- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Salesforce beats Q1 estimates – stock jumps in after-hours

- Home

- News & Analysis

- Economic Updates

- Salesforce beats Q1 estimates – stock jumps in after-hours

- 1 Month -9.76%

- 3 Month -23.89%

- Year-to-date -36.95%

- 1 Year -32.70%

- Jefferies $260

- Barclays $208

- Well Fargo $225

- Mizuho $225

- UBS $185

- Morgan Stanley $291

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSalesforce Inc. (CRM) reported its first quarter financial results after market close on Tuesday. The company beat both revenue and earnings per share estimates.

World’s leading customer relationship management reported revenue of $7.411 billion for the quarter vs. $7.328 billion expected.

Earnings per share reported at $0.98 per share for the quarter vs. $0.94 per share estimate.

”We had another great quarter, delivering $7.4 billion in revenue, up 24% year-over-year,” said Marc Benioff, Co-CEO of the company following the latest results.

”There is no greater measure of our resilience and the momentum in our business than the $42 billion we have in remaining performance obligation, representing all future revenue under contract. While delivering incredible growth at scale, we’re committed to consistent margin expansion and cash flow growth as part of our long-term plan to drive both top and bottom line performance,” Benioff added.

Bret Taylor, Co-CEO of Salesforce also commented on the results: ”Our financial results once again demonstrate the strength and durability of our business model as we continue to see strong demand from customers across the entire Customer 360 portfolio.”

”Salesforce has become even more strategic and relevant to our customers as we are providing them with the agility and resilience they need to drive growth and efficiency in these uncertain economic times,” Taylor added.

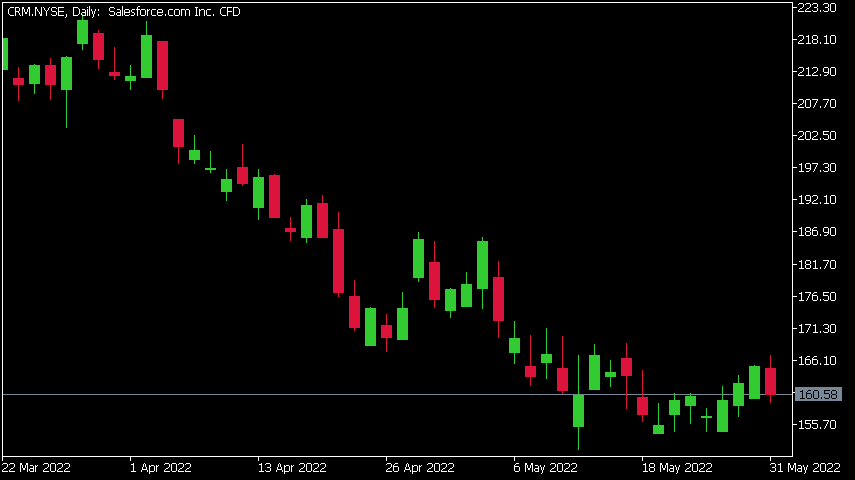

Salesforce Inc. (CRM) chart

Shares of Salesforce were down by 2.94% at the end of trading on Tuesday at $160.58 per share. The share price rose in the after-hours trading by over 7%.

Here is how the stock has performed in the past year:

Salesforce price targets

Salesforce Inc. is the 70th largest company in the world with a market cap of $159.26 billion.

You can trade Salesforce Inc. (CRM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Salesforce Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Lithium stocks drop after calls that Battery ‘Bull Market’ is over

Australian lithium stocks have fallen remarkably after analysts from Goldman Sachs predicted that the material’s price has reached a peaked. Their predictions outline are that the price may fall 76% from its current highs. The predicted price drop is due to an oversupply that has been produced in the short-term outpacing the demand. In addition, ...

June 1, 2022Read More >Previous Article

EU Leaders Further Tighten Oil Dependency

The European Union has advised of a proposal to further limit the export of Russian oil. They are looking to ban the buying of the liquid gold to ...

June 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading