- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- PayPal reports Q3 results

- 416 million active accounts

- 9 billion in payment transactions

- $310 billion in total payment volume

- 2 payment transactions per active account

News & AnalysisPayPal Holdings Inc. (PYPL) reported its third-quarter financial results after the closing bell on the Monday.

The company reported revenue of $6.18 billion (13% increase year-over-year) in Q3, below $6.23 billion expected by the analysts on Wall Street. Earnings per share at $1.11 per share (4% increase year-over-year) vs. $1.07 per share expected.

Other key metrics in Q3:

PayPal also announced it is teaming up with Amazon to enable Venmo (mobile payment service owned by PayPal) pay with Venmo on Amazon from next year.

Company CEO, Dan Schulman commented on the results: ”Our third quarter results show solid growth on top of a record year. The strength of PayPal’s two-sided platform and ubiquity in our core markets has set us up to grow at scale, expand our work with existing merchants and attract new partners. We’re thrilled that we are teaming up with Amazon to enable customers in the U.S. to pay with Venmo at checkout.”

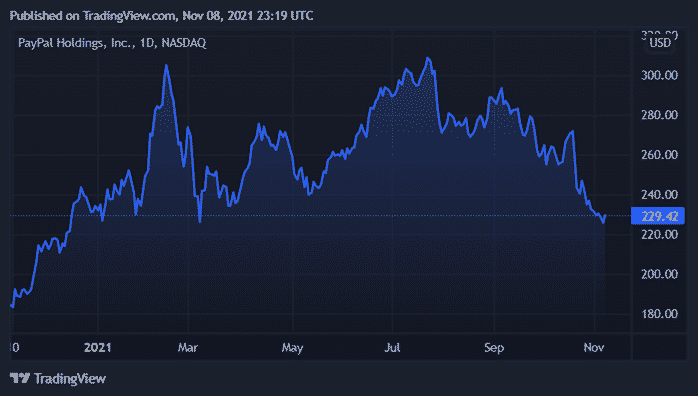

PayPal Holdings Inc. (PYPL) chart (1Y)

Share price of PayPal was trading lower in the after-hours trading following the latest financial results, down by around 5%. The stock is up by 24% in the past year at $229.42 per share.

PayPal is the 35th largest company in the world with a total market cap of $269.57 billion.

You can trade PayPal Holdings Inc. (PYPL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: PayPal, Refinitiv, TradingView

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Beyond Meat Q3 numbers fall short of expectations

Beyond Meat Inc. (BYND) reported its third-quarter financial results after the closing bell on Wednesday. The plant-based company posted disappointing results, falling short of Wall Street analyst expectations. The company reported revenue of $106.4 million (12.7% increase year-over- year) vs. $109.2 million expected. Loss per share at $0.87 a s...

November 11, 2021Read More >Previous Article

Moderna doesn’t get the boost – Q3 earnings fall short

Moderna (MRNA) reported their Q3 financial results before the opening bell on Thursday. The pharmaceutical company posted disappointing results below ...

November 5, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading