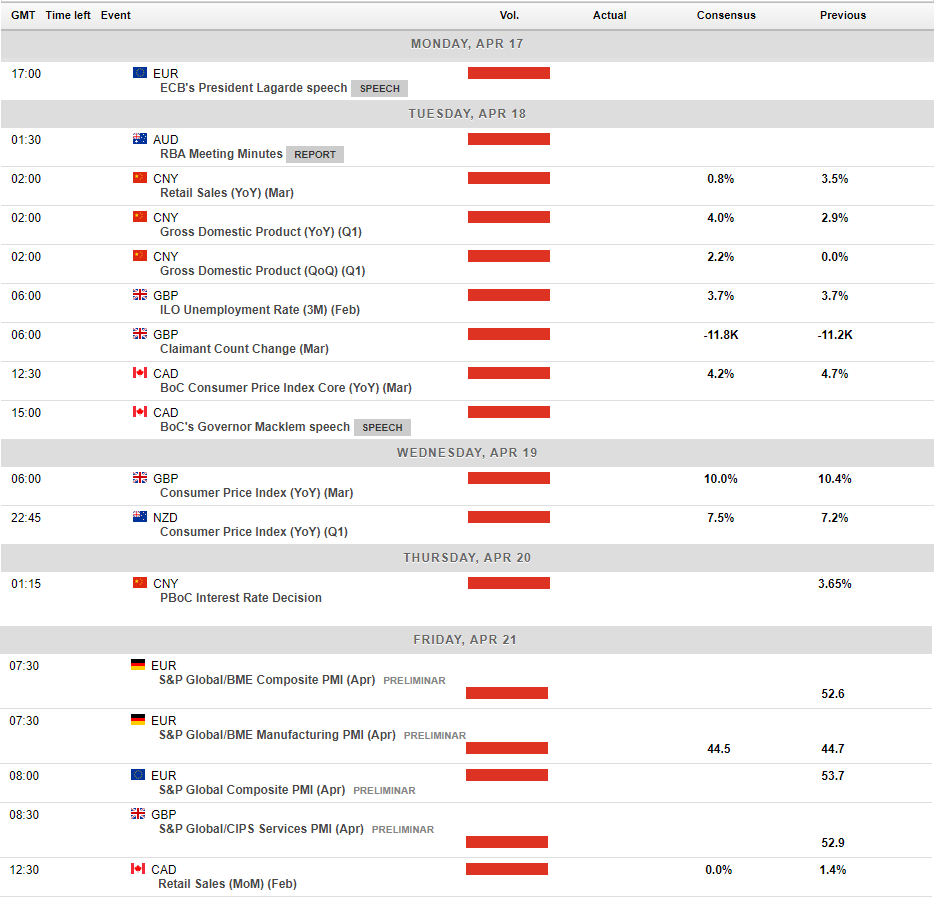

With The market Split on the Bank of England’s next move, Markets are pricing in a 79% chance of a 25bp hike at their May 11th meeting, the raft of economic data due out over the next week may well decide it one way or another with labour force and wage data due on Tuesday, Inflation data on Wednesday and Retails sales and PMI figures due on Friday.

Eurozone

EU data will kick off with ECB President Lagarde due to speak on Monday in New York, but it will be data later in the week that will likely cement whether the bull run in the Euro continues.

EU powerhouse Germany will release sentiment figures on Tuesday followed by a plethora of Manufacturing and Services PMI figures out off the Eurozone in the subsequent days

EURUSD rallied for the 4th straight week last week, testing the big psychological level of 1.10 , much of its strength coming from the expectation the EU was still early into their rate hiking cycle, with markets pricing in a continuation of hikes until September this year. Data this week could see a hawkish or dovish repricing of these odds, and ply a big part in whether EURUSD can break through and hold 1.10 or be rejected.

Asia

In Asia a quieter calendar is ahead with the main risk events being Monetary Policy Meeting Minutes out of Australia and Chinese GDP on Tuesday, followed by New Zealand inflation figures on Thursday.

With the RBA pausing rates at their last meeting for the first time after 10 straight hikes these minutes will probably take on extra importance, is this it? No more hikes, or just a pause will be what traders will try to decipher from these so we could see some Aussie Dollar volatility.

Despite NZ being at the top of the table in regard to official interest rates, with their previous meeting surprising the market with a supersized 50bp hike, markets are till pricing in (just) another hike from the RBNZ in their May meeting. NZ CPI figures released on Thursday could move the needle on those odds and see an adjustment in the Kiwi dollar.

Full calendar of major events below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

GO Markets named as Compare Forex Brokers’ Best Liquidity Broker, Lowest Commission Forex Broker and Best Forex Broker in Singapore 2023

A 2023 Compare Forex Brokers’ comparison of the top global forex brokers named GO Markets as the top broker in multiple categories, including: Best Liquidity Broker 2023 Lowest Commission Forex Broker 2023 Best Singapore Forex Broker 2023 Justin Grossbard at Compare ForexBrokers said, “In our testing, GO Markets rated well w...

April 17, 2023Read More >Previous Article

JP Morgan Chase & Co. tops Q1 estimates – the stock is rising

JP Morgan Chase & Co. (NYSE: JPM) announced Q1 financial results before the market open in the US on Friday. The largest bank in the US beat bo...

April 15, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading