- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Macquarie Group banks 50% increase in profit

News & AnalysisAustralian bank, Macquarie has announced a strong uptick in earnings for the year. The company banked an impressive $4.706 Billion in profit which was an increase of 56% on 3,015 Billion for the FY21. Net profit was also up by 30% on 1H22. The company decided to give back ordinary dividends to the value of $6.22 per share.

The bank unlike the other ‘Big 4’ has much more of a focus and a larger business dedicated to capital markets. It is more of an Investment Bank then a traditional lending bank. This allowed the organisation to remain versatile and adjust to the economic conditions. Assets under management grew 37% from $563 Billion to 774.8 Billion. The annuity side of the asset management team contributed a combined net profit of $4.132 Billion.

Withstanding volatile conditions, a significant portion of the year’s success came from its European investment and positions in both Rail and UK meters portfolio. Macquarie also had strong returns from its commodities and global sector rising by 50% for a total of $3.911 Billion which was supported by strong oil and gas prices.

Company CEO Shemara Wikramanyake outlined that “While many of the regions and markets in which Macquarie operates saw heightened levels of volatility this year, our longstanding strategy to address key areas of unmet need in the community is unchanged.” The cautious review and outlook suggest that the volatility may remain for a while. Pressures from high-interest rates, inflationary pressures, and geopolitical events may still play a role in the short-term future.

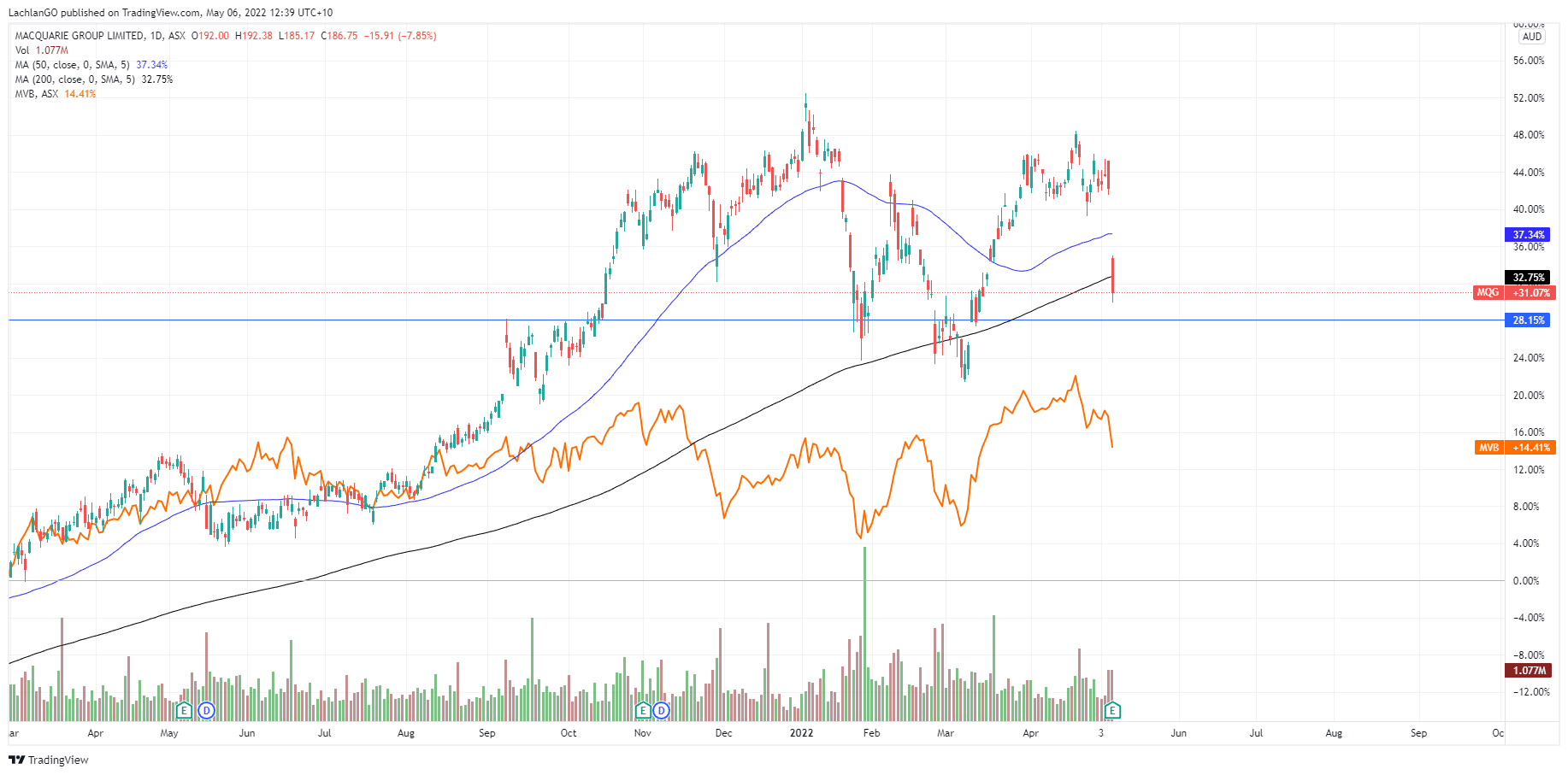

The Macquarie Group price chart has been one of the more bullish charts within the Banking sector. Looking at the chart below, Macquarie Group has outperformed the Australian Banks ETF. However, the stock has seen a sell-off through the 200MA after a gap down on the release of the news this morning. This sell-off may be more reflective of the market than the companies’ performance itself with a very bearish overall market sentiment.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Under Armour under performs – the stock tumbles

Under Armour Inc. (UAA) reported its latest financial results Q1 on Friday. The US sportswear equipment company fell short of analyst estimates for the quarter, sending the stock in free fall. Revenue reported at $1.301 billion vs. $1.319 billion expected. Analysts were expecting earnings per share of $0.04 for the quarter, however, Under Arm...

May 9, 2022Read More >Previous Article

Is the Japanese Yen, JPY at risk?

The Japanese Yen, Japan’s currency, has long been classed in the safe haven category along with the USD and Gold. A currency that even in times ...

May 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading