- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Meta fourth quarter numbers are in

News & AnalysisMeta Platforms (FB) reported its fourth quarter financial numbers after the closing bell on Wall Street on Wednesday.

The company reported total revenue of $33.671 billion (up by 20% year-over-year), above analyst forecast of $33.357 billion.

Earnings per share at $3.67 (down by 5% year-over-year), falling short of analyst estimate of $3.85 per share.

Founder and CEO, Mark Zuckerberg commented on the latest results: ”We had a solid quarter as people turned to our products to stay connected and businesses continued to use our services to grow.”

Zuckerberg also outlined the progress the company has made and highlighted what the company will focus this year: ”I’m encouraged by the progress we made this past year in a number of important growth areas like Reels, commerce, and virtual reality, and we’ll continue investing in these and other key priorities in 2022 as we work towards building the metaverse.”

The company also announced that it expects to replace its existing ticker symbol ”FB” to ”META” in the first half of 2022 following the rebrand last year.

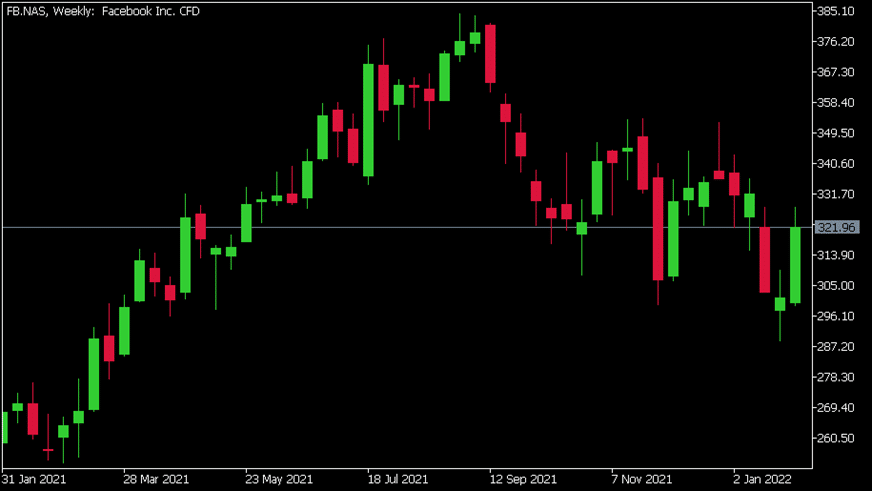

Meta Platforms (FB) chart (Weekly)

Shares of Meta ended the Wednesday trading day higher, up by 1.25% at $321.96. The stock dropped by around 20% in the after-hours trading following the latest results.

Meta is the 7th largest company in the world with a total market cap of $898.50 billion.

You can trade Meta Platforms (FB) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Meta Platforms, TradingView, GO Markets MT5, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Amazon Q4 financial results are in

Amazon.com (AMZN) announced its fourth quarter results after the closing bell on Thursday. The company reported total revenue of $137.412 billion (9% increase vs. the same period in 2020) in the previous quarter, which was just shy of analyst forecast of $137.682 billion. Earnings per share reported at $27.75, above analyst forecast of $3.61 ...

February 4, 2022Read More >Previous Article

Why is Bitcoin’s price falling and what is the aftermath?

Bitcoin, like many investment products, will be affected by decisions made by the U.S. Federal Reserve and their outlook on the U.S. economy. There...

January 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading