- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Target Q1 results announced

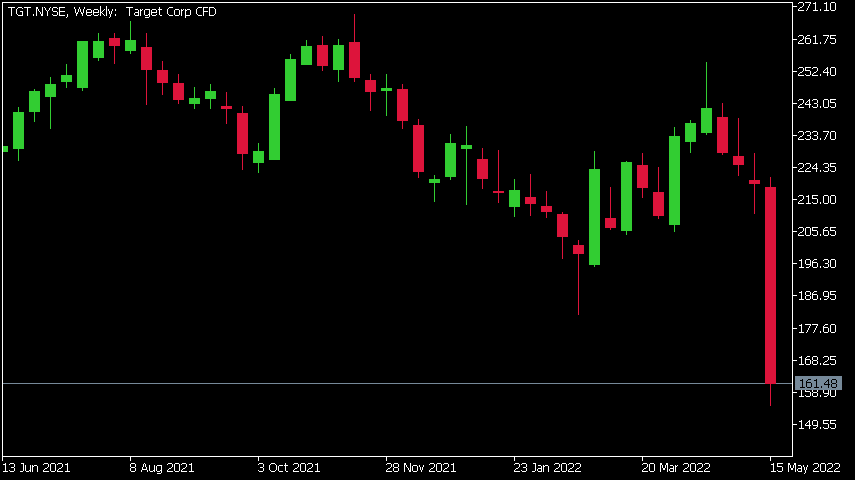

- 1 Month -35.18%

- 3 Month -22.23%

- Year-to-date -30.17%

- 1 Year -26.21%

- Deutsche Bank: $294

- JP Morgan: $290

- Gordon Haskett: $300

- Morgan Stanley: $255

News & AnalysisTarget Corporation (TGT) reported its Q1 financial results before the market open in the US on Wednesday.

The US department store chain reported revenue of $25.17 billion in Q1 (up by 4% vs. the same period last year), slightly beating analyst estimate of $24.475 billion.

The company missed analyst expectations for earnings per share for the quarter, reporting $2.19 earnings per share (decrease of 40.7% year-over-year) vs. $3.07 per share expected.

”Our first-quarter results mark Target’s 20th-consecutive quarter of sales growth, with comp sales growing more than 3 percent on top of a 23 percent increase one year ago,” CEO of Target, Brian Cornell said after the latest results.

”Guests continue to depend on Target for our broad and affordable product assortment, as reflected in Q1 guest traffic growth of nearly 4 percent. Throughout the quarter, we faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time. Despite these near-term challenges, our team remains passionately dedicated to our guests and serving their needs, giving us continued confidence in our long-term financial algorithm, which anticipates mid-single digit revenue growth, and an operating margin rate of 8 percent or higher over time,” Cornell added.

Target Corporation chart

Share of Target plummeted by over 24% on Wednesday after the disappointing Q1 results, trading at $161.48 per share.

Here is how the stock has performed in the past year:

Target price targets

Target is the 180th largest company in the world with a market cap of $74.93 billion.

You can trade Target Corporation (TGT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Target Corporation, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Why are US retail giants bleeding?

Retail and consumer staples Walmart and Target have seen dramatic drops in their share prices in the last week as the cost of inflation begins to take its toll. Both retail in the USA have become unstuck as the consequences of high inflation begins to take effect. The companies saw a big drop in profitability as rising costs continue to put pressur...

May 20, 2022Read More >Previous Article

Supply Chains hit WHEAT

As we come to terms with the Russian invasion of Ukraine, which has affected most of us in one way or another, some more fortunate than those within U...

May 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading