- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Market await FOMC Interest rate decision

News & AnalysisIn what has been a heavily anticipated market event at 4:00am EST Australia, the US federal Reserve is set to release its changed Federal Funds rate for the quarter. The rate changes are an important aspect of keeping inflation under control as higher interest rates impact on consumer and business borrowing and investment.

The market has mostly priced in a 75 bps hike but has not ruled out the potential for a more aggressive 100 bps jump. There is currently a 75/80% chance of a 75 bps increase and 15/20% chance of 100 point hike. After a hawkish build up to the meeting including a very hawkish attitude that came out ‘Jackson Hole’ and hotter than expected CPI and Core CPI figures has led to increase in the level of hawkishness coming out of the Federal Reserve.

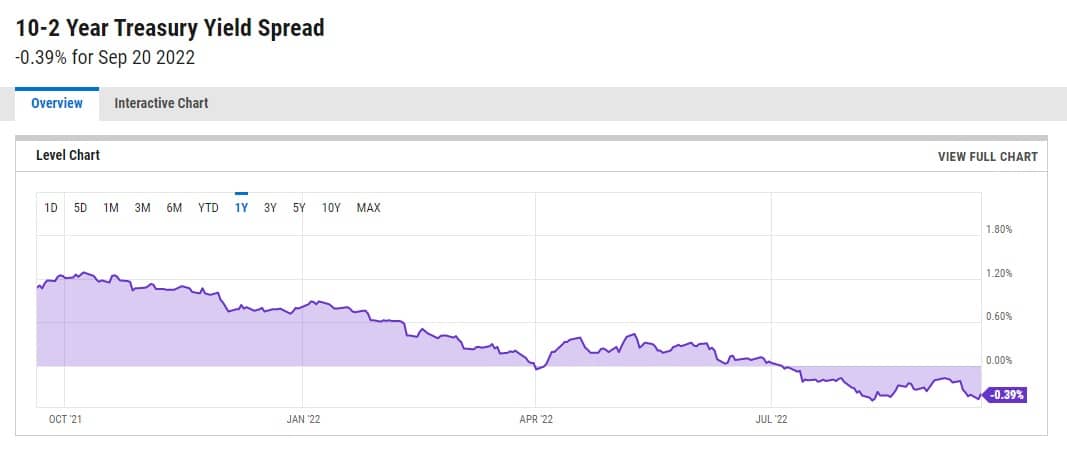

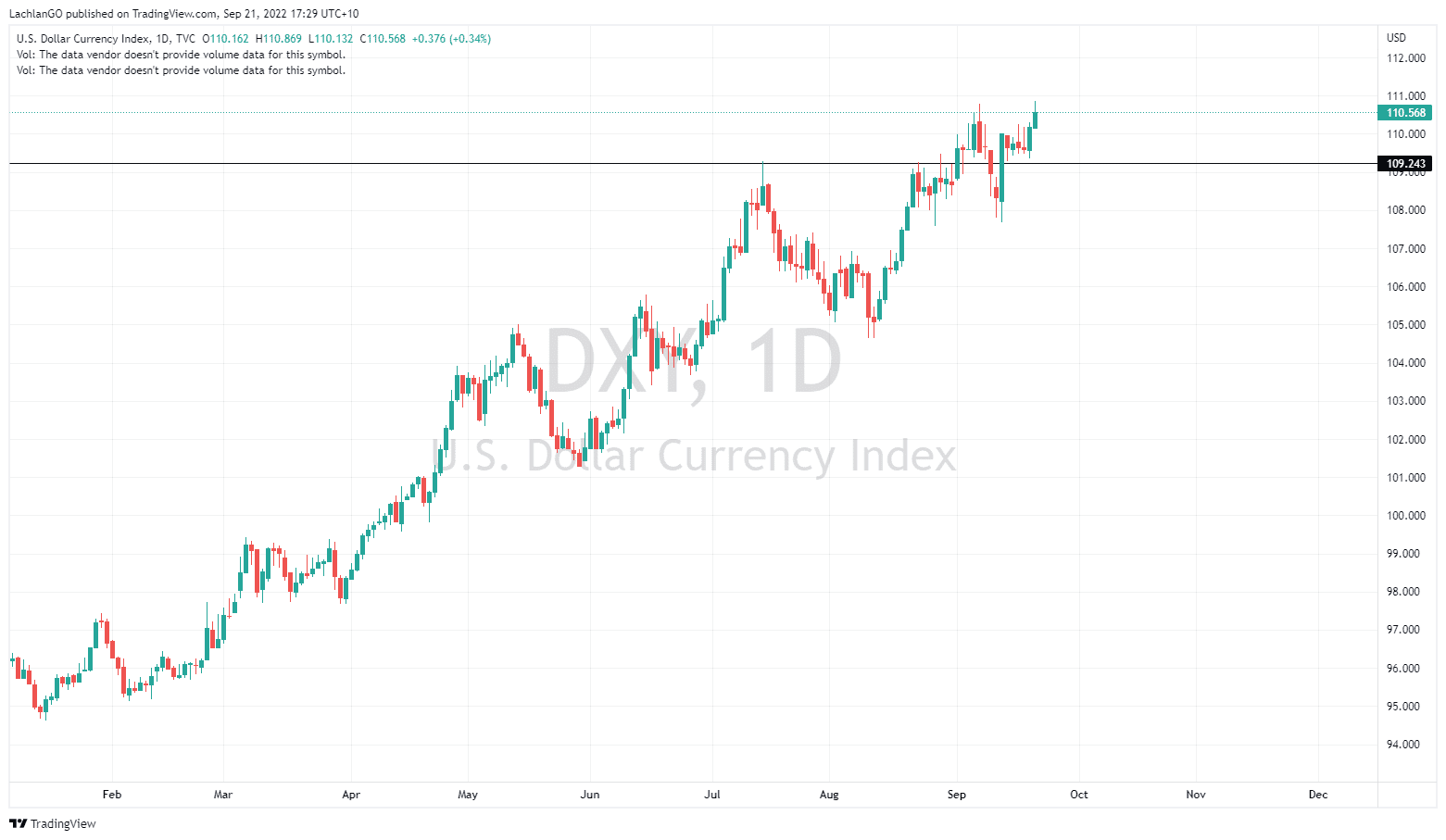

Consequently, the stock market has taken a steep dive and growth stocks have been hit the hardest. On the other hand, the USD has continued its impressive leap up. Furthermore, that yield curves of the 2 year and the 10 year bonds have extended their divergence, further indicating the potential of a recession.

The effect of the change may be substantial, especially if the change is a 100 bps and will likely see a sell down of the equities market. It may also reduce the potential for a soft landing. In addition, the comments and economic forecast from the Federal Reserve will be telling, as it will provide the market with some indication of what the future rate hikes could be.

The US Dollar has been one of the top performing assets during the recent months of volatility and if the FOMC meeting becomes more hawkish it will only increase the value of the USD. The impact will be reversed for growth stocks and Cryptocurrency. With higher interest rates growth assets typically struggle as money flows into safer assets such as gold and the USD.

Ultimately the economic forecasts that come out of this FOMC meeting and the rate changes will influence the global market.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

ASX200 resting on a knifes edge

Inflation and recessionary pressures have caused the aggressive sell offs of some of the largest global indices, however so far, the ASX200 or XJO has fared relatively well. However, there are worrying signs that a resilient XJO may be coming to an end. Whilst the inflation rate in Australia is still at levels that are low compared to much of the r...

September 26, 2022Read More >Previous Article

Technical Analysis – Oil taps a major trend line

The price of oil has been in a strong upward trend since May 2020, when it reached its bottom during the early stages of covid 19 pandemic, and the pr...

September 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading