- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Oil hits $90 per barrel due to political tensions

- Home

- News & Analysis

- Economic Updates

- Oil hits $90 per barrel due to political tensions

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

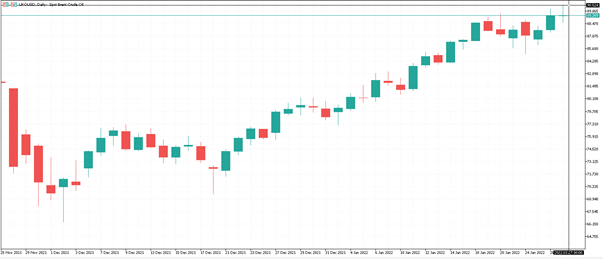

Oil has reached $90 per barrel on Wednesday, which is the first time since 2014. On Wednesday, it was up 2% and the rise comes due to increasing concerns of a shortage in the coming months due to rising political tensions between Russia and Ukraine and the Middle East.

During lockdowns, the demand for oil fell significantly and was trading below $20 a barrel in 2020, but has since rallied with the return of economic activity. As of 9am AEDT, Crude Oil was trading at around 89.98 per barrel.

Ukraine is a transit hub for oil and gas between Russia and the European union with 11.1 metric tons exported through the country in 2021. Russia is also one of the world’s largest oil exporters and energy market prices have also risen on the basis that supply to Europe could also be disrupted in an already tight market.

The U.S is also speaking currently with major energy producer countries and companies around the world over a potential diversion of supplies to Europe. There are even talks of the U.S threatening to halt the opening of a key pipeline that would send Russian gas to Western Europe, that’s if Russia invades Ukraine. Russia has denied it is planning an attack, although there are tens of thousands of Russian troops on the border and escalated fears of an invasion.

Earlier this month in the Middle East, rebels launched a deadly drones and missiles attack on a United Arab Emirates oil depot. The Saudi-led government, that included the UAE, retaliated with several air strikes which caused deaths and a four-day internet outage.

Source: MT5

Also fuelling these concerns is the difficulty encountered by the OPEC+ which works with the petroleum exporting countries to meet increase supply of 400,000 barrels per day. OPEC missed its target last month in December due to limiting supply due to the COVID pandemic. OPEC+ nations only managed two thirds of their stipulated increase with Nigeria, Angola and Russia all coming up short.

Covid-19 lockdowns sent oil demands crashing during the pandemic. Now though, as economies start to get back to life again, demand is increasing. OPEC, in its latest market report, forecast global oil demand to increase by 4.2 million barrels a day this year.

It is predicted by analysts at Goldman Sachs that oil will exceed $100 a barrel in the third quarter of 2022, even suggesting as high as $105 by Q1 2023. Either way, it now looks like that consumer will have to get used to paying more for energy prices and at the pump for the foreseeable future.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Apple reaches a new record and beats expectations

Apple Inc. (AAPL) reported its fiscal 2022 first quarter ended December 25, 2021 after the market close on Wall Street on Thursday. The company beat both revenue and earnings per share estimates, sending the stock higher in the after-hours trading. Apple reported total revenue of $123.945 billion (an all-time revenue record and up 11% year-ov...

January 28, 2022Read More >Previous Article

What is an NFT?

A Non-Fungible Token (NFT) is a non-interchangeable unit of data stored on a blockchain, a form of digital ledger.[1] Types of NFT data units may be...

January 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading