- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Market smashed as CPI figures comes in hotter than expected

- Home

- News & Analysis

- Economic Updates

- Market smashed as CPI figures comes in hotter than expected

News & AnalysisNews & Analysis

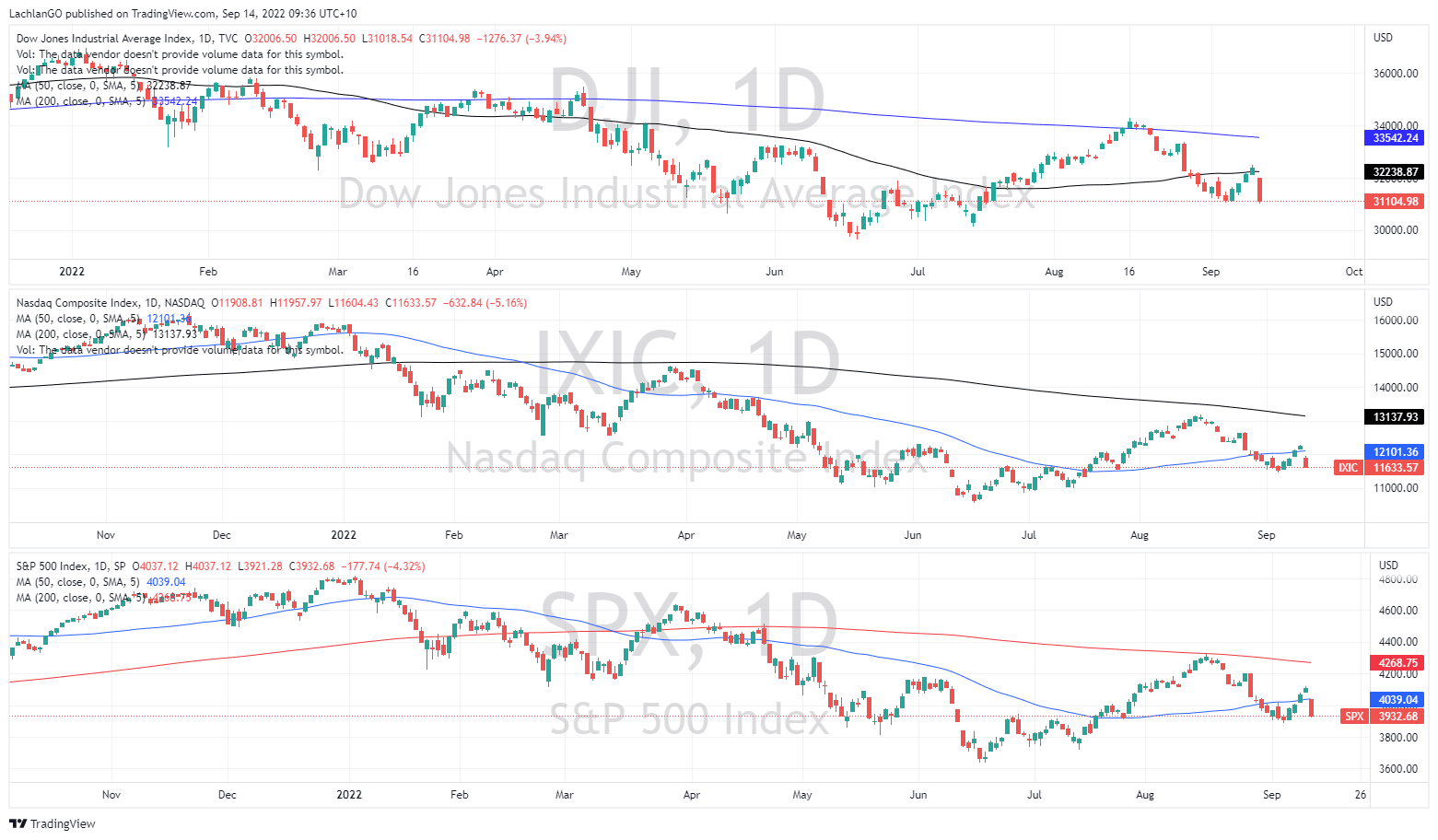

News & AnalysisNews & AnalysisThe US market has been smashed overnight on the back of higher then expected inflation figures. There had been some hope that inflation pressure was easing and that interest rate hikes were beginning to have an impact, however the bulls were no where to be seen in last night’s trading session as both the CPI and Core CPI figures came in higher then expected. The CPI figure was recorded at 0.1% which was higher then the expected -0.1% figure and core CPI came in at 0.6%, 0.3% higher than analysts were predicting. The figures have now pushed the bond market to predict a 20-30% chance of a 100-bps hike next week after being at 0% on Monday. This is compared to a 68% chance of a 75-bps hike which dropped from 91% on Monday.

The consequences of the inflated numbers was a brutal self-off on Wall Street with the Dow Jones, Nasdaq and S&P500 having their worst day in 2 years. The Dow Jones fell more than 1000 point to drop 3.94%, whilst the Nasdaq and S&P500 fell 5.16% and 4.32% respectively.

The impact of the figures also drove the USD higher. The index which is already at mutli-decade highs moved another 1.58% higher moving over $110. The USD strength showed against other currencies with the $AUD falling 2.29% and the EUR dropping 1.53%. The drop was also seen in the cryptocurrency sphere with Bitcoin falling nearly 10% whipping out its last week of gains. Commodities had an interesting session as the market was left unsure of which way to go. Natural Gas ended the day flat, and Brent fell just 0.63% as they showed relative strength.

All eyes will be looking forward to next week where the Federal Reserve will determine whether a 75-bps hike will still suffice or if 100 bps will be needed to stem inflation.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

NZDJPY showing a potential buy?

The NZDJPY like most currencies against the JPY has been in a strong uptrend for over 2 years. With the Central Bank of Japan remaining dovish in its monetary policy the currency has taken a beating against most other currencies and as other Central Banks have acted against rising inflation. The NZD has been able to take adva...

September 15, 2022Read More >Previous Article

Will the CHF/JPY reach 150?

The CHF has moved almost parabolically against the JPY and is almost touching 150, which would mark a 40 year first. With the Bank of Japan indicat...

September 13, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading