- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Pressure builds on the Construction Industry

News & AnalysisThe construction industry, which is a major cog in the Australian economy, could be under threat from external pressures. Inflationary pressures have pushed up costs these increases are beginning to take their toll on sector. Specifically higher Labour and materials costs have increased pressure on the margins of the large construction companies. Furthermore, as interest rates rise and the housing market decelerates, further stress is being placed on the industry. The threat is not just imaginary, Probuild and Condev both went into voluntary administration as they were unable to maintain their profitability.

The Issue with Construction contracts

Structural issues within the pricing model for many construction companies makes it difficult for them to pass on increased costs. Firstly, contracts are set with a fixed price prior to commencement. Ross McEwan NAB CEO outline that these contracts make it hard to adjust for higher cost of goods. They cannot cope with the ‘shift’ in prices because they do not have the means to adjust the contract. Therefore as the prices of supplies has gone up margins have fallen. Steel prices are 42% higher than last year, timber is 21% higher and electrical products are 14% more expensive for the same period.

Issues to the supply chain have also increased costs. During Covid, disruptions were especially difficult with the procurement of supplies from China. More recently the Russia and Ukraine crisis has caused a supply shock as many crucial materials have been difficult to obtain. Furthermore as the world moves a to a more renewable future supplies for projects in that sector have become critical and the supply is not yet ready to cover the demand.

Pressure on the Housing Market

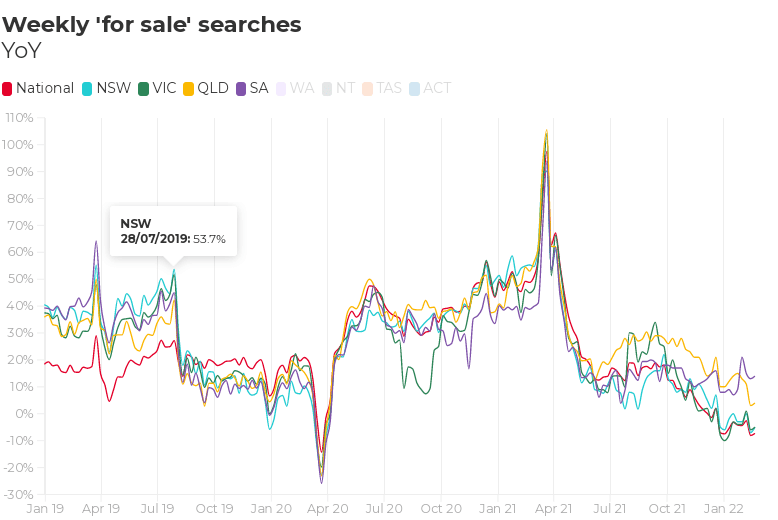

The housing market and the construction industry are obviously very well linked. With housing prices expected drop due to the increase interest rates this again places pressure on the rest of the market. The general economic conditions are also slowing down growth in home buying which also may cause a slowdown in the constructions sector home prices begin to fall and borrowing reduces. The chart below emphasises how interest in home buying has dropped.

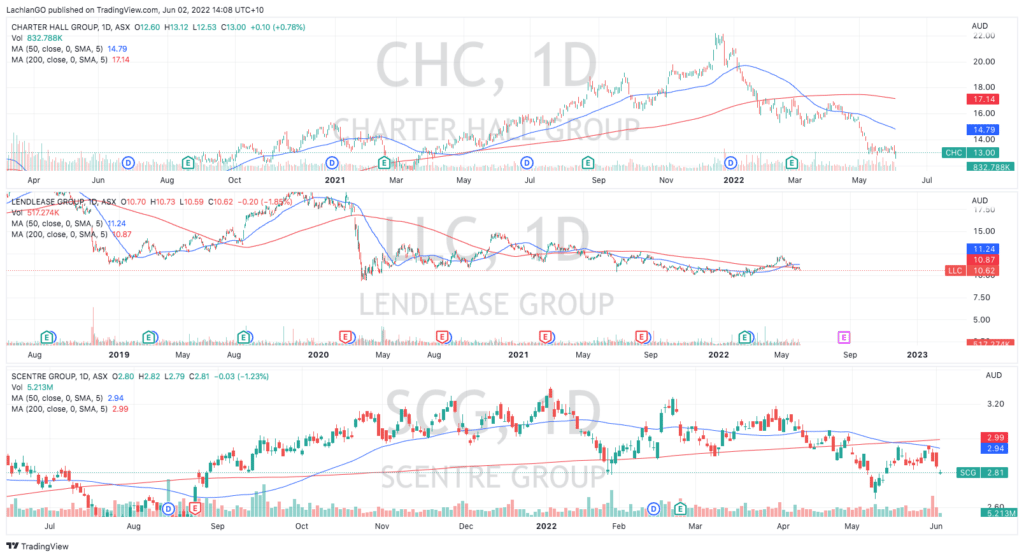

The impact of potential insolvencies and failures of these large construction companies can have disastrous effects on the wider economy. When such large companies go bust they can cause a shock to the economy. The impact of the slow down and construction struggle can be seen in some of the price charts below. Charter Hall Group, (CHC), Lend Lease (LLC) and Scentre Group (SCG) are three of the largest construction companies in Australia.

The price pattern of these charts is fairly similar. All three are clearly in a down trend and have struggled to hold above the key moving averages. Specifically, LLC and SCG, have been unable to break through either the 50 Period MA or the 200 Period MA and instead fell back down. CHC on the other hand has diverged quite a significant distance away from both MAs. In addition, the 50 period MA is accelerating more steeply as it falls.

As there doesn’t seem to be much respite from inflation coming any time soon, these stocks are not showing any signs of a rally in the near term. Potential support to the sector may be provided through government initiatives/infrastructure or a resurgence in foreign investment in property.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Gas and electricity crisis hits the East Coast of Australia

Australians have been hit with a massive spike in gas and electricity bills as the country deals with a sudden shortage in power. Electricity prices were soaring so high and fast that the energy regulator had to step in and place a cap on the price of energy at $40 a gigajoule until 10 June 2022. Causes of the Crisis The supply shock has been...

June 3, 2022Read More >Previous Article

What’s a VPS and why use one?

In my previous article we discussed, what is an EA and their benefits. To read up on their disadvantages please follow the link to an article written ...

June 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading