- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- NVIDIA beats estimates

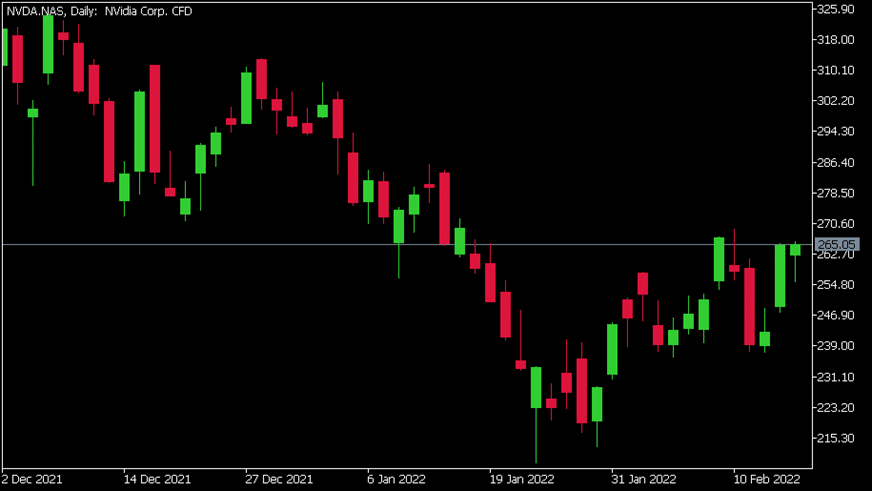

- 1 Month: +5.76%

- 3 Month: -9.40%

- Year-to-date: -9.86%

- 1 Year: +77.85%

News & AnalysisNVIDIA Corp. reported its fourth quarter financial results after the market close on Wednesday.

The US technology giant reported revenue of $7.643 billion in the previous quarter (up by 53% from a year earlier) vs. $7.42 billion expected.

Earnings per share reported at $1.32 (up 69% from a year earlier and up 13% from the quarter before) vs. $1.23 per share expected.

The company paid quarterly cash dividends of $100 million in the fourth quarter.

”We are seeing exceptional demand for NVIDIA computing platforms,” founder and CEO of NVIDIA, Jensen Huang said in a statement following the latest results.

”NVIDIA is propelling advances in AI, digital biology, climate sciences, gaming, creative design, autonomous vehicles and robotics – some of today’s most impactful fields.”

”We are entering the new year with strong momentum across our businesses and excellent traction with our new software business models with NVIDIA AI, NVIDIA Omniverse and NVIDIA DRIVE. GTC is coming. We will announce many new products, applications and partners for NVIDIA computing,” he added.

NVIDIA Corp. (NVDA) chart (daily)

Shares of NVIDIA were little changed at the end of the trading day on Wall Street, up by 0.06% at $265.05 per share. Here is how the stock has performed in the past year –

NVIDIA is the 8th largest company in the world, with a total market cap of $660.65 billion.

You can trade NVIDIA Corp. (NVDA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: NVIDIA Corp., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Tesla’s share price and Elon donates $5.74 BN

Tesla Inc, formerly known as Tesla Motors (2003–17), is an American manufacturer of electric automobiles, solar panels, and batteries for cars and home power storage. It was founded in 2003 by American entrepreneurs Martin Eberhard and Marc Tarpenning and was named after Serbian American inventor Nikola Tesla. Elon Musk took over as CEO in...

February 17, 2022Read More >Previous Article

Cisco tops Wall Street expectations

Cisco Systems Inc. reported its second quarter results for the period ended January 29, 2022, after the closing bell on Wall Street today. The company...

February 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading