- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Stocks drop, yields up as Fed hawks bash pivot hopes

- Home

- News & Analysis

- Economic Updates

- Stocks drop, yields up as Fed hawks bash pivot hopes

News & AnalysisNews & Analysis

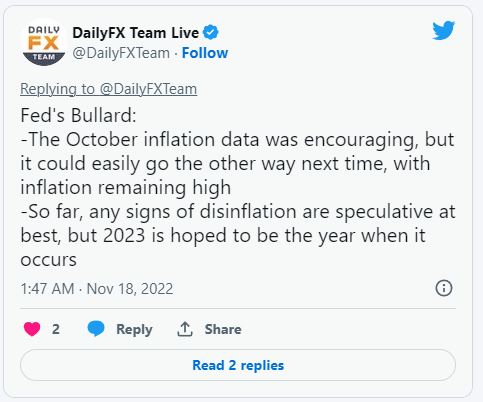

News & AnalysisNews & AnalysisUS equities declined modestly in Thursdays session futures were pointing to a steeper decline after Voting Fed member Bullard dampened hopes of a Fed “pivot” anytime soon, re-iterating the Feds determination to see inflation lower and downplaying one soft inflation report.

Stocks did recover during the session though as the “bad news is good news” narrative came into play after weak manufacturing figures were released, the Philly Fed manufacturing index coming in at -19.4 against an expected reading of -6. The S&P 500 perfectly bouncing off it’s 100 day moving average and rallying strongly to recoup most of the downside.

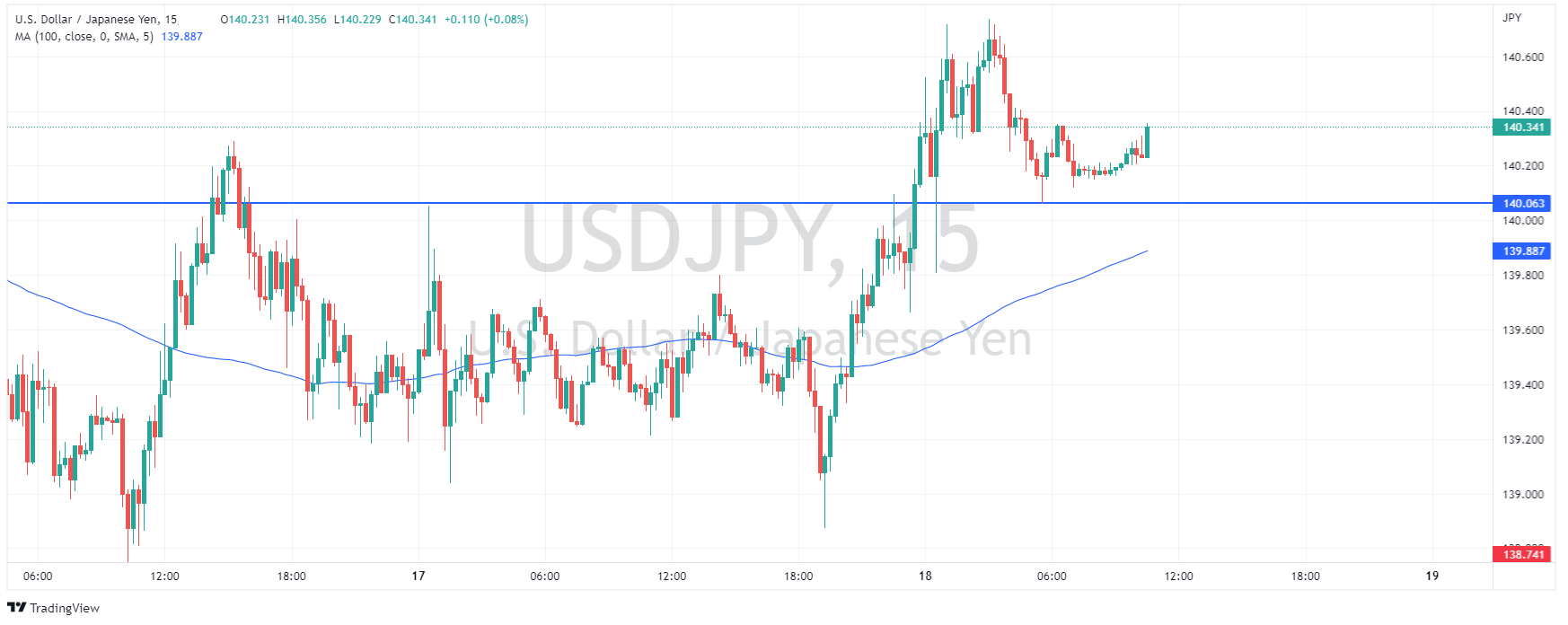

The US Dollar rallied modestly, with rising 10 Year treasury yields seeing the USDJPY break through and hold the 140 level.

BTCUSD took a pause today, ending the day practically unchanged after trading a narrow range in the 16000’s , with news out of the FTX collapse getting worse every day , holding these levels will be a real test of the tokens resilience and crypto bulls nerve.

Crude Oil prices tumbled once again today, with US crude back at one-month lows trading with a $81 handle before finding support at the October lows.

In the day ahead, US monthly option expiry is coming up, lately this has seen elevated volatility in equities markets, so something to watch out for. Otherwise, a very light calendar with really only ECB President Lagarde’s speech a possible market mover.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

FTX, a failure in Corporate Governance and effective risk management

The FTX bankruptcy case has been a fascinating study in the failure of corporate governance providing a warning to the Cryptocurrency industry that a lack of regulation will not excuse poor financial management and that these exchanges are not immune to failure. In the last week, the company engaged distressed company expert, John Ray III to tak...

November 18, 2022Read More >Previous Article

The latest Alibaba results are here – the stock is rising

Alibaba Group Holding Limited (NYSE: BABA, HKEX: 9988) announced the latest financial results on Thursday. The Chinese e-commerce giant reported re...

November 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading