- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Stocks down, USD and Yields up ahead of key FOMC meeting

- Home

- News & Analysis

- Economic Updates

- Stocks down, USD and Yields up ahead of key FOMC meeting

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks slid in a choppy session where a positive open soon sold off sharply on the back of a positive JOLTS report sparking a “good news is bad news” reaction in equity markets.

The JOLTS survey showed that job openings surged in September, rising to 10.72 million, well above the expected 9.85 million, this saw rate hike odds soaring ahead of the pivotal Fed meeting tomorrow.

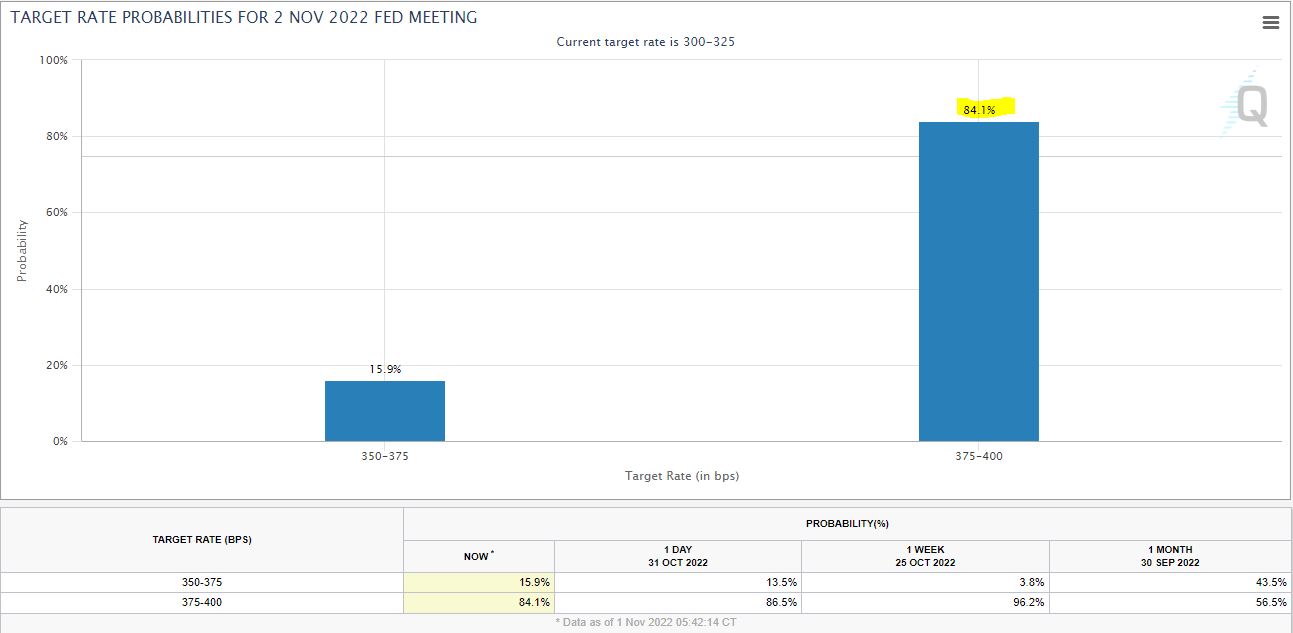

A 75bp hike tomorrow is almost fully priced in (Fed Fund futures showing a 84.1% probability), but a less certain path is ahead namely in the December and February meetings, which will make the accompanying statement and press conference being the most important part of tomorrows FOMC meeting as traders look for clues where the Fed is heading.

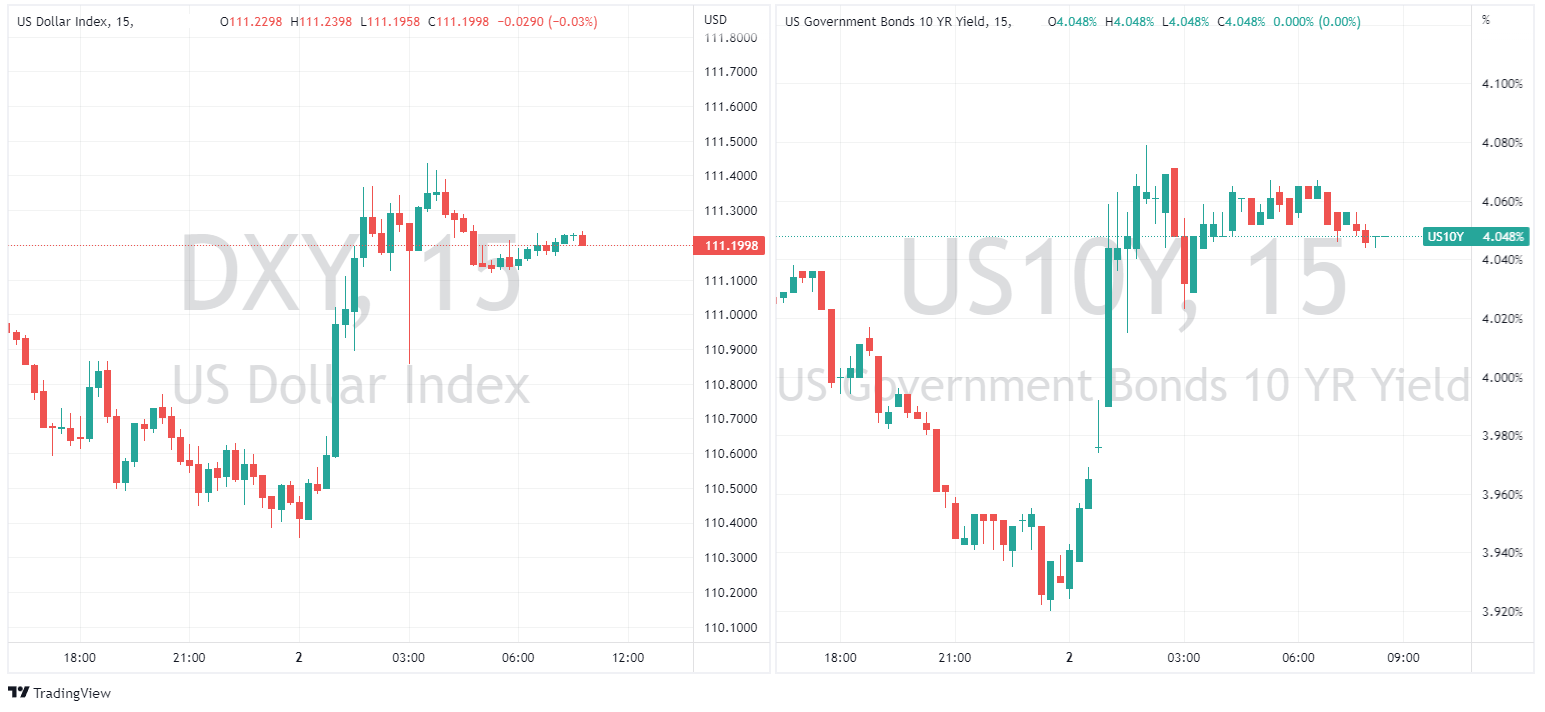

In FX – The US Dollar shot higher, mirroring US 10 year bond yields as the market priced in a more hawkish Federal reserve after the big upside surprise in the JOLTS figures. The US Dollar index breaking back and holding above 111.

In commodities, Crude oil jumped after the JOLTS data indicated the US job market is still showing strength, dampening recession fears. Though the gains were mostly retraced in a choppy second half of the session, ahead of today’s important EIA report on US Crude inventories.

Natural Gas tumbled on warmer than usual winter weather forecasts which will result in lower demand for heating fuels, allaying traders fears of tight supplies.

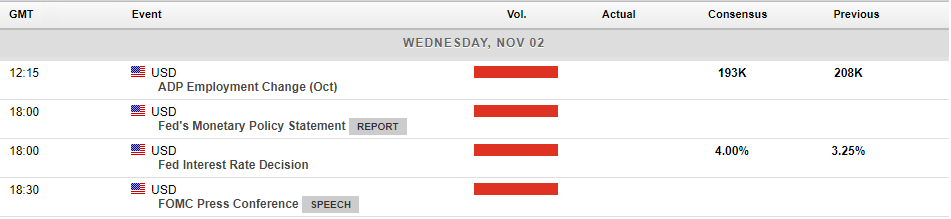

In Economic releases, the big one to watch for will be the FOMC Monetary Policy statement. This has been one of the most anticipated Fed meetings this year, while a 75bp hike is almost a lock, expect some volatility around the statement and press conference as traders look for clue as to where the Fed is going next.

We also have ADP employment change, which may give some clues to the closely watched Non-farm payrolls on Friday.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

ASX200 breaks out on the back of softer RBA interest rate hike

The ASX200 has seen some positive price action in recent weeks as the Australian equities market has benefited from relatively weaker inflation then much of the rest of the world. With the Reserve Bank of Australia, (RBA) only increasing interest rates by 25 bps at each of its last two meeting, the country’s central bank has seemingly chosen that...

November 2, 2022Read More >Previous Article

Shares of Pfizer rise as Q3 earnings beat estimates

Shares of Pfizer rise as Q3 earnings beat estimates Pfizer Inc. (NYSE:PFE) reported its latest financial results for the third quarter before the o...

November 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading