- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Salesforce record fourth quarter and Slack expectations

- Home

- News & Analysis

- Articles

- Economic Updates

- Salesforce record fourth quarter and Slack expectations

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

Salesforce the worlds #1 customer relationship management (CRM) platform has just announced record fourth quarter and full fiscal 2022 results exceeding expectations. The pandemic-led shift to hybrid work has kept up a strong demand for its cloud-based software.

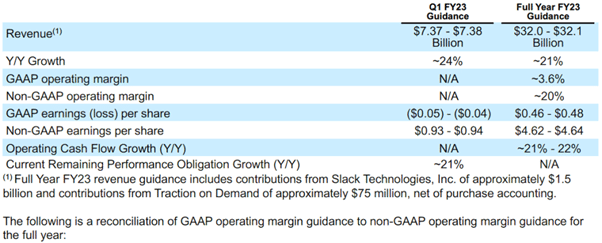

Total fourth quarter revenue was $7.33 billion, an increase of 26% year over year, and 27% in constant currency. Salesforce’s subscription and support revenue for the fourth quarter also rose 24.7% to $6.83 Billion.

“We had another phenomenal quarter and full-year of financial results,” said Marc Benioff, Chair and Co-CEO of Salesforce.

With our customers’ success driving our financial success, we’re generating disciplined, profitable growth at scale quarter after quarter,” said Bret Taylor, Co-CEO of Salesforce. “Our Customer 360 platform has never been more strategic or relevant in driving the growth and resilience of our customers around the world.”

Salesforce has also been working to integrate Slack after its $27.7 billion purchase of the instant messaging platform, as well as adding products in a bid to sell more tools to existing customers. Analysts see a lot of room to increase sales of the company’s flagship software that lets businesses manage and interact with customers. Salesforce believes the software market can grow double digits over the next several years, as companies across the globe continue to have conversations about facilitating hybrid and remote work models.

Salesforce has not slowed down Slack’s roadmap, with the platform launching Slack Huddles and Clips in the second half of 2021.

Salesforce said it expects $1.5 billion in sales form Slack in its fiscal year 2023.

Salesforce’s stock price has been on a downhill ride in the past several months, falling more than 30% from it’s November record high of over $310. Shares have recently increased over 4% and are currently trading at $209.65.

Salesforce (CRM)

Salesforce.com Inc. is the 51st largest company in the world with total market cap of $205.75 billion

Gavin Patterson the Chief Revenue Office said the global sanctions against Russia arising out of the war with Ukraine will have “minimal impact” on Salesforce’s business and haven’t forced the company to take any actions.

You can trade Salesforce.com Inc. (CRM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Reuters, Yahoo Finance, itnews

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Energy crunch sees coal, oil and gas soar.

Coal and Gas prices have surged and joined gold and oil as demand surges due to the supply shortages stemming from the Russia and Ukraine conflict. The global indices were up overall as the market still remains unsure of how to react to the unfolding crisis. In Europe, the FTSE provided strength with a 1.36% gain and the DAX provided a small bou...

March 3, 2022Read More >Previous Article

Advantages and disadvantages of using an Expert Advisor (EAs)

What is an Expert Advisor (EA)? Expert Advisors (EAs) are trading software that automatically run and trade based on their preprogrammed rules ...

March 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading