- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- NIO’s May delivery numbers have arrived

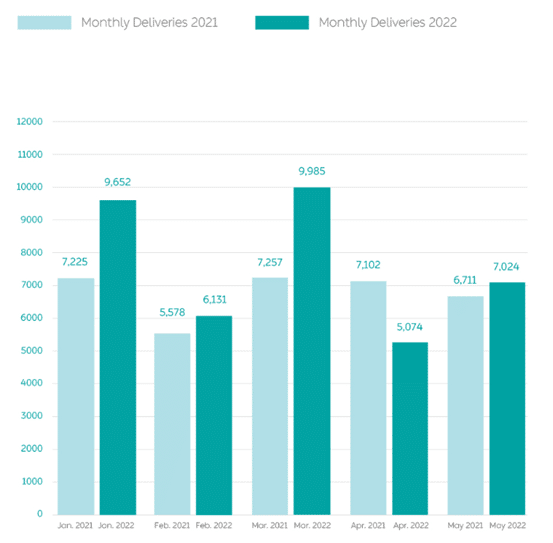

- 746 ES8s – the company’s six-seater or seven-seater flagship premium smart electric SUV

- 2,936 ES6s – the company’s five-seater high-performance premium smart electric SUV

- 1,635 EC6s – the company’s five-seater premium smart electric coupe SUV

- 1,707 ET7s – the Company’s flagship premium smart electric sedan

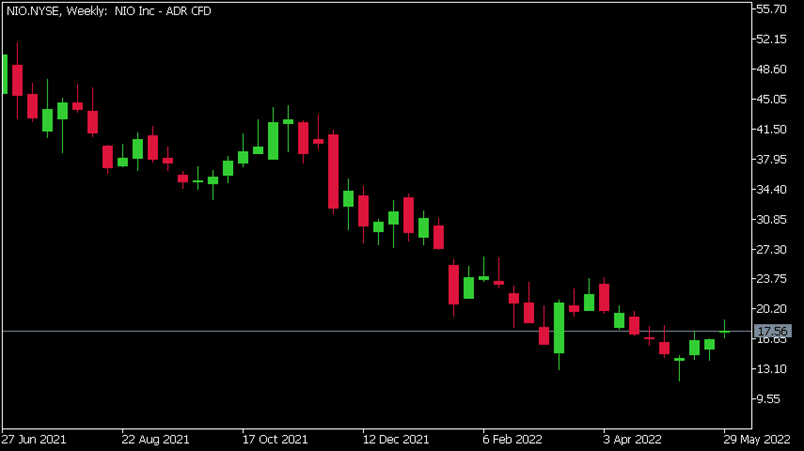

- 1 Month -3.09%

- 3 Month -19.29%

- Year-to-date -44.54%

- 1 Year -57.31%

- UBS $32

- Mizuho $60

- Morgan Stanley $34

- Barclays $34

- Deutsche Bank $70

- Goldman Sachs $56

News & AnalysisNIO Inc. (NIO) reported its latest delivery numbers for May on Wednesday.

The Chinese electric vehicle company delivered 7,024 cars in the previous month – a 11.8% increase year-over-year.

Production and deliveries have been recovering from the constraints caused by COVID-19 outbreaks in China, according to the company, however, it still had a slight impact on the production last month.

The company expects ”to accelerate the delivery recovery starting from June.”

The deliveries in May consisted of:

NIO has delivered a total of 204,936 electric vehicles as of 31st May, 2022.

The company will report its Q1 earnings results on the 9th June.

NIO Inc. chart

Here is how the stock has performed in the past year:

NIO price targets

NIO is the 17th largest automaker in the world with a market cap of $29.90 billion.

You can trade NIO Inc. (NIO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: NIO Inc., MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

What’s an EA: Expert Advisor

Expert Advisors are programs which are configured to execute trades or read market price movements. When a parameter is met or triggered, it commands the EA to open or close trades on your behalf whilst you are otherwise engaged or sleeping. EAs are compatible to be used on the Metatrader 4 and 5 systems. Algorithmic trading is a method of ...

June 2, 2022Read More >Previous Article

Lithium stocks drop after calls that Battery ‘Bull Market’ is over

Australian lithium stocks have fallen remarkably after analysts from Goldman Sachs predicted that the material’s price has reached a peaked. Their p...

June 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading