- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Netflix & earnings – Q2 numbers released

News & AnalysisNetflix reported their Q2 earnings after the closing bell on Tuesday.

The online streaming service reported total revenue of $7.34 billion in the previous quarter, narrowly beating analyst forecast of $7.32 billion. Earnings per share were reported below analyst forecast at $2.97 per share vs. $3.16 expected.

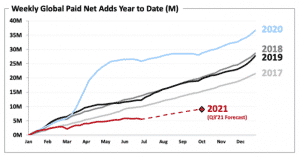

Global paid net subscriber additions grew by 1.54 million, above analyst prediction of 1.19 million.

”Revenue growth was driven by an 11% increase in average paid streaming memberships and 8% growth in average revenue per membership (ARM). ARM rose 4%, excluding a foreign exchange (FX) impact of 1 +$277m. Operating margin of 25.2% expanded 3 percentage points compared with the year ago quarter. EPS of $2.97 vs. $1.59 a year ago included a $63m non-cash unrealized loss from FX remeasurement on our Euro denominated debt.”

”The pandemic has created unusual choppiness in our growth and distorts year-over-year comparisons as acquisition and engagement per member household spiked in the early months of COVID. In Q2’21, our engagement per member household was, as expected, down vs. those unprecedented levels but was still up 17% compared with a more comparable Q2’19. Similarly, retention continues to be strong and better than pre-COVID Q2’19 levels, even as average revenue per membership has grown 8% over this two-year period, demonstrating how much our members value Netflix and that as we improve our service we can charge a bit more.” – Netflix said in a letter to shareholders following the announcement.

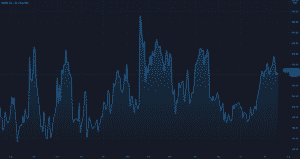

Netflix Chart (1Y)

The share price of Netflix was little changed at the end of the trading day on Tuesday, down by 0.25% at $531.05 per share. The latest numbers did not have much of an impact on the stock in the after-hours trading either – up by 0.78%. Netflix is up by around 5% in the past year.

You can trade Netflix (NFLX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Netlfix, Refinitiv, TradingView

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Coca-Cola, Johnson & Johnson and Verizon Q2 results are in

The earnings season in the US is heating up. On Wednesday – Coca-Cola, Johnson & Johnson and Verizon reported their Q2 earnings before the market open. Let’s take a closer look at the numbers. Coca-Cola The Coca-Cola company posted solid numbers in the second quarter of the year, beating analyst forecasts. The total revenue came in at...

July 22, 2021Read More >Previous Article

Earning season continues – IBM Q2 numbers are in

It is set to be another busy week over in the US with major companies, including Netlfix, Coca-Cola, Intel, Twitter, Snap and American Express set to ...

July 20, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading