- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Less hawkish Fed stems equity losses after UK CPI shock

- Home

- News & Analysis

- Economic Updates

- Less hawkish Fed stems equity losses after UK CPI shock

News & AnalysisNews & Analysis

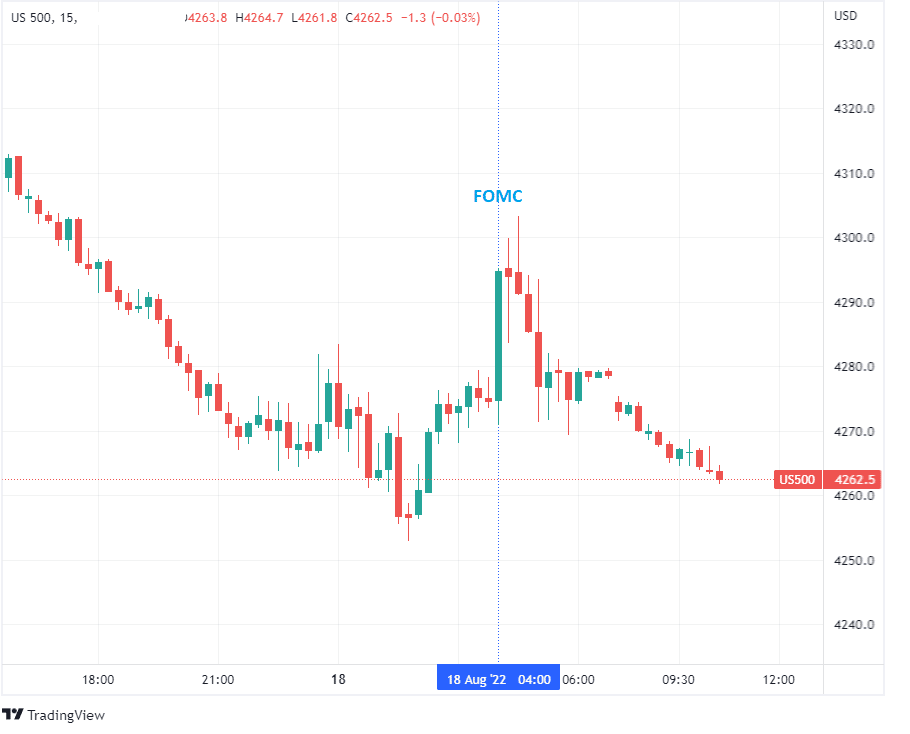

News & AnalysisNews & AnalysisUS equites finished lower on Wednesday after a double digit CPI figure out of the UK saw traders ramping up their hawkish central bank pricing. The July FOMC minutes released late in the session softened the blow somewhat on the back of some participants noting the risk that the Fed could tighten more than necessary, this was seen as dovish, or more accurately “less hawkish” than anticipated, giving US equites a temporary lift which did fully retrace by the end of the session.

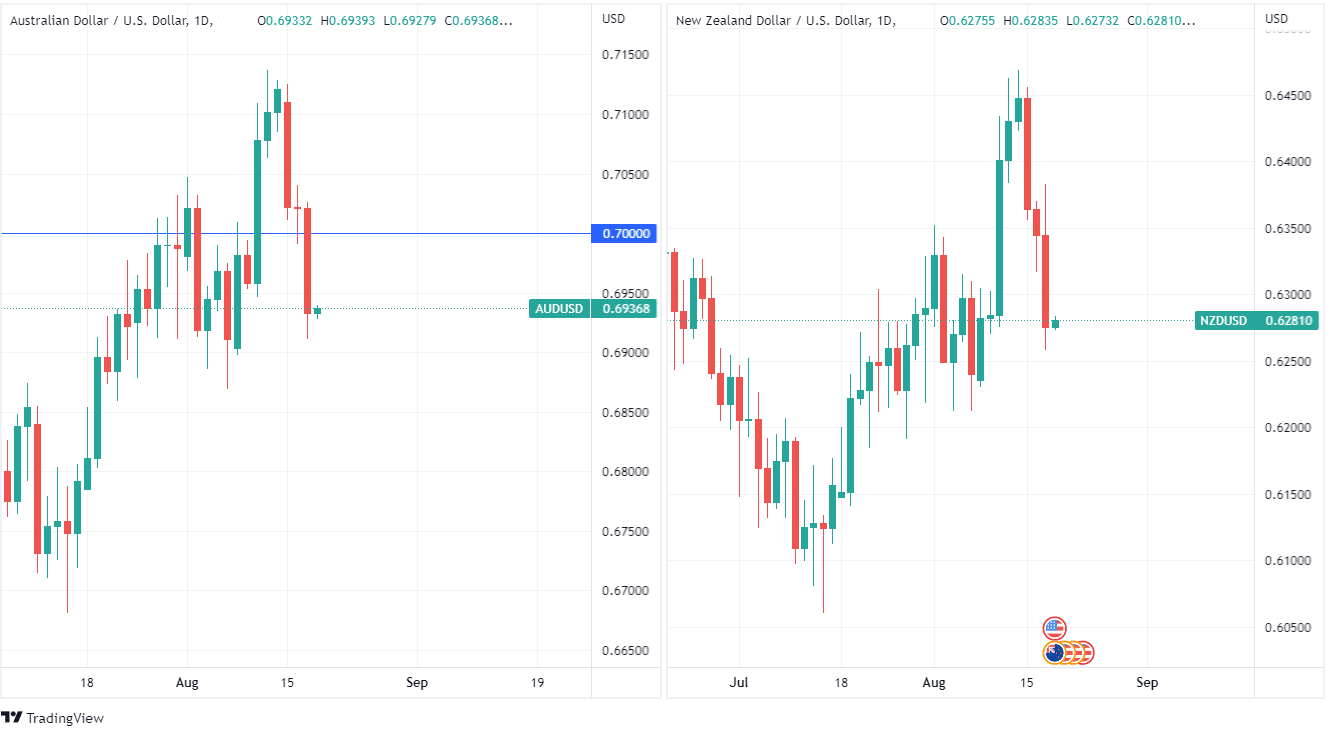

In FX, the US Dollar was mostly stronger on a combination of bond yields rising after the FOMC and a flight to safety as equities remained under pressure. AUD and NZD were underperformers in G10 currencies, the AUD already had the headwinds of softer-than-expected Wage Price Index data, coupled with weakness in the commodity markets, especially iron ore and copper saw the AUDUSD well below the psychological 0.70 US level. NZD fared relatively better with the hawkish 50bp hike from the RBNZ earlier in the day bolstering the kiwi somewhat.

Despite a shock double digit UK CPI figure of 10.1%, Sterling only managed a brief pop, which was sold off quickly on heightened UK recession fears and a strong USD.

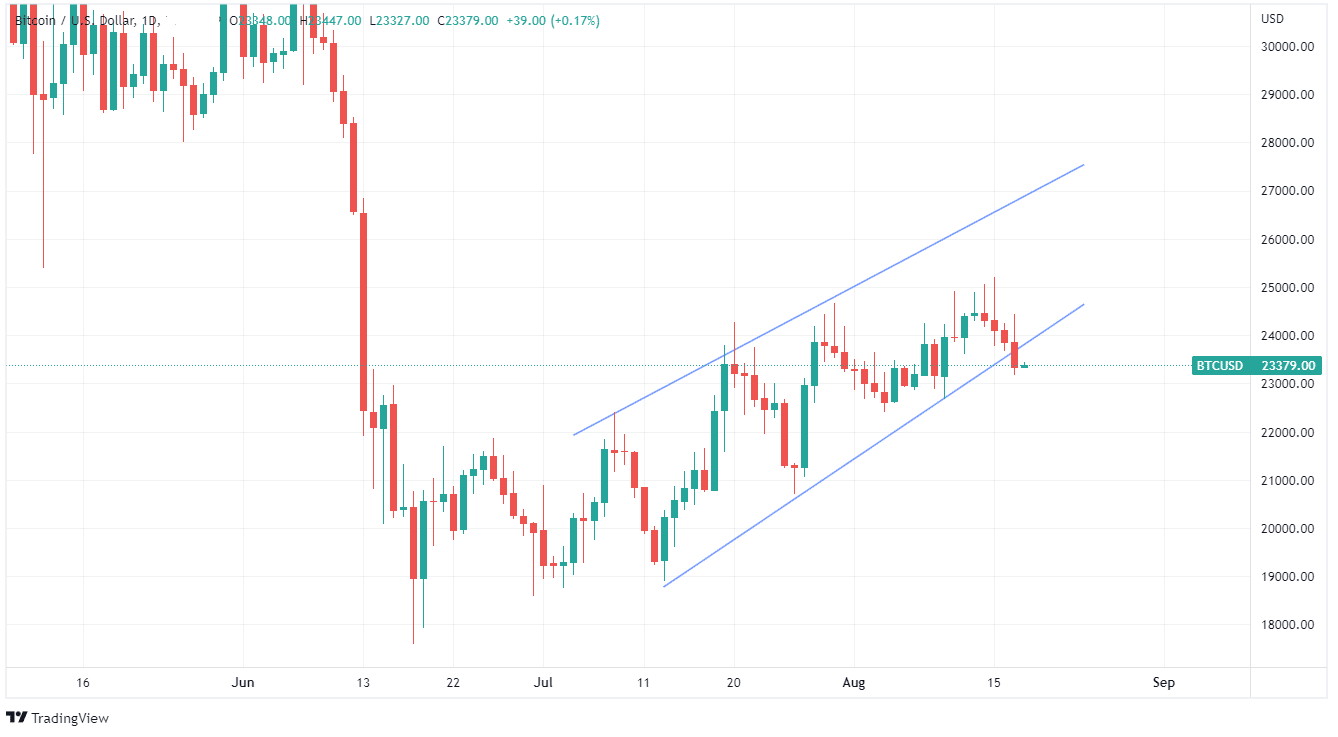

Cryptos again came under pressure, with a 4th straight losing session on Bitcoin taking the price below 23500 and breaching its lower trend line.

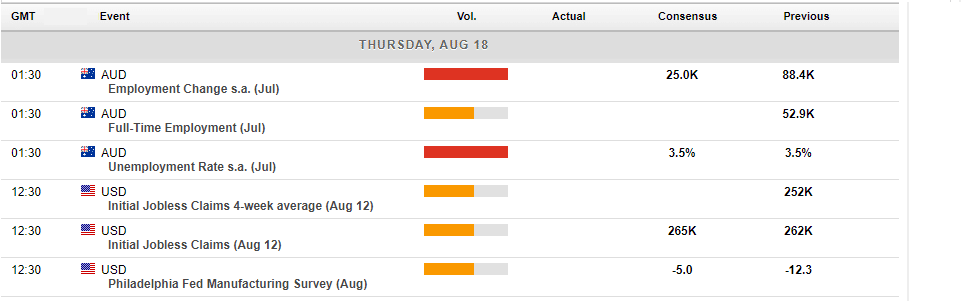

Coming up today, a closely watched (by the RBA and traders alike) Australian employment figure which will take on extra importance for the AUD after yesterdays weaker than expected wage data, due to be released at 11:30 AEST.

US manufacturing figures and jobless claims will be out an hour before their cash session starts.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Disney’s Resurgence & Streaming Plan

Disney is a huge name synonymous with providing movies, TV series and allowing children to live out their fantasies and playing out their dreams within their iconic parks. We have all either, in one shape or form watched a film or series produced by Disney’s huge conveyor belt of production. They are not strangers to us, but somehow if you as...

August 18, 2022Read More >Previous Article

Target falls short in Q2 – the stock is down

Target Corporation (TGT) reported its second quarter earnings results before the opening bell on Wall Street on Wednesday. The US retailer reported...

August 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading