- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Morgan Stanley Q2 earnings beat estimates

News & AnalysisIt has been a fairly busy week over in the US with some of the world’s biggest financial institutions reporting their earnings numbers for the previous quarter. On Thursday, it was Morgan Stanley’s turn to report their earnings for Q2.

The company reported revenue of $14.8 billion in Q2 beating the $13.98 estimate. Earnings per share came in at $1.85 per share vs. forecast of $1.65 per share.

”The Firm delivered another very strong quarter, with contributions from all of our businesses. Our Wealth and Investment Management businesses attracted $120 billion in flows and Institutional Securities generated over $7 billion in revenues. With our transformed business model providing more stable and durable earnings, we have doubled our dividend and announced a $12 billion buyback as we move to return our excess capital to shareholders. Our global franchise is very well positioned to drive further growth.” – company’s Chairman and CEO, James Gorman commented on the report after it was released before the opening bell on Thursday.

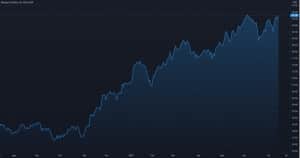

Morgan Stanley Chart (1Y)

The share price of Morgan Stanley traded higher during the session – up by 1.43% at $93.78 per share. The stock is up by 82% in the past year.

You can trade Morgan Stanley (MS) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Morgan Stanley, Refinitiv, TradingView

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Earning season continues – IBM Q2 numbers are in

It is set to be another busy week over in the US with major companies, including Netlfix, Coca-Cola, Intel, Twitter, Snap and American Express set to release their earnings figures for the previous quarter. On Monday, International Business Machines Co. (IBM) released their latest figures after the closing bell. The US technology giant reported ...

July 20, 2021Read More >Previous Article

Up next – Bank of America, Citigroup and Wells Fargo report Q2 results

On Tuesday, JPMorgan and Goldman Sachs released their Q2 results before the US market open – both beating analyst expectations. Today, Bank of Ameri...

July 15, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading