- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Risk on continues as equities, Bitcoin and commodities pump, USD dumps

- Home

- News & Analysis

- Economic Updates

- Risk on continues as equities, Bitcoin and commodities pump, USD dumps

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisRisk on continues as equities, Bitcoin and commodities pump, USD dumps

5 October 2022 By Lachlan MeakinQ4 has continued with a bang in Tuesdays session with US stocks posting their biggest two day gain since April 2020 and the best start to a quarter since 2009 (Best start of Q4 since 2002!)

The re-pricing of risk assets comes on the back of the view that Central banks will be a little less aggressive in their rate hiking cycle, with expectations of subsequent Fed rate cuts being priced in sooner rather than later.

This re-pricing coupled with the markets turning risk on has also see the USD see its biggest five day drop sinch March 2020 with the US Dollar Index dropping sharply, finding some support at the old resistance level of 110.

Another big up day in commodities as well with spot gold (XAUUSD) and Silver (XAGUSD) both continuing from Monday’s steep rally, Gold back up above 1720, looking to test the resistance levels set in August.

Silver topped $21 USD per ounce, setting 3 month highs.

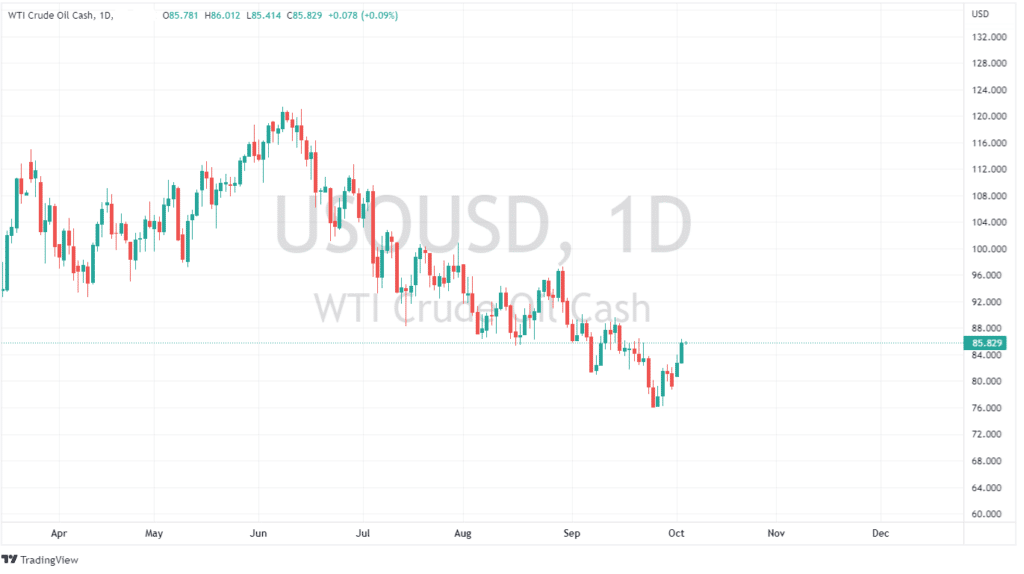

Crude oil (USOUSD) also spiked further on OPEC+ production cut headlines and lessing growth concerns, US crude touching on $87 mid session.

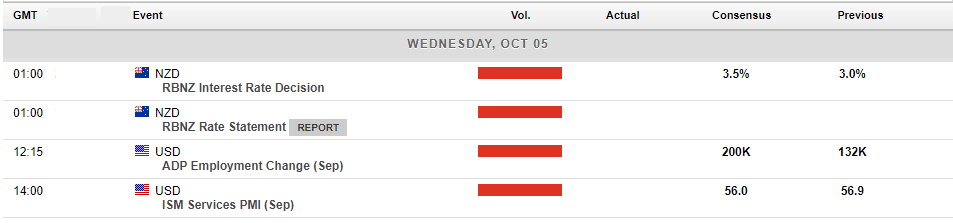

In todays economic releases, it will be interesting to see if the RBNZ channels the RBA with a dovish tilt or continues on their fairly aggressive hiking path, another 50 bp hike is expected from them today.

US ADP employment figures will give a glance into the US labour market ahead of Fridays big one, the official Non-Farm payroll figure.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

EURAUD testing mean of long-term range

The EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair move with some momentum in recent days and weeks. The RBA came out in its most recent meeting and raised rates by an unexpectedly low 25 bps vs 50 bps. This helped equities and housing stability but pu...

October 6, 2022Read More >Previous Article

Reserve Bank of Australia surprises the market by lifting cash rate by 25 bps

The Reserve Bank of Australia, (RBA) has surprised much of the market by raising the country's cash rate by just 25 basis points. With analysts expect...

October 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading