- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Stocks dump, yields rise as market reprices rate-hike roadmap ahead of Jackson Hole

- Home

- News & Analysis

- Economic Updates

- Stocks dump, yields rise as market reprices rate-hike roadmap ahead of Jackson Hole

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisStocks dump, yields rise as market reprices rate-hike roadmap ahead of Jackson Hole

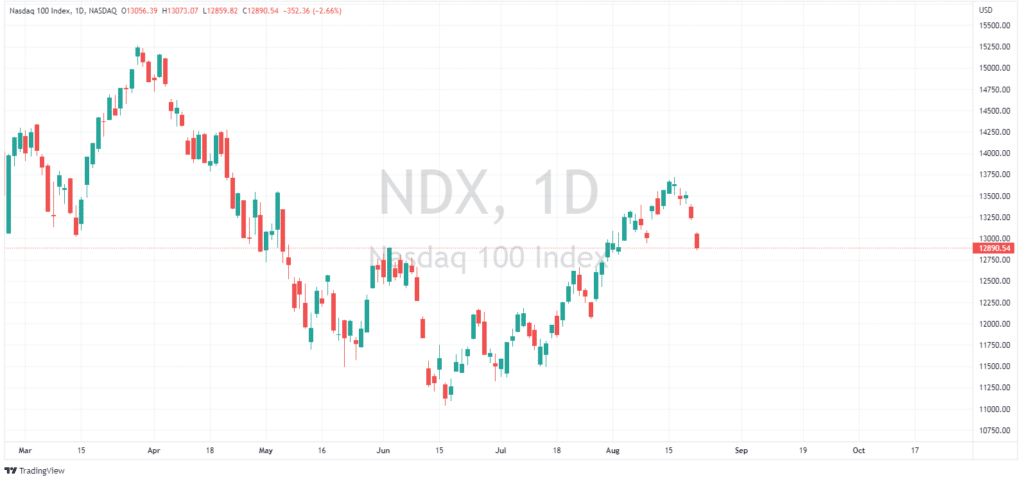

23 August 2022 By Lachlan MeakinUS equites suffered a steep decline in Mondays session in a broad sell-off that saw the Nasdaq leading the charge lower dropping 2.6% as global risk appetite was pressured by growth and energy supply concerns.

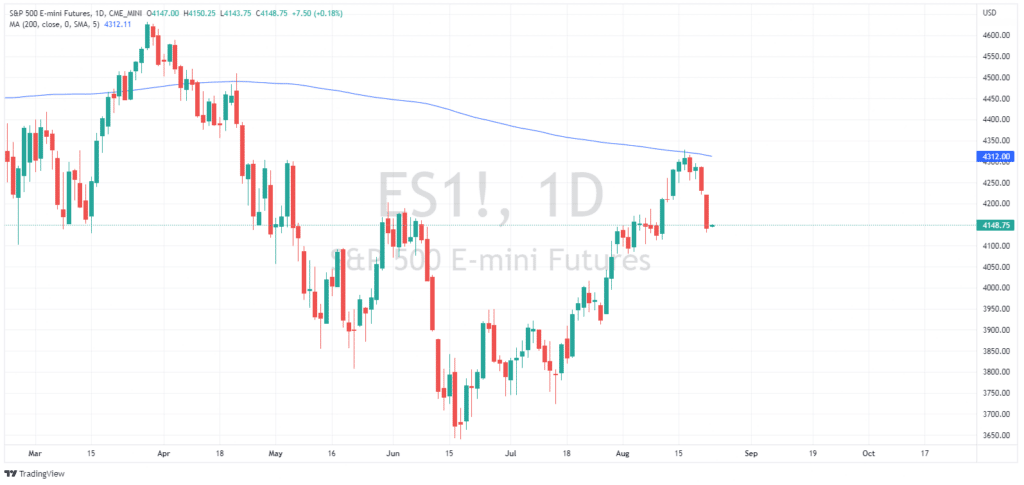

The S&P 500 is now down over 200 points since the price was rejected at the 200 day SMA last week.

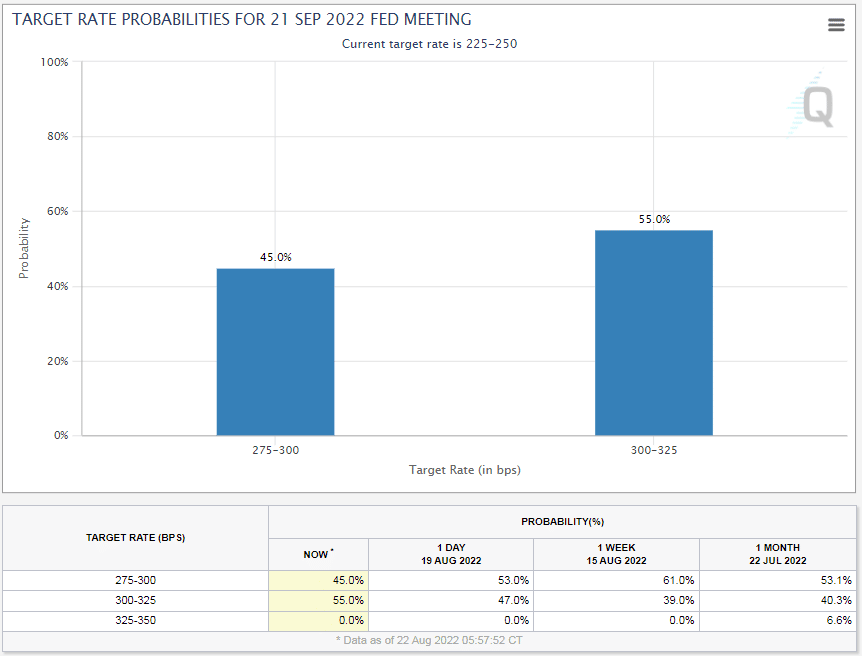

Yields rose sharply as traders positioned for a more aggressive rate-hike trajectory from the Fed coming up to the closely watched Jackson Hole symposium later in the week. A 75bp hike in September is now the preferred market bet, with odds rising to 55%, up from 47% at Fridays close.

The US dollar was again ascendant on the back of this hawkish repricing in yields seeing the US Dollar index retest the 109 level and seeing EURUSD testing support briefly at parity before crashing through to end the session down almost 100 pips, and well below the psychological 1.00 level.

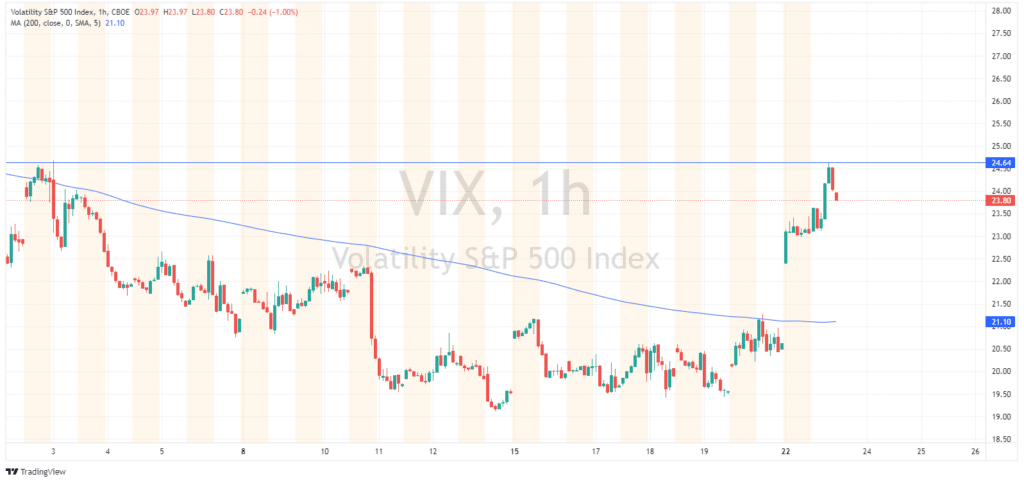

After a period of low volatility the VIX index spiked above 24, equalling the highs set earlier in the month as traded rushed to hedge themselves from a further downturn.

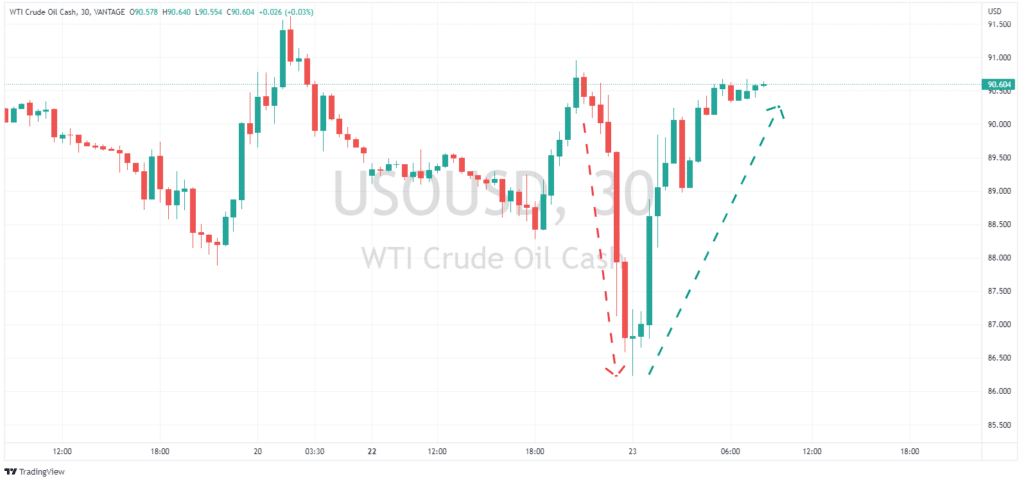

Crude Oil dumped then pumped as optimism of an Iran deal saw prices drop, only to sharply rebound on OPEC+ hints that they may need to tighten output to “stabilise” the oil markets.

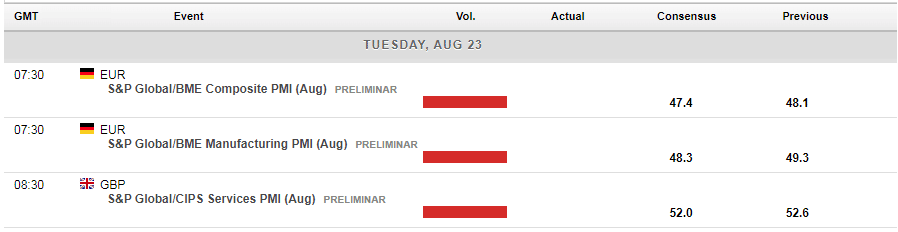

In Economic announcements today, multiple PMI figures are due out of Germany, the UK and US. German and UK figures in particular will be closely watched as they are expected to show the energy crunch caused weakness in their respective manufacturing sectors, putting both the BoE and ECB in very difficult positions as stagflationary forces start to take hold (slow growth, high inflation). GBP and EUR traders will need to keep an eye on these.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

EUR continues to tumble as energy crisis worsens

The Euro has fallen to 20-year lows as it deals with increasing energy prices and increased bond yields as recession fears rise again. Across both the UK and Europe inflation has been especially high even compared other countries such as Australia and the USA and in response, the EUR has taken a large hit. The recent spike in energy prices has brou...

August 23, 2022Read More >Previous Article

Zoom reports Q2 results – the stock dips

Zoom Video Communications Inc. (ZM) reported its latest financial results after the market close on Wall Street on Monday. The US communications te...

August 23, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading