- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Microsoft Earnings impress after strong revenue from its cloud system

- Home

- News & Analysis

- Economic Updates

- Microsoft Earnings impress after strong revenue from its cloud system

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMicrosoft Earnings impress after strong revenue from its cloud system

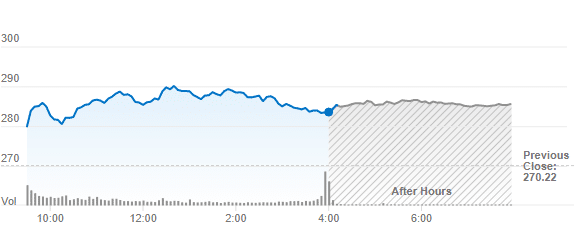

28 April 2022 By GO MarketsTechnology leader Microsoft has released its quarterly report beating analysts’ expectations. The company’s balance sheet and price surge were largely driven by strong revenue in its cloud computing Azure unit but was well supported by its other service areas. The results for the company’s third quarter showed a double-digit growth figure with revenue of $49.4 Billion up 18% and net an income of $16.7 Billion. The company’s profit rose 8% from the corresponding period 12 months ago.

Company CEO, Satya Nadella had this to say about the results, “Going forward, digital technology will be the key input that powers the world’s economic output. Across the tech stack, we are expanding our opportunity and taking share as we help customers differentiate, build resilience, and do more with less.”

Much of Microsoft’s success can be attributed to how well diversified its services are. Many other technology stocks have struggled in recent times such as Meta, Google, and Netflix with slower growth and interest rate pressures. However, Microsoft has been able to stand tall as its services such as LinkedIn, Gaming, Cloud, and its cyber security were able to thrive. The Azure cloud system that Microsoft runs was the star performer growing by 47%. LinkedIn also proved to be a strong area for Microsoft, increasing its revenue by 34% for the year.

In the short term, as interest rate hikes loom and the world is dealing with the remnants of the Covid 19 pandemic and Russia and Ukraine there may still be some headwinds ahead. Microsoft is up against the markets as the NASDAQ recently fell to its lowest levels since 2020. Consequently, despite Microsoft’s strong performance, the company’s share price may still face a volatile short-term future. In the long term, Microsoft has shown that it has formed a strong defensive element against the longer-term macro threats.

The Microsoft share price closed the day up 4.81% from the day before.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

McDonald’s delivers in Q1

McDonald's Corp. reported its Q1 financial results before the opening bell over in the US on Thursday. World’s biggest fast food company reported revenue of $5.666 billion in the quarter, beating analyst forecast of $5.57 billion. Earnings per share also topped analyst estimates at $2.28 per share vs. $2.17 per share expected. "In a quar...

April 29, 2022Read More >Previous Article

RBA rate day well in play after record CPI print

Going into yesterday's Aussie Inflation figures bond markets were pricing in around a 40% chance of a hike to 0.25% at next Tuesdays RBA May meeting. ...

April 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading