- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Review of the Year 2018

- Trade noises knocked out global equities

- The US dollar emerged as a better safe-haven compared to other traditional havens

- US stocks: The leading benchmarks erased all 2018 gains accumulated during the year. there were instances where the benchmarks felt to correction level. The benchmarks were also flirting with bear market levels in the last quarter of 2018.

- European stocks took a beating as trade tensions spook investors who were already buffeted by domestic political challenges and fundamental issues. Major European equity benchmarks were either trading deep into correction levels or very close to bear market territory.

- Asia and Pacific’s region were also trapped in negative territory as the fears of contagion in the Asian markets further dampened risk sentiment.

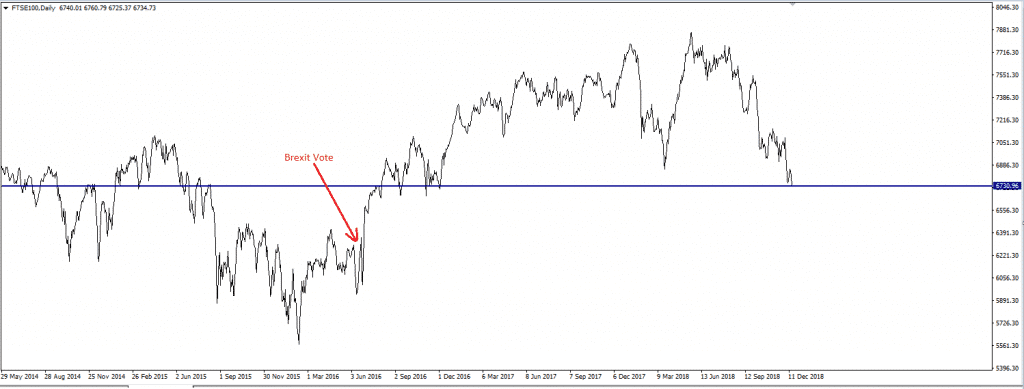

- FSTE 100: After the Brexit vote in June 2016, a weak pound helped the UK stocks to surge higher. However, a combination of different factors alongside increasing Brexit uncertainties sent the FTSE100 to a two-year low.

- The Pound has also lost its ground against nearly all G10 Currencies, given the current political instability. The rising possibility of a no-Brexit deal had caused the GBPUSD pair to plummet to a 20-month low in 2018.

News & Analysis

The bears roared loud and clear in 2018!

In 2018, the financial markets were hit by several headwinds across the year and investors were left struggling to find a direction towards the year-end. Economists and strategists were forced to reassess the economic forecasts for 2019.

Trade and geopolitical issues had changed the dynamics of the financial markets in 2018. After a stellar 2017, investors were gearing up for another positive year, but external factors such as fears of a global trade war rattled the markets.

Trade and Geopolitical Tensions

Trade tensions remained at the forefront of investors’ minds since President Trump decided to clamp down on trade “unfairness”. The fears of a trade war between the world two biggest economies took the financial markets on a rollercoaster ride:

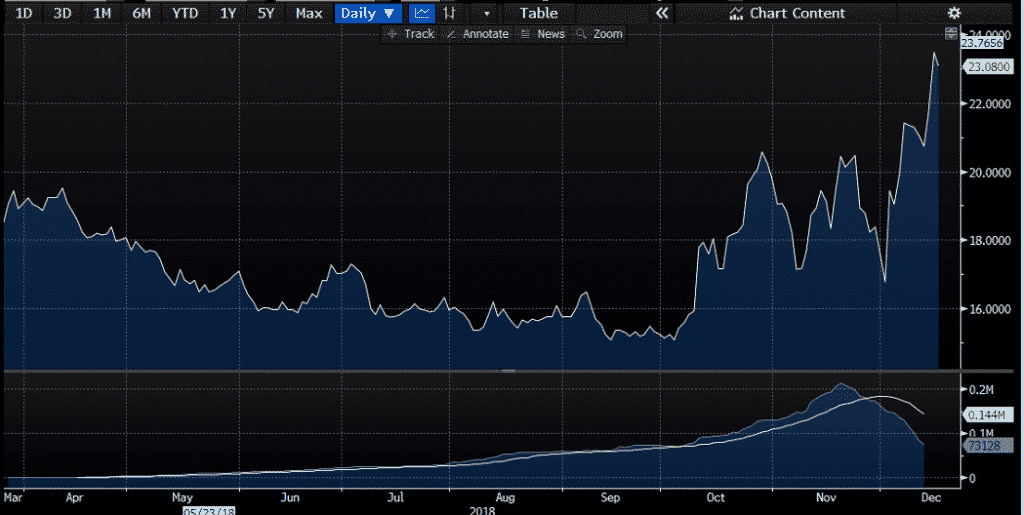

We have seen a spike in the Wall Street fear gauge indicator during the first and last quarter of 2018.

Without any doubt, trade tensions rattled the stock markets. However, the extent of the damage varies across different regions.

Here’s a glance of the major World Equity Indices in 2018:

The sectors that were immediately threatened were Technology, Industrials, Materials and Energy. The first two quarters of the year 2018 were deeply focused on trade.

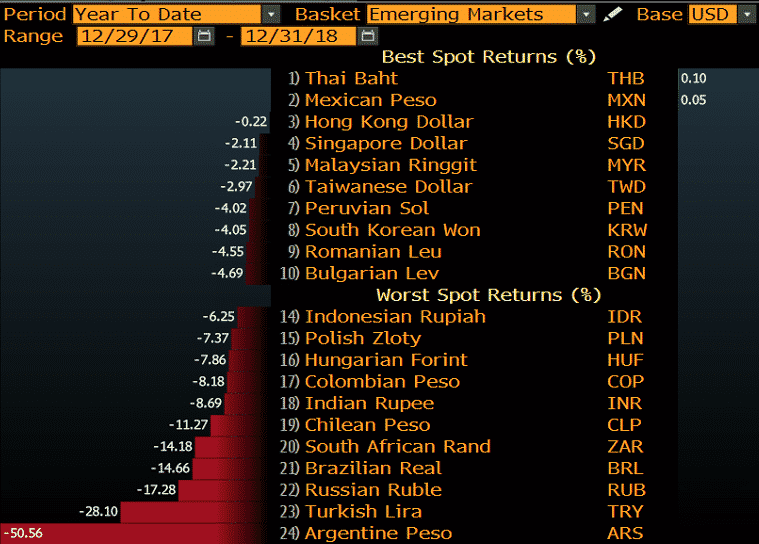

In the FX markets, the US dollar emerged as the strongest currency among major currencies. The Japanese Yen was slightly higher against the greenback due to its safe-haven status. Amid the chaos, investors sought safety with safe-haven currencies.

Source: Bloomberg Terminal (data extracted as of writing does not reflect the price action of the last couple of hours on the last trading day of the year 2018)Brexit

Brexit seems like a never-ending process. The challenging Brexit negotiations and domestic political uncertainties are taking a toll on the UK economy. Fundamentals were mostly pushed aside in 2018 as Brexit drove investors’ sentiment.

Source: GO MT4 (data extracted as of writing does not reflect the price action of the last couple of hours on the last trading day for the year 2018)Europe and the rise of Eurosceptic political parties

Aside from Brexit, we have seen how the growth of the right-wing in Europe had threatened the existence of the European Union throughout 2018. Europe was hit by several headwinds at the same time. Italy was caught in a standoff over its budget deficit plans and the negotiations dragged on for months. The Yellow Vests protests in France also highlighted the fragility of the developed countries within the eurozone area.Fundamentals were on the weak side, and domestic growth was slowing. Overall, the economic data pointed to a slowdown and investors were reluctant to place their money in economies that are facing fundamental issues.

The performance of the Euro against major currencies was mixed. Aside from the emerging currencies, the Euro managed to mostly gain tractions against commodity currencies that are also fundamentally weak.

Fundamentals and political unrest were the fragilities which were hurting the Euro.

Fundamentals

Interest rate and the Inverted yield curve

In 2018, the Fed stood out among the major central banks due to its hawkish stance. They hiked interest rates four times and were planning to hike more in 2019. The gradual increases in interest rates played a significant role in the rout of the equity markets. We saw major equity benchmark erasing gains, while some even fell into the bear market territory.

2018 was a tough year for investors who panicked amid the massive sell-off. They struggled to focus on the fundamentals that were driving corporate earnings and supporting growth as they concentrated on the slowing global growth and the threat of an inverted yield curve.

The 2/10 yield spread dropped below critical support level and hit a single digit spread.

Source: Bloomberg Terminal (data extracted as of writing does not reflect the price action of the last couple of hours on the last trading day of the year 2018)Slowing Global Growth

Investors were anxious as the world’s big economies were battling domestic economic and political issues that were impacting global growth. The outlook for emerging economies was also weak. Geopolitical and trade tensions have changed the dynamics of the markets and the growth metrics. The fears of a hawkish Fed and slowing global growth were what took the markets out and caused a sudden reversal in global risk appetite.Trillion Club

2018 was a monumental year for publicly traded companies, and two had reached the historic market cap of $1 trillion for the first time in history. Both US tech giants Apple and Amazon reached the milestone this year, but it hasn’t been plain sailing for the companies since it happened.

Apple

Apple was flirting with the $1 trillion mark for some time and was expected to become the first company to reach the milestone by analysts, and rightly so.On 2nd August 2018, the share price hit the $206 level which meant it was the first publicly traded company to join the trillion club. The share price kept rising and reached its highest ever level around $233 level in October 2018.

However, global slowdown of the iPhone sales saw the share price drop sharply since and erasing gains made in 2018. As of writing, Apple’s current market stands at $777 billion, making it the second largest company by market cap behind Microsoft at $789 billion.

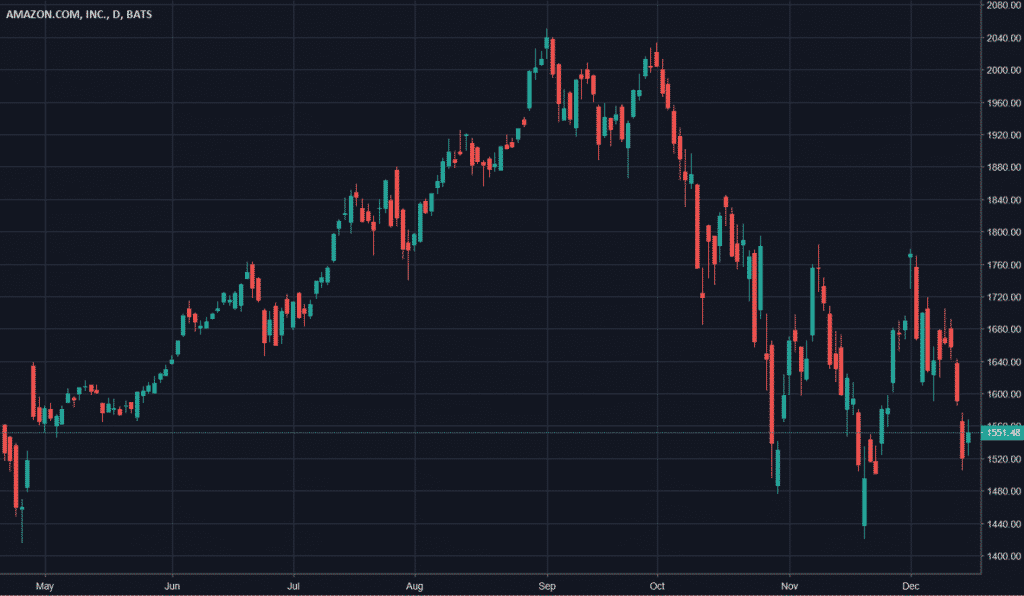

Source: Trading viewAmazon

Just over a month after Apple reached $1 trillion club, Amazon reached the historic milestone after its share price rose to £2,050 per share.Not many people expected Amazon to reach $1 trillion this quickly. Back in March, Brent Thill, an analyst from Jeffries, stated that Amazon would reach the milestone in 2022 when the share price was at around $1585 per share.

Since reaching the $1 trillion market cap, the share price has dropped after Amazon missed Wall Street’s 2018 third-quarter revenue forecast. Despite the share price dropping since reaching $1 trillion market cap, the stock is still up by around 31% in 2018 with a total market cap $743 billion, behind Microsoft and Apple.

With Amazon reaching historic highs, the net worth of the Jeff Bezos, the founder of Amazon skyrocketed to around $168 billion according to the Bloomberg Billionaires Index making him the world’s richest person by some margin. Since then, his net worth has decreased by 23%. But don’t feel too sorry for him, he’s still worth a whopping $128 billion and remains as the world’s richest person, beating Bill Gates in second.

Source: Trading viewCryptocurrencies in Decline

It was a turbulent year for all cryptocurrencies in 2018 after reaching record highs. We saw the total market cap stand at enormous $605 billion at the start of January 2018, but since then market cap has shrunk to around $112 billion, according to CoinMarketCap, after a massive decline in the value of digital currencies. Now let’s take a look at the top 3 cryptocurrency performance in 2018.

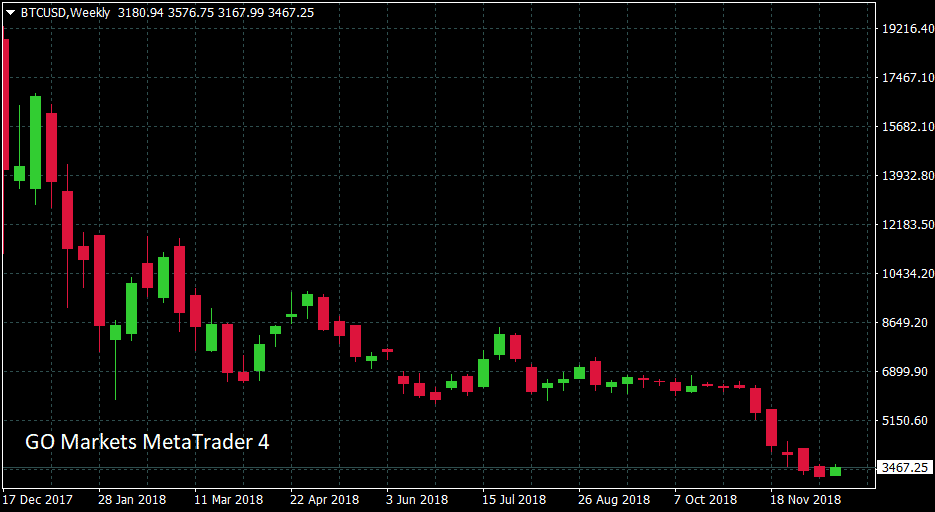

Bitcoin

The largest cryptocurrency by market cap reached its highest level just before the end of 2017 when it was trading at nearly USD 20,000. Back then, some analysts predicted the price could reach $100,000 per Bitcoin or even higher. However, what happened, in reality, was the opposite.The price of Bitcoin has dropped by around 80% as of writing with the total market cap at $61 billion which makes up 54% of the total.

It is worth pointing out that it is not the worst decline Bitcoin has experienced. Back in December 2013, it was trading at around $1,175 level when within two months it dropped down to $103 level – a 91% decline. Will it make a recovery this year? Time will tell.

BTCUSD – Weekly

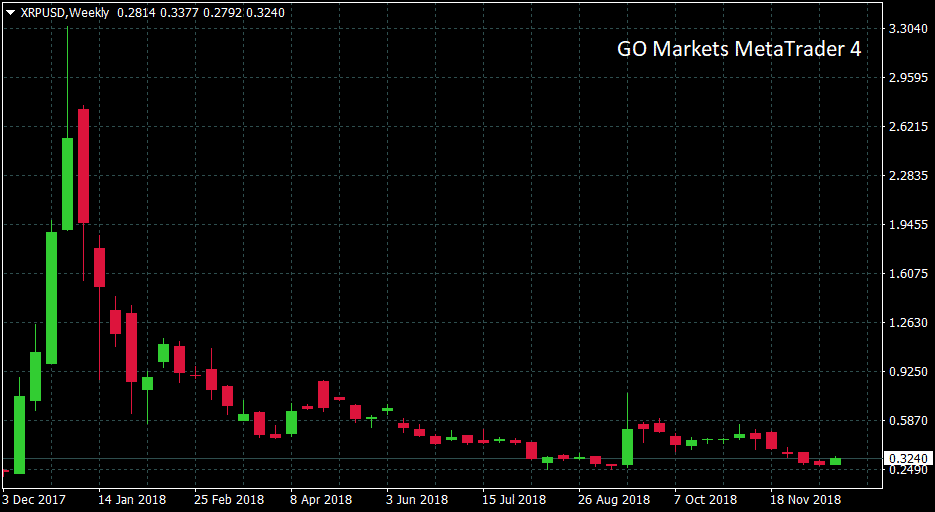

XRP

Even though the price of XRP has declined by around 90% from the record high of approximately $3.29 back in January 2018, we have seen some positive moves made by the Ripple company.Many financial institutions around the world are already working with Ripple to simplify and cut costs of transferring money, some of its customers include big-name financial institutions including – Santander, Standard Chartered, Uni Credit, American Express, Money Gram and US-based bank PNC.

According to their website, the Ripple company allows international financial institutions to ”source liquidity required for cross-border payments with XRP and enable instant payments to and from any country in the world.”

XRP’s market cap has shrunk from $123 billion to $13 billion, an 89% decline in 2018. Despite that, it remains the second largest cryptocurrency behind Bitcoin.

One to keep an eye out for in 2019.

XRPUSD – Weekly

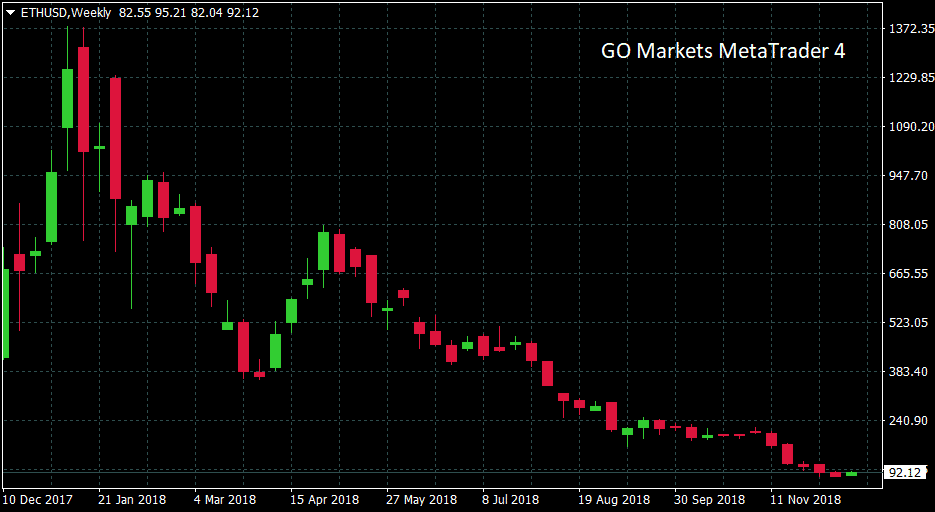

Ethereum

Ethereum has suffered the most significant decline since reaching a record high of $1426, down by around 93% in 2018.It was the second largest cryptocurrencies by market cap for the majority of 2018. However, sharp declines meant that it finished the year as the third largest digital currency.

ETHUSD – Weekly

Even though there has been a decline in the value of most digital currencies in 2018, the optimism around the blockchain technology is growing, and we are seeing more prominent financial institutions announcing plans to implement it in the future.

We have also seen, Antigua and Barbuda announce that it will accept cryptocurrency in return for citizenship. Dash has been making moves in Venezuela after its country’s political and financial state hit rock bottom, helping its people by offering an alternative method of payment. Major football clubs including French football team Paris Saint-Germain have announced a cryptocurrency plan to boost fan engagement.

On the other side, there are also uncertainties around the regulation of cryptocurrencies and fraud revolving around the digital assets. It was reported that $1 billion worth of cryptocurrencies were stolen in 2018, according to a cryptocurrency intelligence company CipherTrace in the third-quarter Anti-Money Laundering report.

Now let’s see what 2019 will bring for digital currencies.

By Deepta Bolaky & Klavs Valters

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Main Macro Themes In 2019

After a stellar year in 2017, investors were taken aback by the massive swings in the markets in 2018. The turmoil in the financial markets has created an environment of panic and fears about a global recession. Even though the risk of a recession is not on the horizon yet, we do expect 2019 to remain volatile. Prudent investors will likely fa...

January 8, 2019Read More >Previous Article

The Causes of Today’s Flash Crash

Today’s flash crash in the FX markets was surprising to many of us. The triggers behind the slump in the currency’s markets are vague, and every...

January 3, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading