- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- RBA rate day well in play after record CPI print

- Home

- News & Analysis

- Economic Updates

- RBA rate day well in play after record CPI print

- The RBA doesn’t hike in an election month (well, not since 2007 anyway)

- The RBA will wait for the wage data released on the 18th of May and the Employment figures on the 19th of May (as they alluded to in the April meeting minutes).

- A 21 year high CPI print shows inflation is out of control and the RBA must act now.

- Enter before the release, based on your own judgement of how the release will go.

OR - Play the retrace and volatility after the initial big move.

(Placing Buy Stop or Sell Stop pending orders around the market before a news release will most likely result in large slippage, not recommended in my experience).

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisGoing into yesterday’s Aussie Inflation figures bond markets were pricing in around a 40% chance of a hike to 0.25% at next Tuesdays RBA May meeting. Most pundits including analysts at the big 4 banks thought this unlikely, with a move in June their predictions.

Yesterday’s eye watering CPI figure, took the market by surprise coming in at 2.1% for the quarter, well over the expected figure of 1.7% (Though I suspect, not a surprise to anyone who has been to a supermarket in the last couple of months)

After 15 long months of rate holds, this puts the RBA rate decision well in play next Tuesday, with the futures market flipping after the CPI print to now be pricing in a 42% chance of a supersized 40 bps hike creating some very good trading opportunities on the AUD in particular, which is the market we will be concentrating on.

There is a multitude of reasons both for and against a hike next Tuesday that you’ll hear trotted out by the talking heads in the next few days including the following:

These are all interesting points for an economist, but as a trader I’m not concerned with what pundits think, I want to know what the market thinks and is priced for and in my opinion the 30-Day Interbank futures (traded on ASX Trade24) are the best way to do this for RBA decisions. Bond traders are a smart bunch, mostly institutions and sophisticated speculators, seeing how they are positioned going into a RBA meeting gives valuable information on how the AUD is likely to react after the decision.

The best place to track the 30-Day Interbank futures price is using the ASX Rate Tracker website found here.

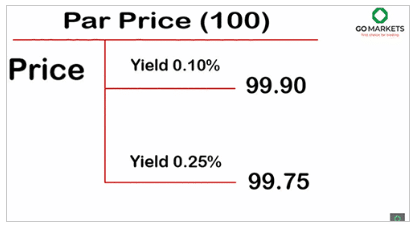

This site not only gives the price of the previous days close of the current months 30-Day future, but does the sums to give the % chance of No Change or Increase to 0.50% based on the futures price.

The table below highlights how market expectations of an interest rate increase at the next RBA Board meeting has evolved in recent days:

Trading DayNo ChangeIncrease to 0.50%13 April90%10%14 April92%8%19 April89%11%20 April85%15%21 April82%18%22 April76%24%26 April83%17%27 April58%42%Source: asx.com.au

I won’t go into the technicals of how this % is calculated in this article. But click the video below for an explainer video.

But , put simply the more the market is divided on the RBA decision, the more volatility and opportunity for FX traders as the market reprices after the announcement.

Examples:

If the futures pricing was showing a 50-50 chance of a hike there would be a large initial move in the AUD up (if they hike) and down (if they hold).If the futures were showing a 90% chance of a hike, then the move up on a hike would be somewhat muted, as the market has mostly priced it in. On the other hand, if they held rates, the initial move to the downside would be dramatic and swift.

How to trade the decision:Trading any major news release where volatility is expected is a difficult prospect and depends on the traders risk appetite and trading style. For a usual news release you can either:

One definite advantage of trading the RBA decision as opposed to the usual new release is having the information of the 30-day interbank futures, and how the big players are positioned. If you are risk on trader, you can use this information to position yourself before the release, align yourself with the bond traders, or trade against them if you have more faith in your favourite pundit.

With this type of trading position size is very important as the initial move could be a big one and Stop Loss orders within that initial spike will very likely get slipped.

Another risk on approach would be to watch the initial move to exhaust itself and trade for a retrace and scalp the initial volatility, this would be my least recommended way due to the accompanying statement that is also released at the same time. This statement could cause some unpredictable moves in the immediate short term as algos and real traders try to make sense of it.

A more risk sensitive approach would be to watch the initial move and volatility from the sidelines see how the market settles after the decision and the accompanying statement has been digested before making your trading decision. Another option is to enjoy the show! Watch the price moves and learn more about how the 30-Day futures influenced them and use that knowledge for another time.

I’ll be sending out another note on Tuesday morning with the latest 30-Day bond prices and what they are indicating.

The RBA rate decision is released 2:30 pm AEST (4:30am GMT) on Tuesday the 3rd of May

Please join myself and GO Markets senior analyst Mike Smith next Tuesday at 2:15pm AEST for a special webinar where we will watch the decision and it’s market reaction live.

You can register for this webinar here.

I hope to see you there;

Lachlan Meakin

Head of ResearchThe information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Microsoft Earnings impress after strong revenue from its cloud system

Technology leader Microsoft has released its quarterly report beating analysts’ expectations. The company's balance sheet and price surge were largely driven by strong revenue in its cloud computing Azure unit but was well supported by its other service areas. The results for the company's third quarter showed a double-digit growth figure with re...

April 28, 2022Read More >Previous Article

Visa crushes Wall Street estimates

Visa Inc. announced its fiscal second quarter 2022 results after the closing bell on Wall Street on Tuesday. The financial services giant topped bo...

April 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading