- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Stocks begin Q4 with a bang as Fed pivot dreams see yields lower

- Home

- News & Analysis

- Economic Updates

- Stocks begin Q4 with a bang as Fed pivot dreams see yields lower

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisStocks begin Q4 with a bang as Fed pivot dreams see yields lower

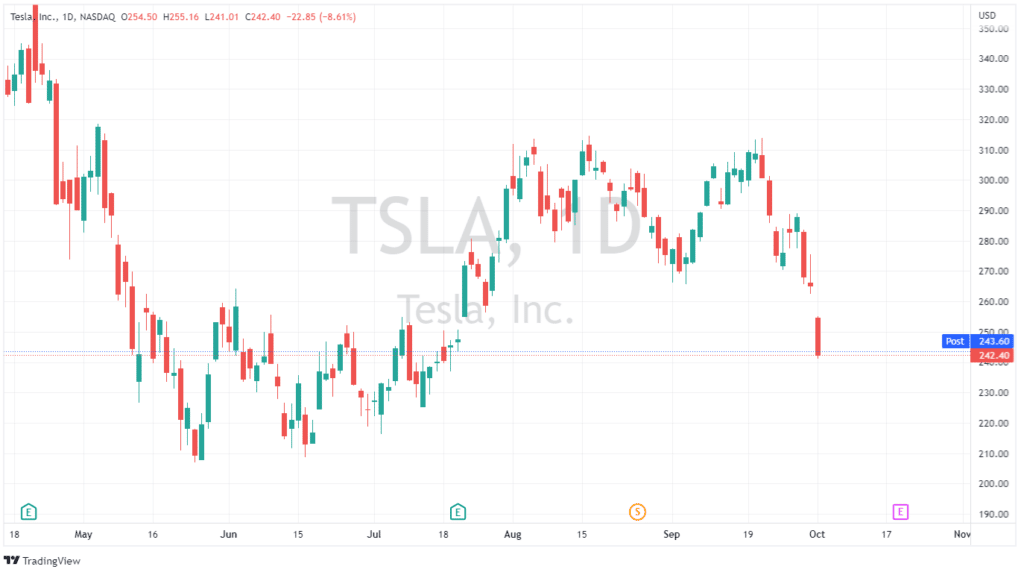

4 October 2022 By Lachlan MeakinUS stocks started with a Q4 bounce after a dismal Q3 helped by softer PMI data and perhaps extreme oversold technical conditions. Bond yields drifting lower as the market priced in a possible and highly speculative Fed pivot also bolstered equities and other risk assets. One big exception was Tesla (TSLA) cratering over 8% on a big miss on delivery expectations.

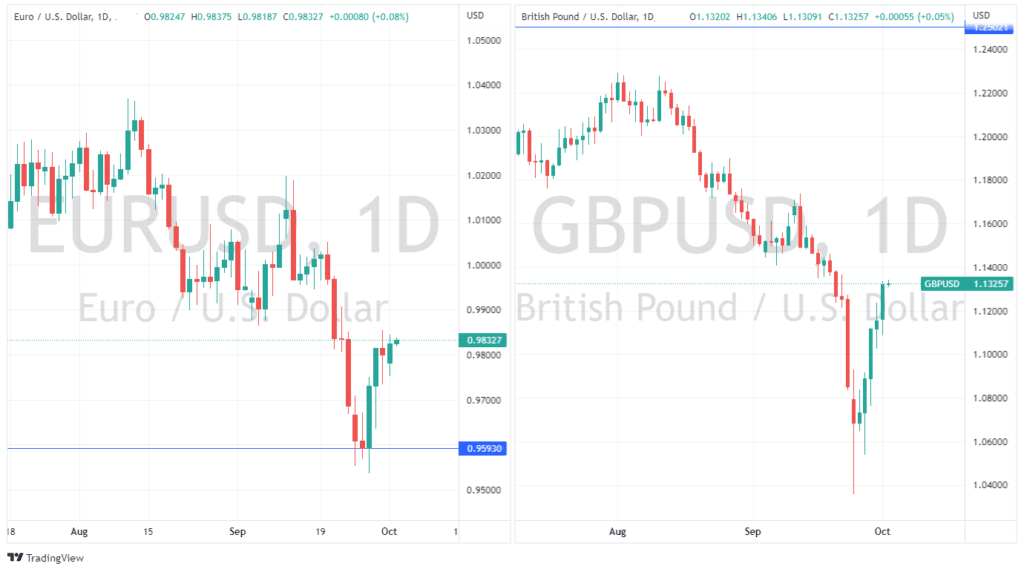

With lowering US yields causing a headwind, the USD was lower on the day. The US Dollar Index dropped back below 112 as both the recently battered Euro and GBP staged a decent up day, the latter greatly helped by reports of the UK government backflipping on previously announced tax cuts.

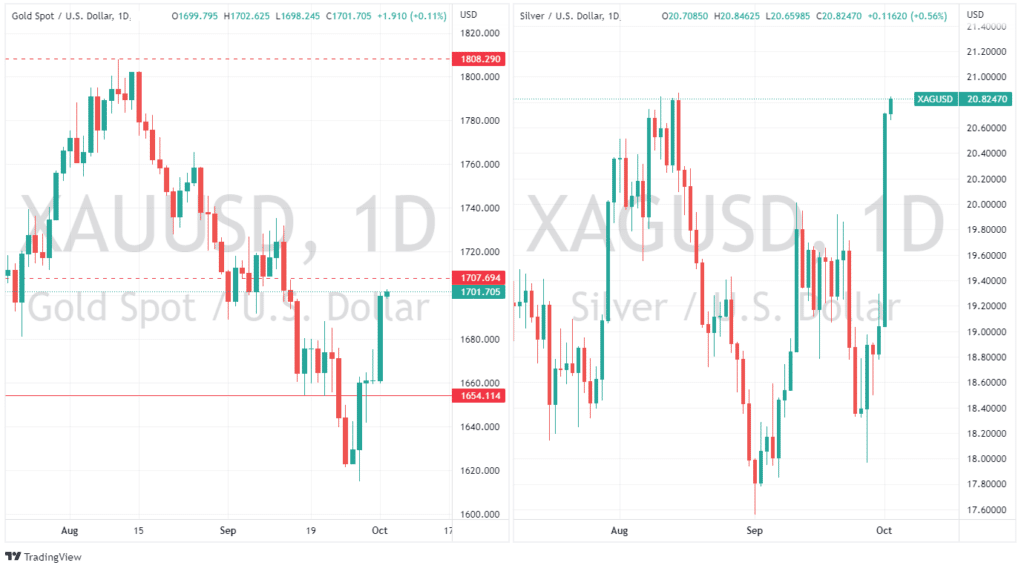

Big moves also today in precious metals with Silver (XAGUSD) soaring almost 9% on the session and Gold (XAUUSD) gaining over 2% to break back above the big psychological level of 1700 USD per ounce.

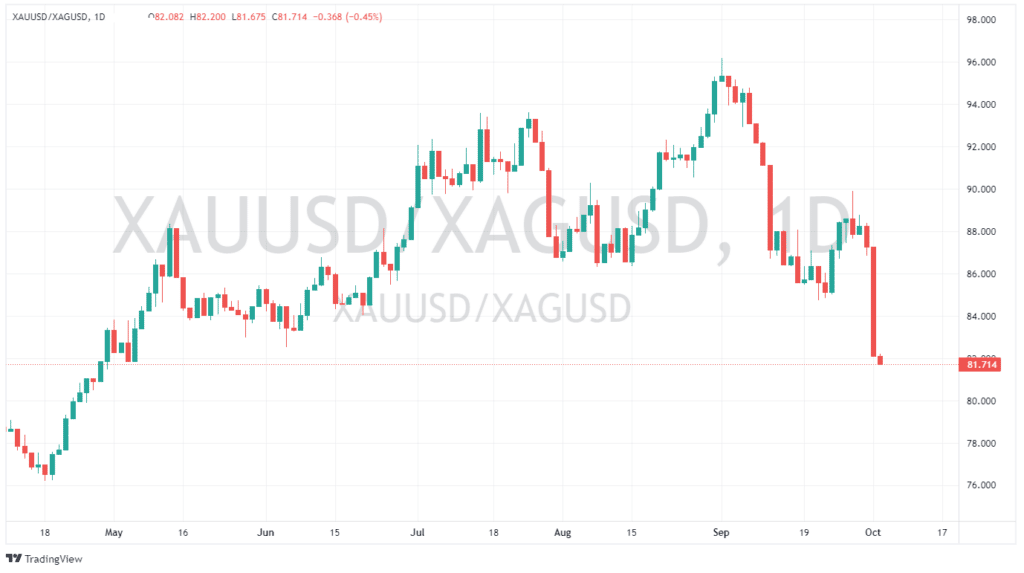

With Silver drastically outperforming Gold, the ratio of the two is back to 5-month lows, worth keeping an eye on for pairs traders.

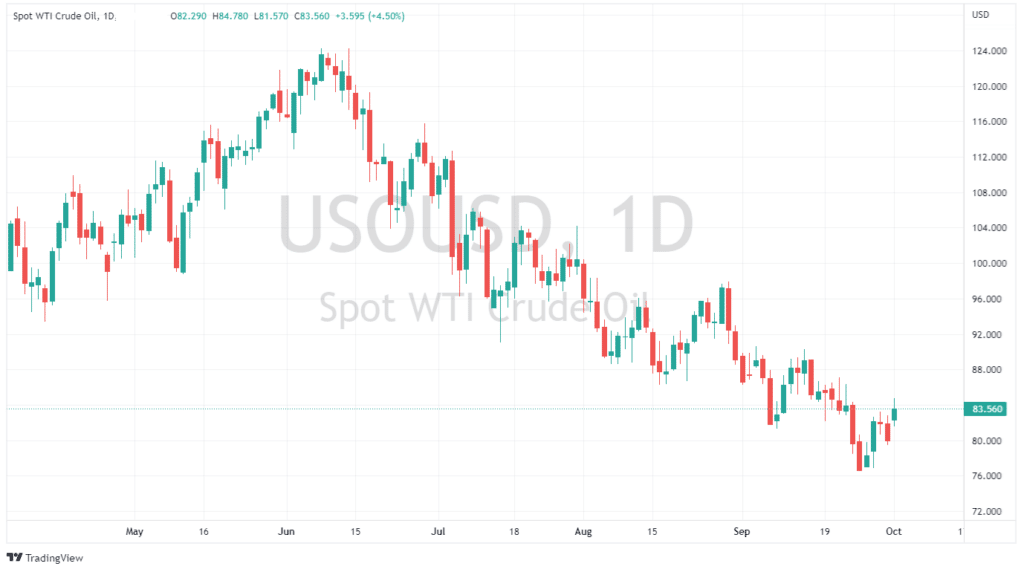

Oil (USOUSD) also joined the party, ripping higher on dovish hopes and rumours that OPEC+ will slash production dramatically this week.

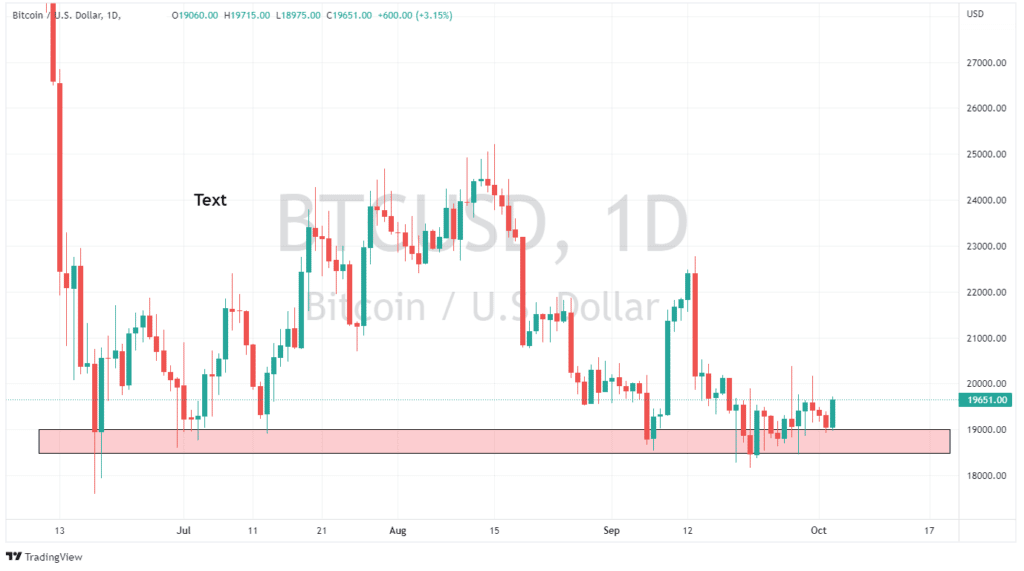

In Crypto, the improved risk sentiment also saw Bitcoin (BTCUSD) bounce after testing major support just under 19k.

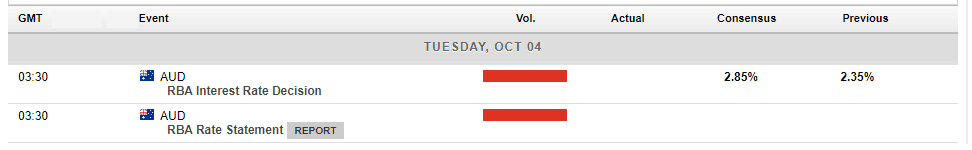

In the day ahead, Central bank action with the RBA interest rate decision at 14:30 AEDST. Rate markets are pricing in around an 80% chance of another 50bp hike.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

China Yuan’s Falls to Record lows

I have recently written a piece on the weakening of the Great British Pound (GBP) just the other day, as it looks like the dollar seems to be king at present and getting stronger against all other top currencies around the world. Today is the Chinese Yuan in focus, yesterday was the Sterling pound, who’s your money on tomorrow? We will have t...

October 4, 2022Read More >Previous Article

Tesla sets a new record

Tesla Inc. (NASDAQ: TSLA) reported its Q3 2022 delivery numbers on Sunday. World’s largest automaker delivered a total of 343,830 cars (up by 42....

October 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading