- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Myer announces first dividend payout since 2017

- Home

- News & Analysis

- Economic Updates

- Myer announces first dividend payout since 2017

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMyer is an Australian mid-range to upscale department store chain. It trades in all Australian states. Myer retails a broad range of products from clothing and cosmetics to homewares and electronics.

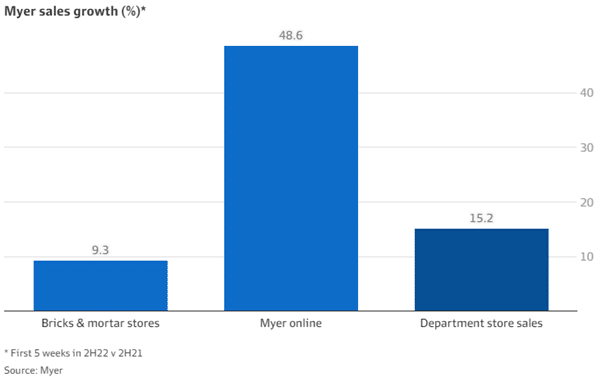

Myer has recently released their half-year results. In the first five weeks of 2022 they have posted a 15.2% increase in sales. Online sales have also surged by 48.6% during the same period.

This increase, along with the rest of the report, had a positive effect on their share value as investors welcomed the good news, pushing the price up 24% to 51 cents on Thursday. This is the highest closing price in over three months.

The Myer One loyalty program was responsible for around 70% of Myer’s sales. Myer One is looking to launch more partnerships in the near future and this will give members more chances to spend at Myer.

Myer’s rollercoaster start to the financial year began with store closures which lead up to a strong pre-Christmas trade period and transitioned into a January that was heavily affected by omicron which contributed to declining consumer confidence.

Although Covid-19 is less of a concern now, there are still factors that are weighing on consumers’ minds, such as potential higher inflation, reactive interest rate rises and increasing petrol prices.

Total sales for the five months were up by double digits, but with January’s Covid-19 affected month, the revenue for the period still managed to increase by 8.5% to $1.52 billion. Same-store sales, excluding periods when stores were closed, rose more than 17%, driven by improved product offering and more inventory.

Myer’s net profit dropped 24.7% to $32.3 million for the 26 weeks period ended January 29. But underlying momentum was positive; stripping out JobKeeper from last year, profits rose 55.2%.

Online sales increased by 47.5% to $424.1 million, and now contributes to 27.9% of total sales.

These positive results have led to Myer paying a fully franked interim dividend of 1.5 cents per share. This will be the first dividend payment since 2017, which was a dividend payment of 2 cents per share.

Retail billionaire Solomon Lew, who holds 20% of Myer’s shares, will receive a dividend payout of $2.4 million.

John King, Myer’s CEO, had launched his turnaround strategy four years ago which aims to reverse the long-term slide in performance. This strategy includes reducing stores’ floor space, dumping lacklustre brands, offering fewer promotions and investing in online shopping. The goal is to increase sales to $1 billion by 2025.

All in all, Myer’s first dividend payment is a positive reflection on their performance so far this year. Investors and the share value have responded positively. If the trend continues, the final dividend can possibly be higher as was the case in 2016.

If you would like to take this opportunity to invest in Myer and don’t already have a trading account, you can register for a Shares account at GO Markets.

Sources: ASX, TradingView, investor.myer.com.au, SMH, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Tech Sector sell-off continues in anticipation of interest rate hikes.

The Dow Jones closed flat after another volatile day. The Nasdaq and the S&P 500 finished 2.04% and 0.74% lower respectively, as tech continued its sell-off and the Nasdaq confirmed its Bear market. The European markets performed a little better as optimism that the worst of Ukraine and Russian conflict may have passed. The FTSE moved up 0.5...

March 15, 2022Read More >Previous Article

Russia and Ukraine peace talks end without ceasefire & Bitcoin drops below 40,000 USD

Global indices finished relatively flat compared to recent day's price action on the back of failed peace talks between Russia and Ukraine and the ECB...

March 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading