- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Netflix takes a dip

- 1 Month -8.96%

- 3 Month -31.75%

- Year-to-date -42.13%

- 1 Year -36.57%

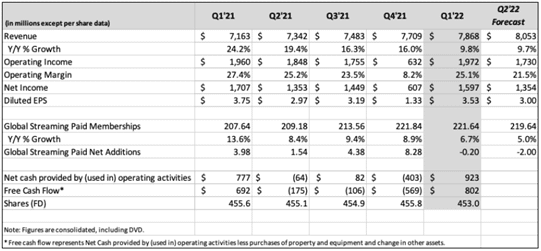

News & AnalysisNetlfix Inc. reported its latest financial results after the closing bell on Wall Street on Tuesday.

The online streaming service company reported revenue just shy of analyst estimates at $7.868 billion in the first quarter vs. $7.929 billion expected.

Earnings per share topped expectations at $3.53 per share vs. $2.90 per share expected.

Netflix lost 200,000 subscribers in the first quarter of 2022 – the first time in over 10 years.

”Our revenue growth has slowed considerably as our results and forecast below show. Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration – when including the large number of households sharing accounts – combined with competition, is creating revenue growth headwinds. The big COVID boost to streaming obscured the picture until recently. While we work to reaccelerate our revenue growth – through improvements to our service and more effective monetization of multi-household sharing – we’ll be holding our operating margin at around 20%. Key to our success has been our ability to create amazing entertainment from all around the world, present it in highly personalized ways, and win more viewing than our competitors. These are Netflix’s core strengths and competitive advantages. Together with our strong profitability, we believe we have the foundation from which we can both significantly improve, and better monetize, our service longer term,” Netflix said in a statement to shareholders following the latest results.

”In the near term though, we’re not growing revenue as fast as we’d like. COVID clouded the picture by significantly increasing our growth in 2020, leading us to believe that most of our slowing growth in 2021 was due to the COVID pull forward.”

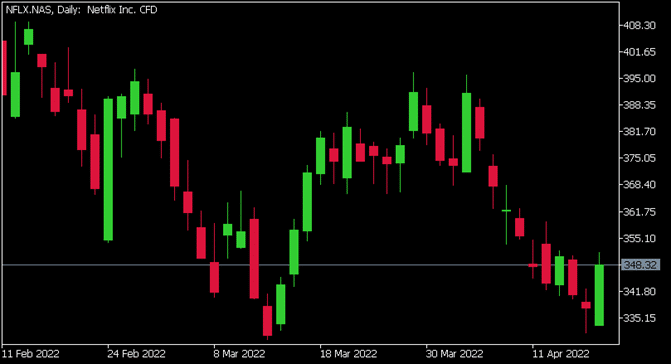

Netflix Inc. chart

Shares of Netflix ended the trading day up by 3.18% on Tuesday at $348.32 per share. However, the stock price fell sharply in the after-market trading hours – down by over 25% due to loss of subscribers and slow growth outlook.

Here is how the stock has performed in the past year:

Netlfix Inc. is the 79th largest company in the world and with a total market cap of $154.87 billion.

You can trade Netflix Inc. (NFLX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Netlfix Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Netflix plumets 25% after hours after hours after disappointing quarterly results.

US streaming giant Netflix (NFLX) has seen its share price fall spectacularly after regular trading hours as the market released poor quarterly results. The concern for the company and the market concern is the first loss of subscribers in a decade. NFLX’s user base dropped by 200,000 and is expected to drop further by 2 million in the next pe...

April 20, 2022Read More >Previous Article

Coal prices soar as Australian Coal miners reach 52-week highs

Coal prices have spiked in recent times due to the energy crunch that has developed in Europe relating to pressures from Russia and Ukraine. Australia...

April 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading