- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Rio Tinto’s record setting performance

- Home

- News & Analysis

- Articles

- Economic Updates

- Rio Tinto’s record setting performance

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAll prices in this article will be in USD unless otherwise stated.

Rio Tinto Group is an Anglo-Australian multinational and the world’s second-largest metals and mining corporation, behind BHP, producing iron ore, copper, diamonds, gold and uranium.

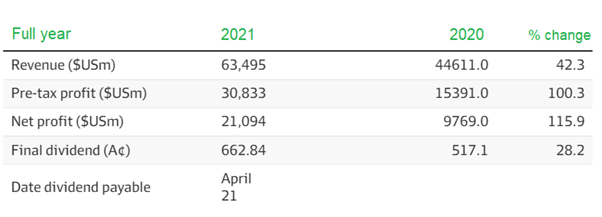

Rio Tinto made history last week by posting the second biggest profit in Australian corporate history, the biggest belonging to BHP. They have decided to reward their shareholders with Australia’s biggest ever dividend worth $16.8 billion, which is roughly $23 billion AUD.

The $21.4 billion of underlying earnings for 2021 was the biggest in all of Rio Tinto’s 149 year history. The achievement has allowed a dividend payment of $4.79 per share. The final and special dividends took Rio Tinto’s total dividends for the year to a record-breaking $10.40 per share. The total dividends paid by Rio Tinto for the year is almost doubled the previous year’s $5.57.

The greatest profit recorded by an Australian company was BHP. They set this record in 2011 with a recorded $21.68 billion in underlying profit.

Comparing both companies, BHP’s record profit was when the Australian dollar was much stronger than today. This means the profit announced by Rio Tinto would be much bigger than BHP, in Australian dollars, $22.5 billion vs $23 billion AUD. This does not take into account inflation.

Rio Tinto’s great result was largely attributed to its most important commodity, iron ore. However, the decade high prices for copper and aluminium have also bolstered their profits.

The shareholder returns unleashed by Rio Tinto over the past four years rank as the four biggest in the company’s history, meaning shareholders in the miner are enjoying a golden era of returns.

The “golden era” was initially built on the proceeds of asset divestments, however, Australian mining companies have been fortunate due to rival mining companies in Brazil suffering massive dam failures in 2019. Australia was able to capitalise on the weak iron ore supply in the aftermath.

The strong operating environment for mining companies like Rio Tinto has only continued since the onset of the COVID-19 pandemic. The pandemic had prompted governments to announce stimulus spending on infrastructure which drove strong demand for the raw materials which were produced by the likes of Rio Tinto and BHP.

Most of Rio’s record setting dividend will be paid to shareholders outside of Australia; the company’s biggest shareholder is Chinese state-owned entity Chinalco while most investors own the stock through the London Stock Exchange.

All in all, the mining industry is currently experiencing a strong year. Rio Tinto, being one of the biggest players, has set the benchmark for other companies in the industry. The strong start to the year is a good indication as to where the industry is going.

If you would like to take this opportunity to invest in Rio Tinto Group and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: ASX, Wikipedia, AFR.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

How the US sanctioned Russia in response to their invasion

Investors are currently bracing for further volatility in the global markets as Russia’s troops have been deployed into eastern Ukraine. The heightened tensions between Russia and Ukraine reached a tipping point last week when the Kremlin had officially recognised regions in eastern Ukraine held by separatists (supported by Russia). Russia ord...

March 4, 2022Read More >Previous Article

Volatile market continues following failed peace talks between Russia and the Ukraine

Global indices were choppy overnight, mainly finishing lower on the back of failed peace talks and Russia continued advances in Ukraine. According to ...

March 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading