- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

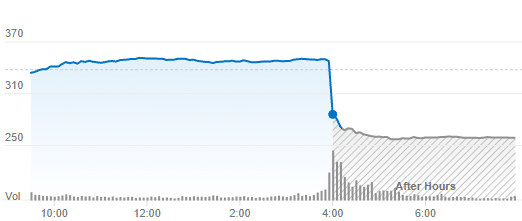

- Netflix plumets 25% after hours after hours after disappointing quarterly results.

- Home

- News & Analysis

- Economic Updates

- Netflix plumets 25% after hours after hours after disappointing quarterly results.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisNetflix plumets 25% after hours after hours after disappointing quarterly results.

20 April 2022 By GO MarketsUS streaming giant Netflix (NFLX) has seen its share price fall spectacularly after regular trading hours as the market released poor quarterly results.

The concern for the company and the market concern is the first loss of subscribers in a decade. NFLX’s user base dropped by 200,000 and is expected to drop further by 2 million in the next period. This was a dramatic drop from the 2.5 million subscriber gain that the company had expected. It is also the fourth time in the last 5 quarters that NFLX’s subscriber growth has fallen below the gains of the previous quarter. NFLX blamed much of the drop on increased competition and banning operations in Russia which saw it lose 700,000 subscribers. Netflix has already increased its fees which makes it the most expensive streaming service. However, it is still the largest streaming platform with more than 221 million subscribers.

The Netflix CEO announced plans for the company to introduce advertisements for lower-cost plans at a different level than its current subscription. In what has been a constant point of difference for the company, the leadership of NFLX conceded that to continue its growth it will need to introduce advertisements to the platform. It plans on integrating adverts into the platform over the next two years. This is in line with some of its competitors such as Disney Plus, Hulu, HBO Max, and others who provide a cheaper service.

The NFLX share price has taken a beating in recent times dropping almost 67% from its highs of $700 in 2021 to $257 at its most recent after hours close. The market has not reacted kindly to the recent inflationary and competition pressures that NFLX has faced, and the next period may be a bumpy path for NFLX.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Macquarie’s recent $3.5 billion sale to AustralianSuper and Singtel

AustralianSuper and Singtel’s company, Australian Tower Network (ATN), has recently won the auction for Axicom. Early this month, Macquire’s Axicom was looking for buyers and had settled for ATN. Shareholders from both ATN and Axicom signed the $3.5 billion deal early this month. The deal would allow ATN to add around 2000 of Axicom’s ...

April 21, 2022Read More >Previous Article

Netflix takes a dip

Netlfix Inc. reported its latest financial results after the closing bell on Wall Street on Tuesday. The online streaming service company reported ...

April 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading