- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Tech and Bitcoin drop, Oil and Gas jump in mixed US session

- Home

- News & Analysis

- Economic Updates

- Tech and Bitcoin drop, Oil and Gas jump in mixed US session

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks were mixed in a quiet session, the Dow and S&P 500 eked out small gains whilst against a backdrop of a the Federal Reserve meeting on Wednesday, the Tech heavy Nasdaq saw a modest decline.

With a news quiet Monday behind us, there is a full calendar ahead with a slew of corporate earnings and of course the big one, the FOMC policy meeting on Wednesday which should see market action pickup from here on.

Not much happened in the FX markets with slight USD weakness in a very quiet session as FX traders seem to be holding fire with the shadow of the Fed looming.

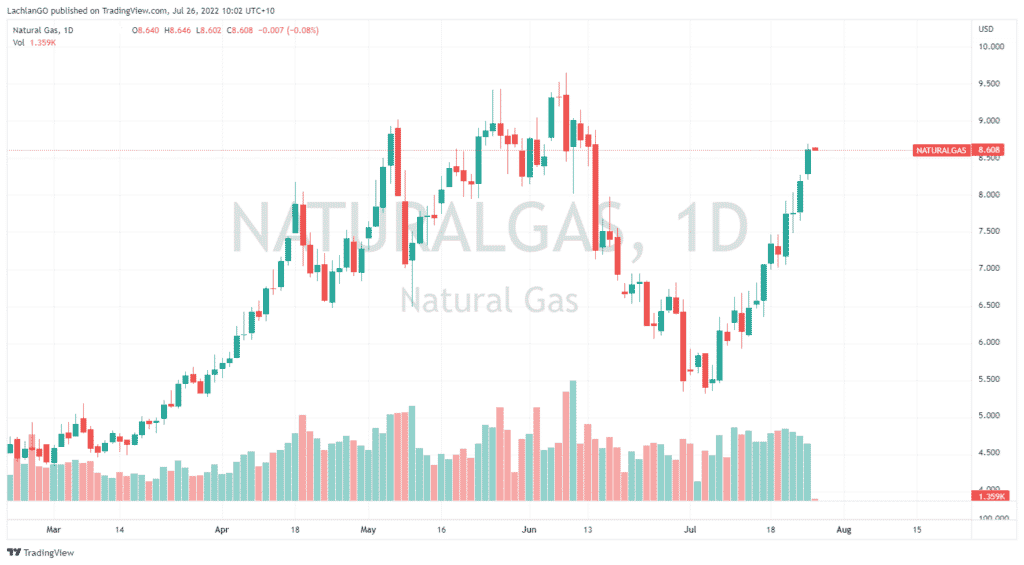

News of more stalling on the Nordstream 1 pipeline saw Natural Gas tear higher, making 6 week highs and fast approaching the record highs set back in May.

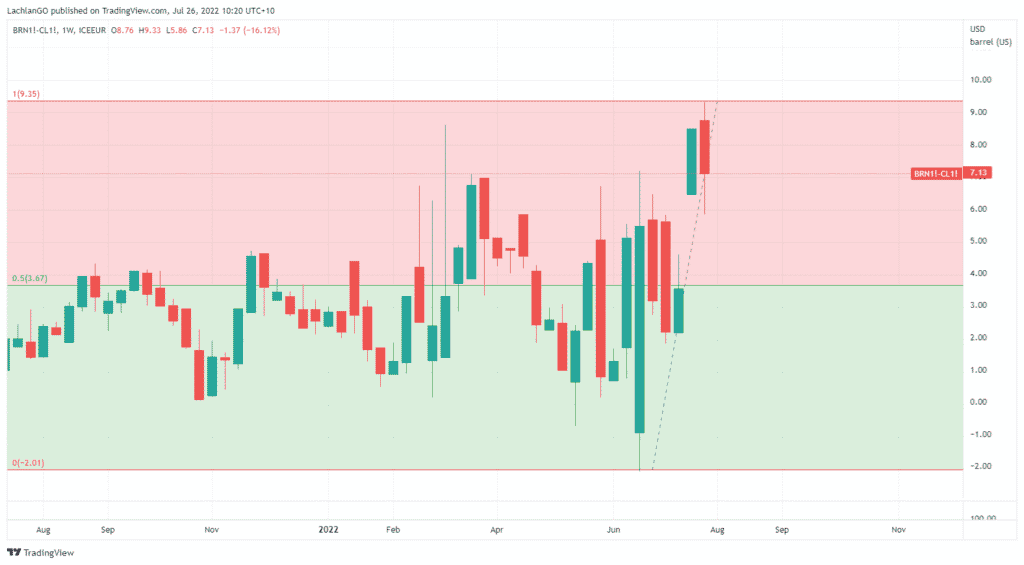

This also helped drag oil up on the day, with Brent up almost 2% and WTI not far behind. We are also seeing the spread between Brent and WTI hitting new extremes as traders weigh up the differing supply fundamentals. Front month futures saw WTI crude trade at a discount of as much as $8.80 a barrel compared to Brent. It will be worth watching this spread for a possible pairs trading opportunity.

UKOil-F – USOil-F chart below

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Wheat Trading Opportunities

Wheat Trading Opportunities Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses for the feedstock for cattle which is vital in economies with large agricultural sectors. The supply and demand for wheat can be volatile with changes occurring for a multitude of different reasons. The...

July 26, 2022Read More >Previous Article

The Week Ahead – The FOMC, inflation and growth all in the spotlight

After a turn around in equity markets last week, where the S&P 500 was up over 2%, The Federal reserve will take centre stage this week along with...

July 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading