- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Paychex beats estimates

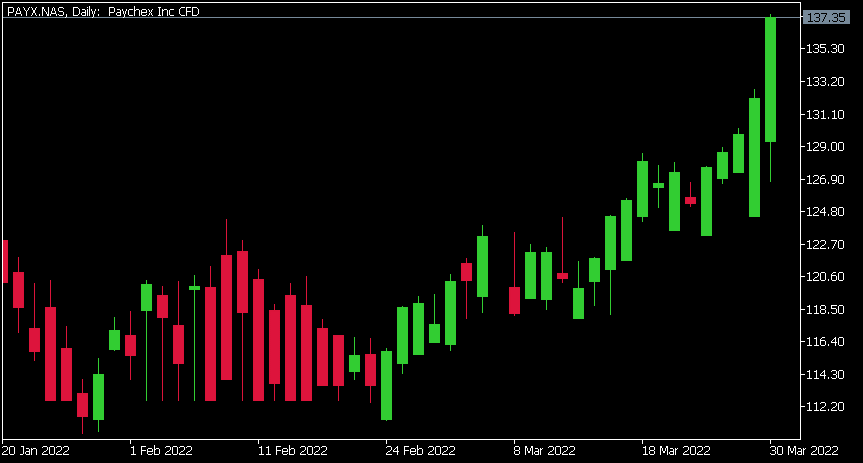

- 1 Month: +13.59%

- 3 Month: -0.47%

- Year-to-date: +0.17%

- 1 Year: +39.50%

News & AnalysisPaychex Inc. reported its latest financial results before the opening bell on Wall Street on Wednesday.

The US payroll services company reported total revenue of $1.276 billion for the quarter ending February 28, 2022 (a 15% increase year-over-year) vs. $1.22 billion expected.

Earnings per share reported at $1.15 per share, above analyst estimates of $1.05 per share.

Martin Mucci, Chairman and CEO commented on the latest results: ”Our strong results for the third quarter, including double-digit growth in both revenue and earnings are a result of progress against key initiatives. We had a strong calendar year end and selling season, delivering a record quarter for new sales revenue and maintaining high levels of client retention. Our value proposition continues to resonate in the market with our unique blend of innovative Paychex Flex® technology and breadth of solutions to help small and mid-sized businesses.”

Paychex Inc. chart

Shares of Paychex were up by around 3% on Wednesday at $137.35 a share.

Here is how the stock has performed in the past year –

Paychex is the 366th largest company in the world with a market cap of $49.59 billion.

You can trade Paychex Inc. (PAYX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Paychex Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

State of Play for FAANG stocks

The FAANG stocks are perhaps the most well-known and well-advertised stocks in the market. The FAANG stocks are made up of META (Which used to be Facebook), Apple, Amazon, Netflix, and Google (now traded as Alphabet). They are often grouped as they are some of the biggest tech players in the market with a collective market cap of around 7 trillion ...

April 1, 2022Read More >Previous Article

Woolworths’ latest green light from Goldman Sachs explained

Woolworths Group Limited is an Australian trans-Tasman retailer headquartered in Bella Vista, Sydney, with extensive operations throughout Australia a...

March 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading