- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Lithium stocks drop after calls that Battery ‘Bull Market’ is over

- Home

- News & Analysis

- Economic Updates

- Lithium stocks drop after calls that Battery ‘Bull Market’ is over

News & AnalysisNews & Analysis

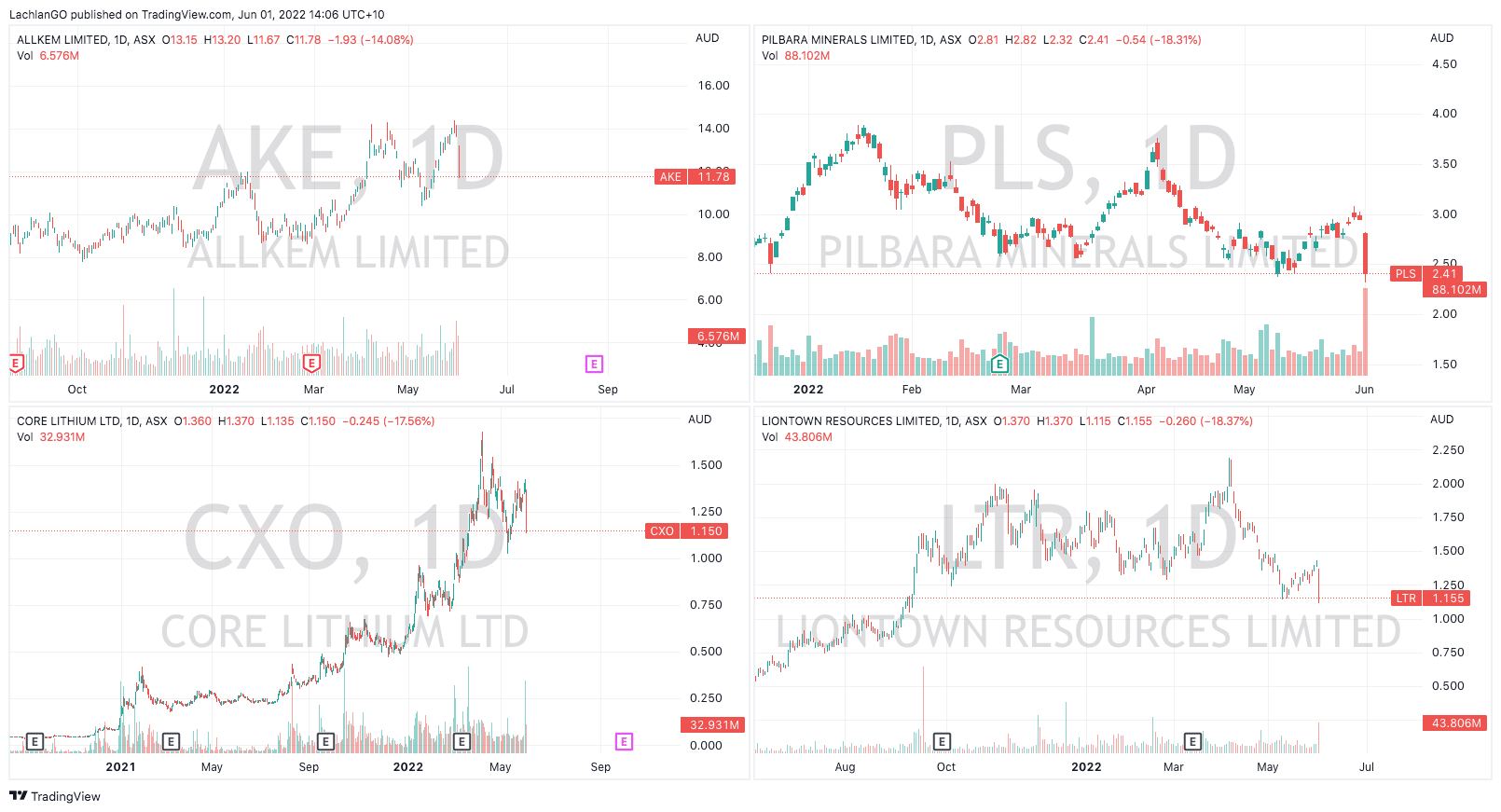

News & AnalysisNews & AnalysisAustralian lithium stocks have fallen remarkably after analysts from Goldman Sachs predicted that the material’s price has reached a peaked. Their predictions outline are that the price may fall 76% from its current highs. The predicted price drop is due to an oversupply that has been produced in the short-term outpacing the demand. In addition, Argentina, one of the world largest producers of Lithium has called into question its own investment into Lithium and the direction of the country’s move into the material, due to environmental factors and the economics of the projects.

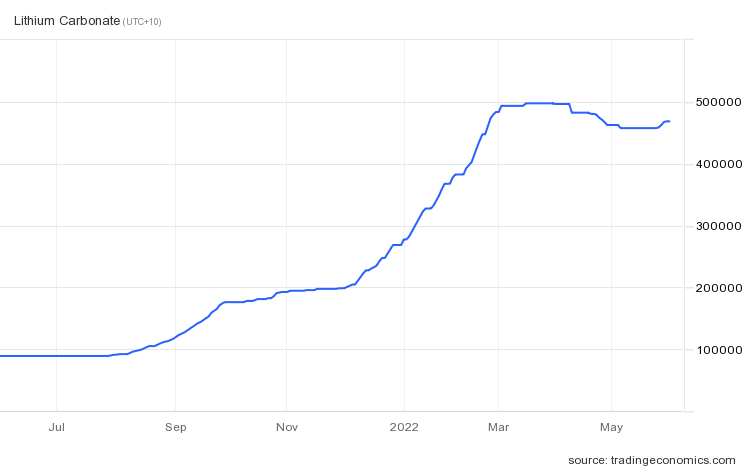

Lithium has seen a dramatic run in recent years as the market has shifted its focus towards renewable energy and electric vehicles that require lithium for batteries. The spot price of lithium carbonate rose sharply to reflect the demand as seen in the chart below which is approximately 65,000 USD per tonne. The price is still holding despite the recent negative sentiment.

Despite the positive spot price, the negative sentiment has caused a significant drop in the price of the major lithium companies. AKE and PLS fell between 10-20% and junior lithium miners were punished even more as their valuations took a hit. Companies such as CXO and LTR fell almost 20% as holders looked to move their money out of the stocks.

Whilst the price action has been brutal, spot prices remain steady and the demand for lithium continues to grow as the world progresses to a more environmentally friendly future.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

NIO’s May delivery numbers have arrived

NIO Inc. (NIO) reported its latest delivery numbers for May on Wednesday. The Chinese electric vehicle company delivered 7,024 cars in the previous month – a 11.8% increase year-over-year. Production and deliveries have been recovering from the constraints caused by COVID-19 outbreaks in China, according to the company, however, it still ha...

June 2, 2022Read More >Previous Article

Salesforce beats Q1 estimates – stock jumps in after-hours

Salesforce Inc. (CRM) reported its first quarter financial results after market close on Tuesday. The company beat both revenue and earnings per share...

June 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading