- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Musk’s future for Twitter

News & AnalysisThe future of the large-cap tech giant and social media platform, Twitter, will be one to watch closely after the Board approved tech billionaire and Tesla CEO, Elon Musk’s offer to buy the company. The question remains, is this a positive move for the company and its move into the future?

Takeover details

Musk’s offer, which has already been accepted by the board, will take the company private for the first time since 2013. The total amount that will be is $54.20 per share, equating to a value of $44 Billion. There are still several hurdles and regulatory processes that need to be signed off on before the process is completed. The most pressing of these is the shareholder approval. The deal may be finalised in the next few weeks.

Is this a good deal?

The question remains, did Twitter shareholders get a ‘bang for their buck’? The reality is it is impossible to know. However, in an ever-increasing market with large competitors such as Reddit, Discord, and Facebook doing everything they can to gain an advantage, relief for shareholders may be welcomed. In addition, with strong inflationary pressures and impending interest hikes, securing a premium offer at a time of high volatility is a somewhat safer outcome for shareholders.

However, even though whilst the premium paid by Musk caused a 5% jump in the share price, Twitter was trading for 77.06 USD not even 12 months ago, in May 2021. Consequently, Twitter shareholders may feel they are being short-changed by this deal.

Musk’s changes

From an operational and business perspective Musk is hoping to move Twitter back to a more free, less restrictive platform which he feels the company has gone away from. Musk stated in his own words, “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated.” He has also stated his desire for the company’s algorithms to be made more transparent and the spambots that often troll the feeds to be removed. In terms of profitability, Musk outlined his ambition to improve the cash flows by focusing on implementing subscriptions models.

Twitter’s Future

As stated previously, the process for acquiring the company and making it public will not happen overnight and therefore there will still be opportunities to trade the company’s shares, although the price will most likely linger near the offer price for the time being. From a societal perspective, a shift towards a more open and less moderated platform may bring in new and more diverse users and potentially more revenue. On the contrary, Twitter may face some backlash from legal and regulatory bodies for the actions of its users.

Lastly, the purchase of Twitter emphasises that there is still value in social media stocks. Therefore, even at a time when technology stocks are selling off, there is still a possible upside opportunity.

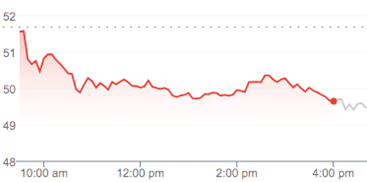

As of 26 April, Twitter’s share price was trading at $49.68 USD.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Visa crushes Wall Street estimates

Visa Inc. announced its fiscal second quarter 2022 results after the closing bell on Wall Street on Tuesday. The financial services giant topped both revenue and earnings per share estimates, sending the share price higher on Wednesday. The company reported revenue of $7.189 billion in the quarter vs. $6.833 billion estimate. Earnings per ...

April 28, 2022Read More >Previous Article

Coca-Cola tops Wall Street expectations in the first quarter

The Coca-Cola Company reported its latest financial results for the first quarter of the year before the Wall Street opening bell on Monday. World�...

April 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading