- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Seek’s latest dividend reaches three year high

- Home

- News & Analysis

- Economic Updates

- Seek’s latest dividend reaches three year high

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSeek is a technology company that matches employers with potential candidates, via their online career opportunities advertising service and other related services.

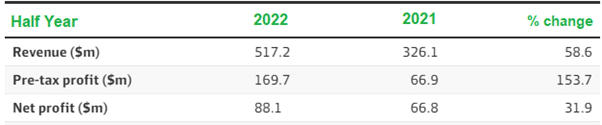

Seek’s latest declared dividend is the highest payment in the past three years. This announcement came after a significant increase in sales and profits achieved in the first half of the 2021-22 financial year.

Seek’s success was largely attributed to its Australian and New Zealand business, where revenue was up 72% compared to the previous year, while its Asia business reported a growth of 42% to revenue. This success could also have been driven by the increase of employees seeking new job opportunities due to changing working conditions.

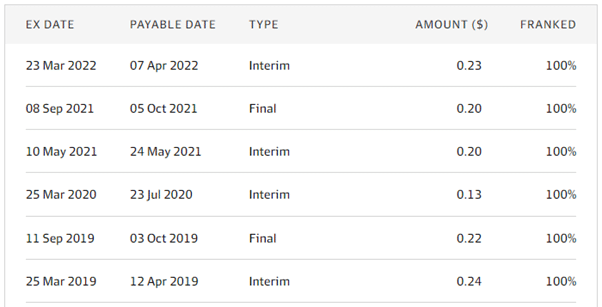

As a result, Seek declared an interim dividend of 23 cents a share, its best in three years.

Dividend History

Seek’s revenue from continuing operations increased by 59% to $517.2 million, while reported profit from continuing operations was up 152% to $126.7 million. Total reported profit increased by 32% to $88.1 million.

Based on this half year performance, it is projected that the full year’s revenue will be in the range of $1.05 to $1.10 billion. With earnings before interest, taxes, depreciation, and amortisation to be in the range of $490 to $515 million and net profit after tax to be in the range of $230 to $250 million.

Seek is currently on track to have another profitable financial year. This follows a pandemic stricken two years’ period of wild financial performances, including a $113.1 million loss in financial year 2019-20 and a $752.2 million in financial year 2020-21.

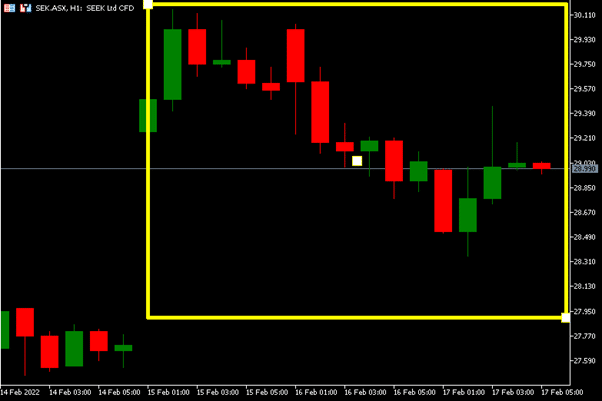

Seek’s share price is responding well to the recent good news. It has increased by roughly 5.5% since the announcement.

All in all, Seek is seeking to bounce back strongly after a few years where the pandemic has caused a great concern when it comes to job security, especially in hospitality. While companies and businesses are returning to a new normal, Seek could be an essential service to help achieve this goal.

If you would like to take this opportunity to invest in Seek and don’t already have a trading account, you can register for a Shares or Shares CFD account with GO Markets.

Source: GO Markets MT5, ASX, AFR.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Walmart delivers in Q4

Walmart Inc. (WMT) reported its latest financial results before the opening bell on Wall Street on Thursday. World’s largest supermarket chain reported revenue of $152.871 billion (up by 0.5% year-over-year), narrowly beating analyst forecast of $151.72 billion. Earnings per share reported at $1.52 vs. $1.50 per share expected. Doug McMi...

February 18, 2022Read More >Previous Article

What are ETFs and why trade them as CFDs?

An exchange-traded fund, or ETF, is a basket of securities (forming a fund) that trade like shares on major stock exchanges. The securities that m...

February 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading