- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Microsoft falls short of expectations

- 1 Month -1.79%

- 3 Month -6.78%

- Year-to-date -25.10%

- 1 Year -12.09%

- Rosenblatt $330

- Wells Fargo $350

- Cowen & Co. $330

- Mizuho $340

- Citigroup $330

- BMO Capital $305

- Morgan Stanley $354

News & AnalysisMicrosoft Corporation reported its fiscal fourth-quarter financial results after the closing bell on Wall Street on Tuesday, missing analyst estimates for the quarter.

The company reported revenue of $51.9 billion (up by 12% year-over-year) vs. $52.384 billion expected.

Earnings per share reported at $2.23 per share (up by 3% year-over-year) vs. $2.29 per share estimate.

”We see real opportunity to help every customer in every industry use digital technology to overcome today’s challenges and emerge stronger,” Satya Nadella, Chairman and CEO of Microsoft said in a press release after the latest results.

”No company is better positioned than Microsoft to help organizations deliver on their digital imperative – so they can do more with less,” Nadella added.

”In a dynamic environment we saw strong demand, took share, and increased customer commitment to our cloud platform. Commercial bookings grew 25% and Microsoft Cloud revenue was $25 billion, up 28% year over year,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

”As we begin a new fiscal year, we remain committed to balancing operational discipline with continued investments in key strategic areas to drive future growth,” Hood concluded.

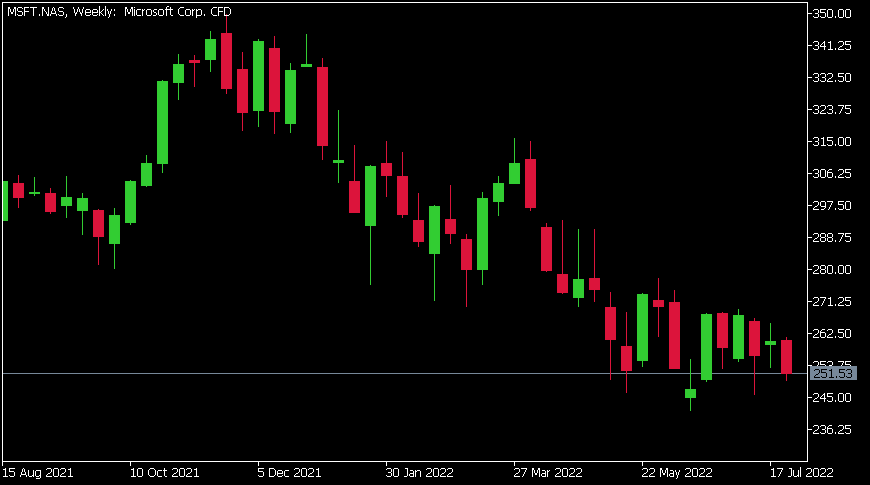

Microsoft Corporation (MSFT) chart

Shares of Microsoft ended Tuesday down by 2.68% at $251.53 per share.

Here is how the stock has performed in the past year:

Microsoft price targets

Microsoft is the 3rd largest company in the world with a market cap of $1.883 trillion.

You can trade Microsoft Corporation (MSFT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Microsoft Corporation , TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Australian CPI figures increase to 6.1%

The Australian Consumer data was released today with Consumer Price Index rising to 6.1% over the past 12 months. For the quarter, the CPI rose by 1.8% which was 0.1% lower then what analysts expected the figure to be. This was also lower then the 2.1% jump seen in the previous March quarter. The most significant contributors to the increase were n...

July 27, 2022Read More >Previous Article

Coca-Cola tops estimates in the second quarter – the stock gains

The Coca-Cola Company (KO) reported its latest financial results for the second quarter before the opening bell in the US on Tuesday, beating Wall Str...

July 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading