- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Tech leads US Stocks higher on soft PPI and employment figures, Gold surges towards all time high

- Home

- News & Analysis

- Articles

- Economic Updates

- Tech leads US Stocks higher on soft PPI and employment figures, Gold surges towards all time high

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisTech leads US Stocks higher on soft PPI and employment figures, Gold surges towards all time high

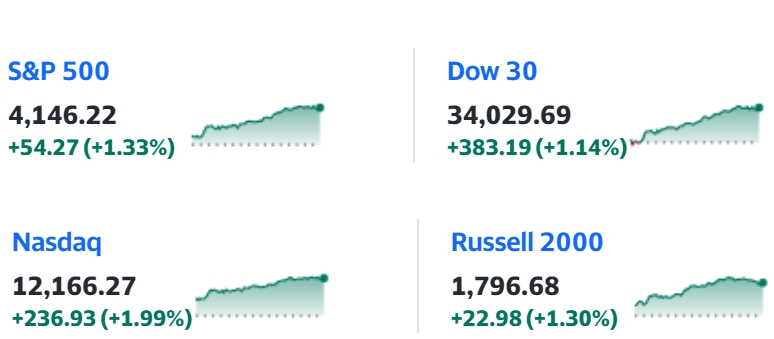

14 April 2023 By Lachlan MeakinA significantly softer than expected PPI print confirming Wednesdays CPI saw the green light for risk on in Thursday’s session and saw a broad rally in risk assets. All major US indexes rallied strongly with the Tech heavy NASDAQ outperforming while the S&P 500 closing at its highest level since February.

The March producer price index, which is a measure of prices paid by companies and often a leading indicator of consumer inflation, declined by 0.5% month over month against an expectation that it would remain flat, coupled with a weaker than expected employment figure, with unemployment claims rising by 239k vs an expected 233k saw the risk on trade also boom in Forex Markets.

FX Markets

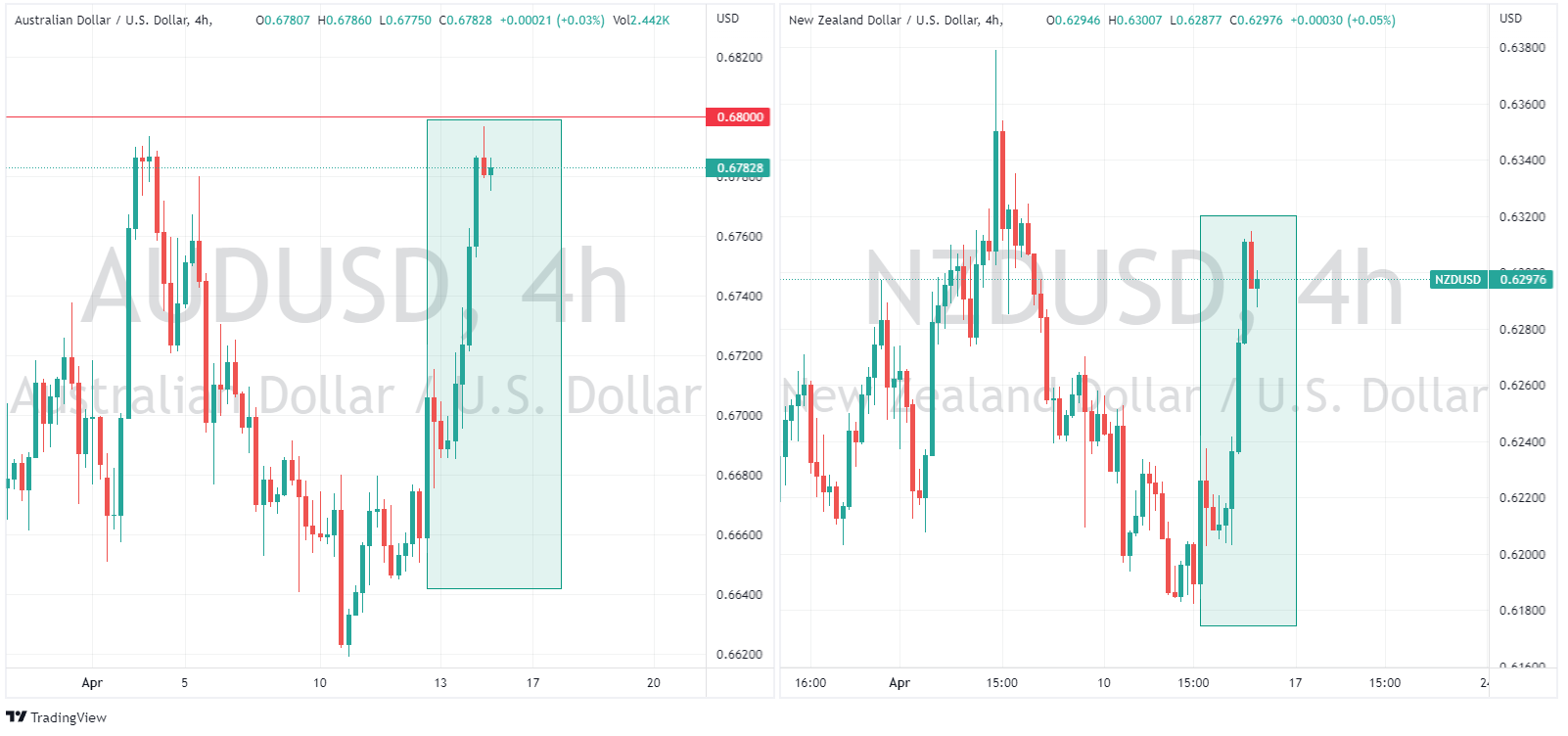

Risk sensitive AUD and NZD were the G10 outperformers both seeing gains of around 1.5% against the USD with NZDUSD poking above 0.63 and the AUDUSD just stopping short of regaining 0.68 and testing the resistance levels set earlier in the month.

CHF, EUR, and JPY all saw gains against the USD to varying degrees, the USDCHF led the charge , pushing through 0.8900 to the downside to hit its lowest since January 2021 of 0.8860.

EURUSD printed a 1yr high of 1.1067 rallying on Dollar weakness and helped by ECB speak with members noting the persistence of high core inflation and stating the ECB has further to go in tightening monetary policy.

USDJPY dropped further into its range before The Yen ran out of momentum just shy of the key psychological 132.00 level.

GBP was the underperformer, GBPUSD still rallied on the session though largely due to broad USD weakness, seemingly hampered by comments from BoE’s Pill who noted indicators of momentum in wage growth appears to be easing.

Commodities

Gold broke out again on Dollar weakness and falling yields, with XAUUSD hitting 12-month highs and its 4th highest price print in history, stopping just short of 2049 USD an ounce. XUUSD seeming to continue its march towards all-time highs that were set back in August 2020

Crude Oil declined on the day, retracing some of yesterdays gains, but still holding above the resistance level at the top of its previous range which could now act as support.

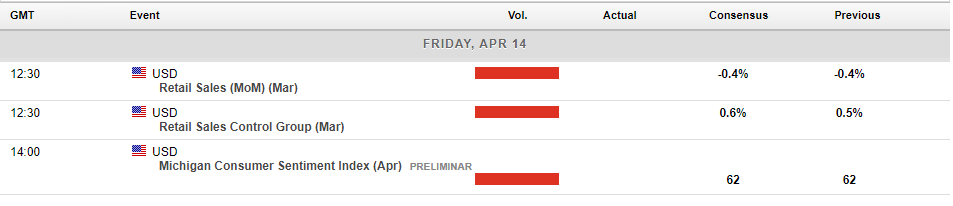

In Fridays economic calendar, some more risk events out of the US with Retail Sales and Consumer Sentiment released

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

JP Morgan Chase & Co. tops Q1 estimates – the stock is rising

JP Morgan Chase & Co. (NYSE: JPM) announced Q1 financial results before the market open in the US on Friday. The largest bank in the US beat both revenue and earnings per share (EPS) estimates for the first quarter of 2023, sending the stock price higher. The company reported revenue of $38.349 billion vs. forecast of $36.125 billion. ...

April 15, 2023Read More >Previous Article

Indices Trading – What are Indices and how to use CFDs to trade them

Index trading is one of the most popular class of markets to trade for CFD traders, rivalling major FX pairs in trading volume, but what is indices tr...

April 13, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading