- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Philip Morris exceeds Q2 expectations – the stock gains

- Home

- News & Analysis

- Economic Updates

- Philip Morris exceeds Q2 expectations – the stock gains

- 1 Month -7.86%

- 3 Month -10.92%

- Year-to-date -1.48%

- 1 Year -3.75%

- Jefferies $99

- Morgan Stanley $112

- Stifel $105

- Goldman Sachs $100

- JP Morgan $110

- UBS $110

- Deutsche Bank $120

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisPhilip Morris International Inc. (PM) reported its second quarter financial results before the market open on Wall Street on Thursday.

World’s largest tobacco company reported revenue of $7.832 billion in Q2 vs. $6.711 billion expected.

Earnings per share reported at $1.48 per share, also beating analyst estimate of $1.25 per share.

“First and foremost, the war in Ukraine continues to deeply affect the lives of our employees and families in the region,” said Jacek Olczak, CEO of Philip Morris in a press release following the announcement of the latest results.

“My first priority is to give them the help they need and as a company we are focused on doing our utmost to support them throughout this conflict.”

“We are raising our outlook for the full year and now expect to deliver pro forma adjusted growth in net revenues of 6% to 8%, on an organic basis, and diluted EPS of 10% to 12%, excluding currency, underpinned by pro forma heated tobacco unit shipment volume of 90 to 92 billion units.”

“Building on our excellent financial results in 2021, this year’s outlook puts us well on track to comfortably exceed our minimum compound annual net revenue and adjusted diluted EPS growth targets for 2021 to 2023 on a pro forma basis,” Olczak concluded.

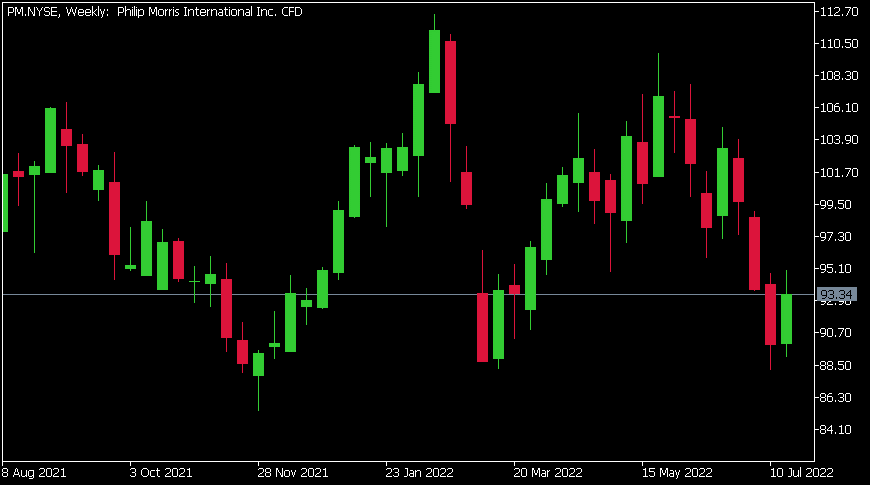

Philip Morris International Inc. (PM) chart

Shares of Philip Morris were higher at the end of the trading day on Thursday, up by 4.19% at $93.34 per share.

Here is how the stock has performed in the past year:

Philip Morris price targets

Philip Morris is the 73rd largest company in the world with a market cap of $144.79 billion.

You can trade Philip Morris International Inc. (PM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Philip Morris International Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Wall st rallies on tech lead, ECB turns hawkish, kind of

Tech stocks led US equities higher overnight, the Nasdaq rallied 1.3% making it three up sessions on the trot, led by tech heavyweights Amazon (AMZN) and a blockbuster session from Tesla (TSLA) which finished up almost 10% after a positive earnings report. Weak US figures saw a drop in Treasury yields as rate hike expectations took a d...

July 22, 2022Read More >Previous Article

Is the AUDUSD ready to reverse?

Recent History The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and...

July 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading