- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Soft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

- Home

- News & Analysis

- Economic Updates

- Soft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSoft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

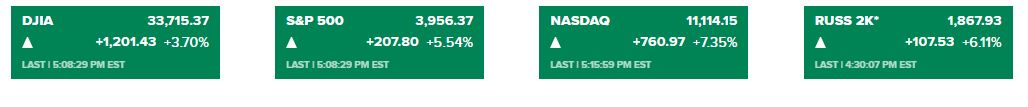

11 November 2022 By Lachlan MeakinRisk on was definitely back on in Thursdays US session after a softer than expected October Core CPI print, coming in at 0.3% vs the expected 0.5%, combined with broadly less-hawkish comments from Federal Reserve members Daly, Logan and Harker sparked the biggest rally in US equities since April 2020.

The rally was broad with all major US indexes posting big gains, with the recently underperforming NASDAQ surging a stunning 7.35%

It wasn’t just equities having large moves, the optimism that inflation may have peaked in the US also saw big gains in Gold, Bonds and crypto while the US dollar dropped the most in a decade as markets rushed to price in new terminal rate predictions.

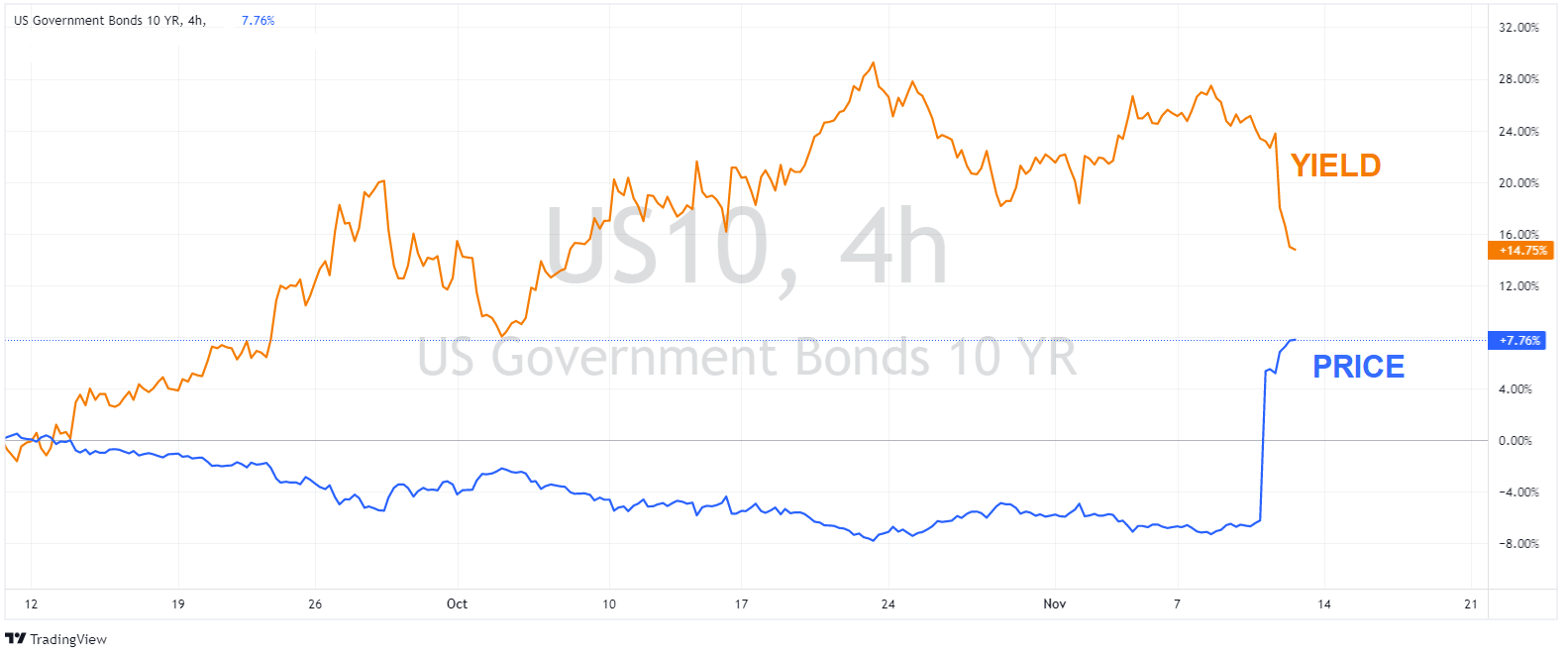

US 10-year treasury yields had the biggest collapse since March 2020, seeing bond prices break November highs (Yields and price are inverted)

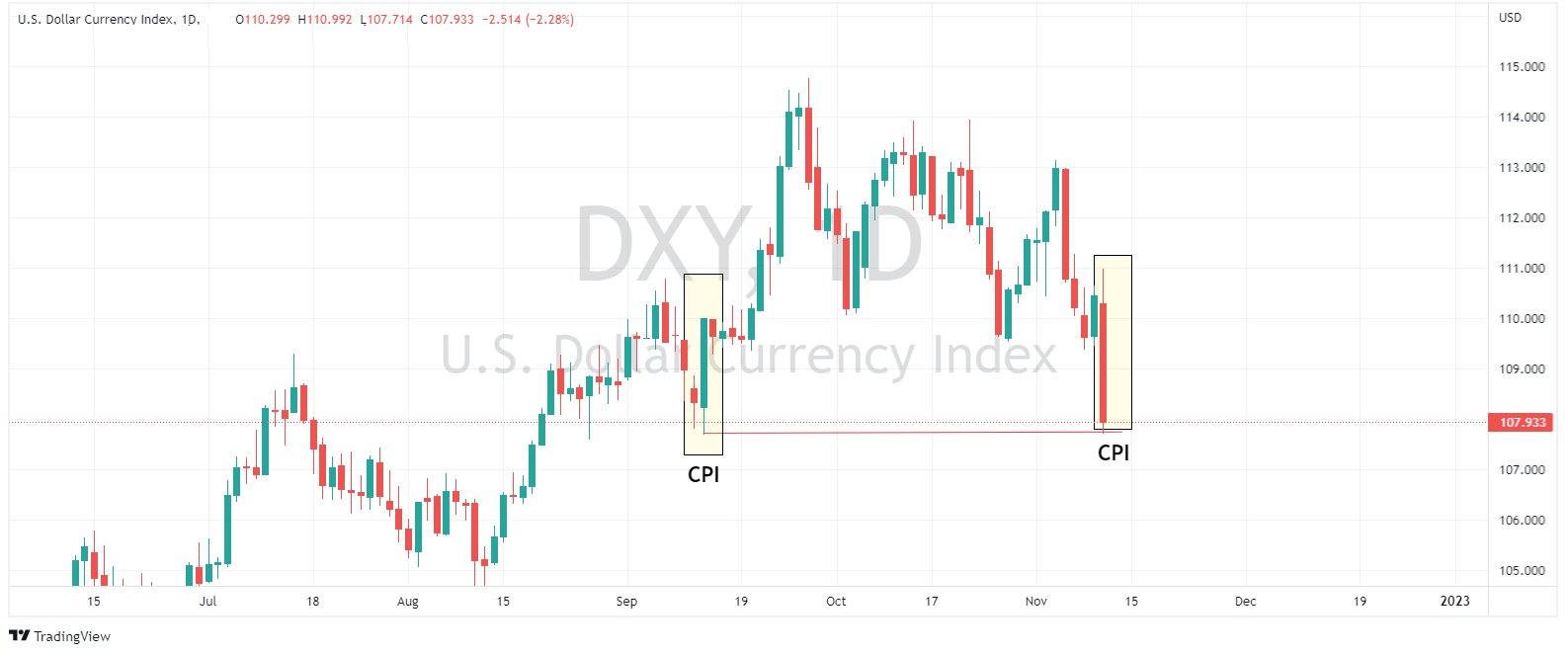

The US Dollar Index had its biggest daily drop since Dec 2015, crashing over 2% to 2-month lows. The Dollar Index has now erased all the gains since September’s hotter than expected CPI print.

Golds recent rally continued as a cratering US dollar and lower yields provided a strong tailwind that saw XAUUSD surge to almost 1760 USd per ounce, it’s highest level since August.

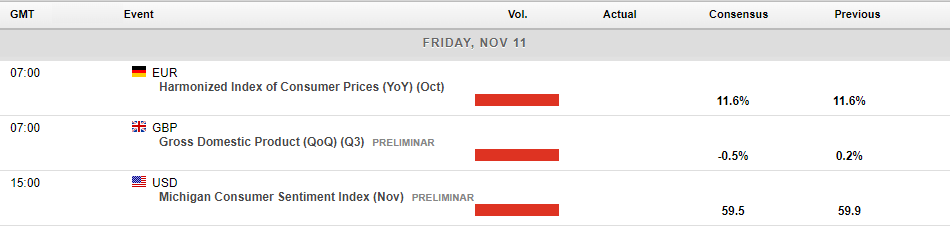

Today’s economic calendar is fairly light, the highlight being UK GDP but US consumer sentiment could also see some volatility with traders continuing to try and position for the Feds next move.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US markets break winning streak after post CPI exuberance, cryptos down again

The US equity post CPI rally of last week ran out of steam in Mondays session as consumer inflation expectations rose and mixed messages from Federal Reserve members saw a choppy first half of the session only to see a steep decline into the close with the Dow Jones ultimately finishing down 211 points (-0.63%) Futures opened Monday with a gap d...

November 15, 2022Read More >Previous Article

NIO falls short of expectations for Q3 – but the demand is growing

NIO Inc. (NYSE: NIO) announced Q3 financial results before the market open in the US on Thursday. The Chinese automaker fell short of analyst estimate...

November 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading