- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- McDonald’s delivers in Q1

- 1 Month +2.10%

- 3 Month +1.50%

- Year-to-date -5.82%

- 1 Year +7.34%

- UBS: $290

- Morgan Stanley: $287

- Barclays: $305

- Credit Suisse: $281

News & AnalysisMcDonald’s Corp. reported its Q1 financial results before the opening bell over in the US on Thursday.

World’s biggest fast food company reported revenue of $5.666 billion in the quarter, beating analyst forecast of $5.57 billion.

Earnings per share also topped analyst estimates at $2.28 per share vs. $2.17 per share expected.

“In a quarter that saw an increasingly complex and uncertain operating environment, I am proud to share that once again the Arches have shone brightly,” President and CEO of the company, Chris Kempczinski said in a press release after the strong Q1 results.

“Our strong performance in the first quarter was underpinned by global comparable sales up nearly 12%, reflecting broad-based momentum across all segments. In most of our major markets, we sustained QSR traffic share gains by focusing on elevating our brand, accelerating digital channels and showcasing our core equities of chicken and beef. By staying on the side of the consumer and executing our strategy, Accelerating the Arches, we have continued to drive growth. It is why I believe there has never been a better time to be part of brand McDonald’s,” Kempczinski added.

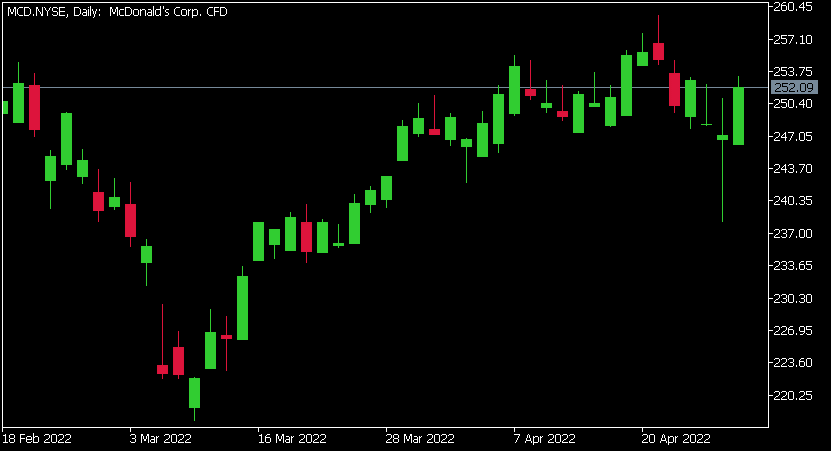

McDonald’s Corp. chart

The latest results had a positive impact on the share price at the open on Wednesday, the stock was up by over 2% at $252.09 per share.

Here is how the stock has performed in the past year:

McDonald’s price targets

McDonald’s Corp. is the 57th largest company in the world, with a total market cap of $186.39 billion.

You can trade McDonald’s Corp. (MCD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: McDonald’s Corp., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Amazon falls short in Q1

Amazon.com Inc. announced its first quarter results after the market close in the US on Thursday, falling short of Wall Street analyst expectations. The US online retailer reported revenue of $116.444 billion in the quarter vs. $116.45 billion estimate. Analysts were expecting earnings per share of $8.35 a share in Q1, however, the company re...

April 29, 2022Read More >Previous Article

Microsoft Earnings impress after strong revenue from its cloud system

Technology leader Microsoft has released its quarterly report beating analysts’ expectations. The company's balance sheet and price surge were large...

April 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading