- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Pfizer gets a boost – Q1 earnings beat estimates

- Home

- News & Analysis

- Economic Updates

- Pfizer gets a boost – Q1 earnings beat estimates

- 1 Month -3.60%

- 3 Month -6.92%

- Year-to-date -16.35%

- 1 Year +64%

- Morgan Stanley: $55

- Wells Fargo: $65

- Citigroup: $57

- Barclays: $54

- UBS: $60

- Goldman Sachs: $51

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisPfizer Inc. reported its first quarter financial results before the market open in the US on Tuesday.

The American pharmaceutical giant reported revenue of $25.661 billion in the first quarter of the year (up by 77% year-over-year) vs. $24.099 billion expected.

Earnings per share also reported above analyst expectations at $1.62 per share (up by 72% year-over-year) vs. $1.49 per share estimate.

Chairman and CEO of Pfizer, Dr. Albert Bourla commented on the latest results: ”I am very proud of our performance this quarter, both from a financial perspective and from the standpoint of trying to be a force for good in the world. We continue to supply the world with Comirnaty, which remains a critical tool for helping patients and societies avoid the worst impacts of the COVID-19 pandemic, and we are on track to fulfill our commitment to deliver at least 2 billion doses to low- and middle-income countries in 2021 and 2022, including at least 1 billion doses this year. In addition, we are delivering on our production commitments for Paxlovid, which is already having a profound impact on the lives of patients. In response to the devastating war in Ukraine, and as a company that is – 1 – dedicated to promoting human health, we have chosen to continue to supply the people of Russia with the medications they need, and are donating all profits from our Russian subsidiary to humanitarian efforts in Ukraine. We will continue to do all we can to support the health of all people, which is in line with our purpose: Breakthroughs that change patients’ lives.”

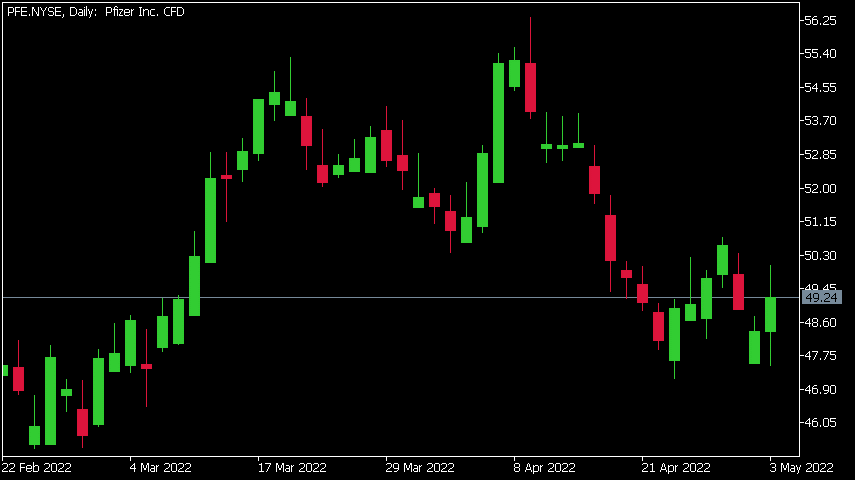

Pfizer Inc. chart

Latest results had a positive impact on the share price, the stock was up by 2.05% at the of Tuesday at $49.24 per share.

Here is how the stock has performed in the past year:

Pfizer price targets

Pfizer Inc. is the 28th largest company in the world with a market cap of $278.09 billion.

You can trade Pfizer Inc. (PFE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Pfizer Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Airbnb sets a new record and tops estimates for Q1

Airbnb Inc. announced its first quarter earnings results after the closing bell on Wall Street on Tuesday, exceeding analyst estimates for the first three months of the year. The company reported revenue of $1.509 billion vs. $1.452 billion expected. Total revenue represents an increase of 80% from Q1 2019 and 70% from Q1 2020. Loss per share...

May 4, 2022Read More >Previous Article

The Impact of China’s Lockdown

China’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest ...

May 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading