- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Lucid posts better than expected results in Q1

- Home

- News & Analysis

- Economic Updates

- Lucid posts better than expected results in Q1

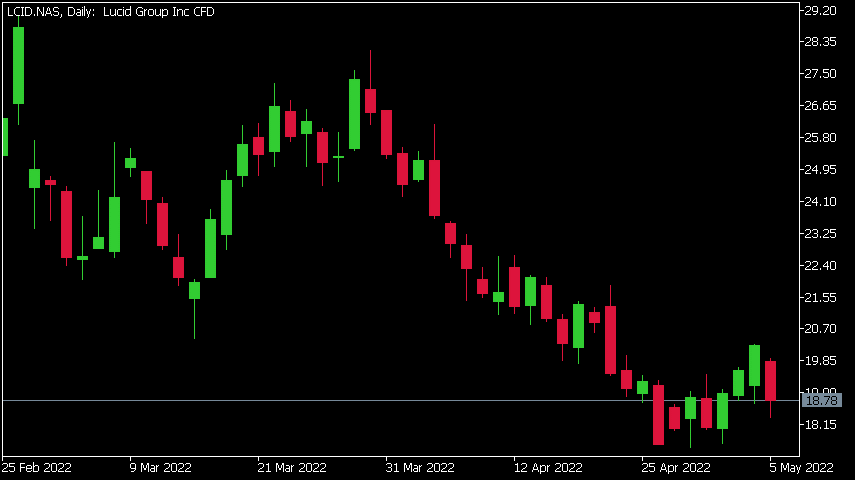

- 1 Month -15.55%

- 3 Month -30.06%

- Year-to-date -50.46%

- 1 Year -0.58%

- Morgan Stanley: $12

- B of A Securities: $30

- Citigroup: $28

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisLucid Group Inc. (LCID) reported its first quarter financial results after the market close on Thursday, delivering solid results.

The US electric vehicle manufacturer reported revenue of $57.675 million, surpassing analyst estimate of $55.556 million.

The company reported a loss per share of -$0.05 vs. -$0.31 loss per share expected.

“We continued to make progress in the first quarter of 2022 despite on-going global supply chain challenges,” Lucid CEO, Peter Rawlinson said in a press release after the results were announced.

Sherry House, CFO of Lucid also commented on the results: “Our Q1 revenue was $57.7 million, primarily driven by higher customer deliveries of Lucid Air vehicles. We continue to have a healthy balance sheet, closing the quarter with nearly $5.4 billion of cash on hand, which we believe is sufficient to fund the Company well into 2023.”

“In addition to the 30,000 customer reservations we announced today, we recently signed a deal in which the government of Saudi Arabia committed to purchase up to 100,000 electric vehicles from Lucid over the next 10 years,” House added.

Lucid also confirmed that its production volume is on track to produce 12,000-14,000 vehicles this year.

Lucid Group Inc. chart

Shares of Lucid were down by 6.96% at the close of trading on Thursday at $18.78 per share.

Here is how the stock has performed in the past year:

Lucid price targets

Lucid Group Inc. is the 2nd largest electric vehicle manufacturer in the world with a market cap of $31.38 billion.

You can trade Lucid Group Inc (LCID) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Lucid Group Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Is the Japanese Yen, JPY at risk?

The Japanese Yen, Japan’s currency, has long been classed in the safe haven category along with the USD and Gold. A currency that even in times of extreme pressure in the world economies, has been able to hold its price somewhat, compared to other major currencies. This is one of the reasons why Japan’s economy, albeit heavily in debt, is r...

May 6, 2022Read More >Previous Article

AGL Energy and The Mike Cannon-Brookes Take Over

First things first; who is AGL Energy? AGL is a leading integrated essential service provider, with a proud 185-year history of innovation and a p...

May 5, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading